Ford Sees Strong October Sales Despite Electric Vehicle Struggles

Ford Motor Co. (F) surprised analysts with its performance in October, reporting a 15% increase in overall U.S. sales. The data led to a nearly 1.5% rise in Ford’s stock price during Monday afternoon trading.

Sales Success Driven by Trucks and Hybrids

In October, Ford sold 172,756 vehicles, reclaiming some of the market share it lost previously. This improvement is notable considering that last October, the company faced challenges due to a United Auto Workers strike, affecting sales significantly.

While trucks and hybrids contributed to this sales surge, not all news was positive. Electric vehicle sales declined by 8.3%, primarily due to a drop in Ford Lightning F-150 sales. Adding to these concerns, the company announced plans to close the Rouge Electric Vehicle Center, which produces the Lightning F-150, in the coming weeks.

Recalls and Safety Investigations

Ford is currently navigating mixed news related to recalls. A total of 6,212 Mustang vehicles are being recalled due to an instrument panel issue that may prevent lights from illuminating. However, this problem can be easily resolved with a software update available at dealerships.

On a brighter note, the National Highway Traffic Safety Administration (NHTSA) has concluded its investigation into engine failures in Ford vehicles, finding that engine replacements and extended warranties were sufficient to address the issues. The investigation focused on intake valves in specific engine models, and Ford’s proactive measures have resulted in the matter being resolved.

Analysts Weigh In on Ford Stock

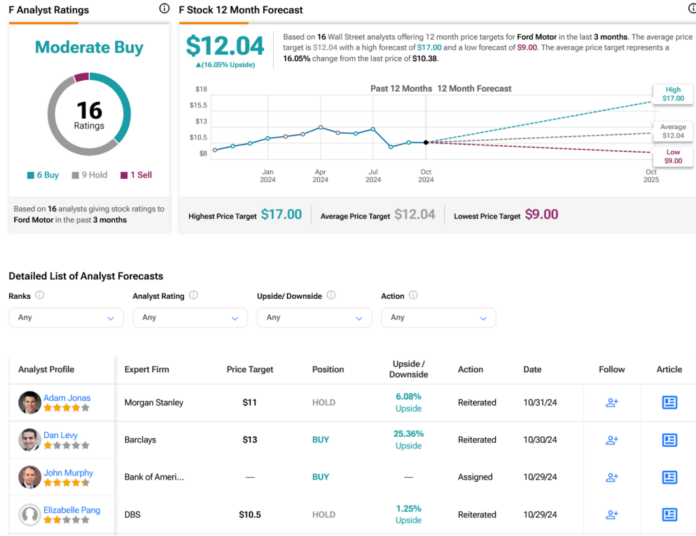

On Wall Street, Ford stock receives a Moderate Buy consensus rating, according to recent assessments. Analysts have categorized the stock with six Buy ratings, nine Holds, and one Sell over the past three months. Following a year in which the shares gained 6.14%, the average price target for Ford stock is $12.04 per share, suggesting a potential upside of 16.05% from current levels.

See more F analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.