Flanigan’s Enterprises Reports Mixed Results as Stock Outperforms Market

Shares of Flanigan’s Enterprises, Inc. (BDL) increased by 2.6% following the release of their earnings report for the quarter ending September 28, 2024. In contrast, the S&P 500 Index fell by 2.6% during the same period. Over the last month, the stock has gained 3%, while the S&P 500 declined by 2.3%. These trends indicate investor confidence in Flanigan’s performance amid a tough market landscape.

Revenue Growth Highlights

For the fiscal year ended September 28, 2024, Flanigan’s reported total revenues of $188.3 million, marking a 7.9% increase from $174.4 million the previous year. Restaurant food and bar sales rose by 6.3%, reaching $144.8 million, up from $136.2 million. Package store sales experienced an impressive growth rate of 15.1%, climbing to $40.5 million from $35.2 million.

Conversely, revenue from franchise operations fell by 8.8%, totaling $1.7 million, down from $1.9 million. On a positive note, rental income grew by 16.2% to $1.1 million, compared to $0.9 million. However, net income attributable to Flanigan’s decreased to $3.4 million from $3.9 million, indicating a 16.1% year-over-year drop. Basic and diluted earnings per share (EPS) also fell by 15.8%, dropping from $2.15 to $1.81, pointing to profitability pressures despite rising revenues.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Business Segment Analysis

The growth in the restaurant and package store segments demonstrates continued consumer demand and operational effectiveness. Nevertheless, the decrease in net income and EPS may reflect rising costs related to inflation and operational expenses impacting profit margins. The decline in franchise revenues suggests ongoing challenges in the company’s franchise business model.

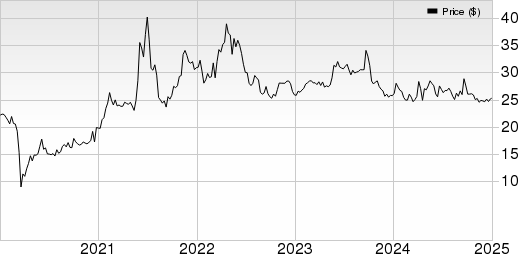

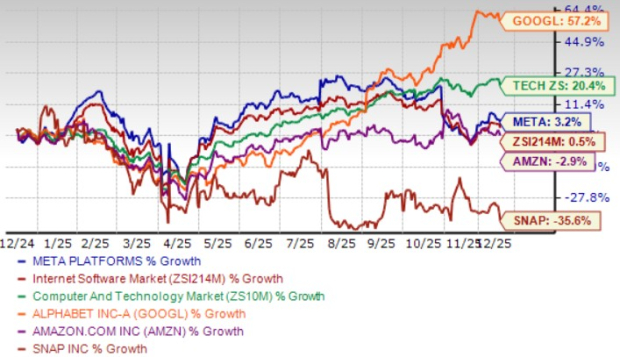

Flanigan’s Enterprises, Inc. Price, Consensus and EPS Surprise

Flanigan’s Enterprises, Inc. price-consensus-eps-surprise-chart | Flanigan’s Enterprises, Inc. Quote

Insights from Management

Management highlighted robust outcomes in Flanigan’s restaurant and retail operations, crediting growth to consumer loyalty and effective service. However, they acknowledged pressure on profit margins caused by rising labor and material costs. The specifics regarding these costs and strategies for addressing them were not detailed.

The drop in franchise-related revenues was linked to external factors, although management did not provide further details, which may lead to investor concerns. Overall, management expressed confidence in the brand’s strength while recognizing the challenges in improving profitability.

Future Outlook

The company refrained from offering specific future guidance in its earnings release. Investors will likely need to wait for further commentary in upcoming reports for a clearer understanding of the direction ahead.

Operational Stability

During the fiscal year and quarter, there were no significant acquisitions, divestitures, or restructuring activities reported. This stability suggests a steady operational environment for Flanigan’s without any major shifts in strategy.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts have identified their top picks expected to rise +100% or more in the near future. Among these, Director of Research Sheraz Mian has singled out one with outstanding potential.

This company, targeting millennial and Gen Z demographics, generated nearly $1 billion in revenue last quarter alone. With a recent market dip, now presents a prime opportunity to invest. While not every elite pick results in success, this one could surpass previous Zacks’ Stocks Set to Double, like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Flanigan’s Enterprises, Inc. (BDL): Free Stock Analysis Report

Read this article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.