Is Five9 (FIVN) Poised for a Comeback in 2025?

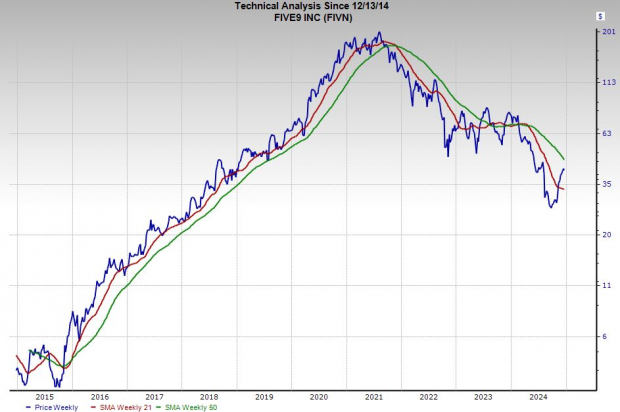

Five9, Inc. FIVN stock has plummeted by 80% from its summer 2021 highs. This decline was primarily due to rising interest rates, leading investors to shun stocks that trade at high valuations relative to future earnings. Additionally, shareholders rejected a buyout proposal from Zoom back in September 2021.

However, the stock has shown potential for recovery this fall, soaring 40% since early November, thanks to a strong quarterly performance that exceeded expectations.

The introduction of AI-enhanced features is driving Five9’s success, and recent earnings upgrades have boosted its Zacks Rank to #1 (Strong Buy).

In the past decade, FIVN has outperformed the Zacks Tech sector, gaining 845% versus 340%. Despite this, it remains 80% below its historical highs, suggesting that FIVN could offer substantial upside for investors looking ahead to 2025.

Understanding Five9’s Growth Potential

Five9 has been a key player in the cloud software market for contact centers. The company offers user-friendly applications that enhance customer interactions across various channels, including voice, chat, email, social media, and mobile. Its mission is to modernize contact centers, meeting today’s expectations for efficient and personalized communication anytime, anywhere.

The launch of Five9’s Intelligent CX Platform signifies its commitment to keeping pace in the AI-driven market. This platform aims to provide hyper-personalized customer experiences throughout the interaction journey.

Image Source: Zacks Investment Research

Five9’s goal is to empower customer service agents to respond to customer needs efficiently, fostering a more proactive and tailored service.

In its third quarter, FIVN reported a 20% growth in subscription revenue and a 15% overall revenue increase. They achieved an adjusted EBITDA margin of 20%, generating an operating cash flow of $41 million.

Upon reporting results on November 7, Five9 raised its forecast and saw positive revisions to its EPS, earning it a Zacks Rank #1. CEO Mike Burkland expressed optimism, stating, “We are energized by the momentum we are seeing with our AI products and believe that the market opportunity ahead is stronger than ever.”

Image Source: Zacks Investment Research

Looking ahead, Five9 is expected to increase its adjusted earnings by 15% in 2024 and 8% in 2025. The company has consistently exceeded earnings estimates by an average of 22% over the past four quarters, and sales are projected to rise by 13% in 2024 and 10.5% in 2025, ultimately reaching $1.14 billion, a significant leap from $435 million in 2020.

Can Five9’s Stock Recover in 2025?

Over the past decade, FIVN’s stock has surged by 845%, greatly outperforming the Zacks Tech sector’s 340%. However, it has faced a 35% drop over the last five years and currently trades 80% below its peak observed in August 2021, shortly after Zoom ZM announced its intention to acquire Five9 for $14.7 billion in an all-stock deal.

By September 2021, the acquisition was called off after Five9’s shareholders failed to approve the deal. Today, Five9’s market cap stands at $3.2 billion, with the stock experiencing a 45% decline in 2024.

Image Source: Zacks Investment Research

Recently, FIVN has shown signs of recovery, surging 50% in the past three months and 35% following its Q3 report early in November.

Currently, Five9’s stock is trading 19% below the average Zacks price target, as it seeks to regain its 50-week moving average.

Image Source: Zacks Investment Research

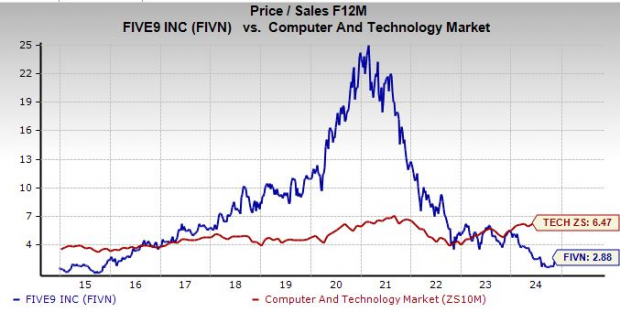

At a forward sales multiple of 2.9X for the next 12 months, FIVN is priced at a 55% discount compared to the Tech sector and 50% below its 10-year average. The company’s forward earnings multiple remains elevated, which has contributed to its recent stock decline and underperformance.

Should Five9 continue to enhance its profitability through AI advancements, it may emerge as a strong contender in the long run.

As Wall Street takes notice, the stock could see renewed interest, especially since 12 out of 19 brokerage ratings tracked by Zacks have categorized it as a “Strong Buy,” with two additional “Buys” and no “Sells.”

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is a cornerstone of our economy—comprising a multi-trillion-dollar industry responsible for some of the largest and most lucrative companies globally.

Innovative technology is guiding a shift towards cleaner energy, potentially surpassing traditional fossil fuels. Trillions are being invested in clean energy projects, from solar initiatives to hydrogen fuel cells.

Companies emerging from this sector might hold exciting prospects for your investment portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

Five9, Inc. (FIVN): Free Stock Analysis Report

Zoom Communications, Inc. (ZM): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.