CrowdStrike Recovers Strongly After Software Glitch

On July 19, CrowdStrike (NASDAQ: CRWD) faced a major setback when it released a corrupted update to its cybersecurity software. This incident caused computer outages for millions of businesses globally, resulting in a sharp 42% decline in CrowdStrike’s stock. Investors worried that this could lead to significant customer losses and decreased revenue.

Since then, CEO George Kurtz addressed these concerns, helping the stock rebound by 58% from its low on August 2. Upcoming financial results for the third quarter of fiscal 2025, ending October 31, will be announced on November 26, offering new insights into CrowdStrike’s recovery journey.

Setbacks and Customer Retention

The software glitch significantly impacted devices running on Microsoft Windows, crashing about 8.5 million computers worldwide. This chaos affected many industries, with estimates suggesting losses exceeding $5 billion for CrowdStrike’s top clients.

While the company has faced some legal challenges, including a $500 million lawsuit from Delta Airlines, there has not been the mass customer exodus many expected. In an investor conference on August 28, Kurtz noted that while some new deals are delayed, most are still active in the sales pipeline.

Moreover, CrowdStrike adjusted its fiscal 2025 revenue forecast down by only 2.5%, maintaining its long-term goal of reaching $10 billion in annual recurring revenue by fiscal 2031.

Potential clients seem to be waiting to see how CrowdStrike handles this incident, rather than abandoning its services altogether.

Leader in AI-Driven Cybersecurity

The lack of significant customer departures may be attributed to the scarcity of effective alternatives to CrowdStrike. The cybersecurity landscape is complex, often requiring businesses to use various vendors. CrowdStrike stands out with its comprehensive solution covering cloud security, identity management, endpoint protection, and more, making it both convenient and cost-effective.

Its flagship Falcon platform features 28 different modules, with 65% of customers using at least five as of the fiscal 2025 second quarter (ending July 31). The company also reported a remarkable 66% year-over-year increase in contracts for eight or more modules, highlighting a trend where many clients spending $100,000 or more annually utilize at least eight modules.

CrowdStrike is also at the forefront of artificial intelligence, enhancing its threat detection and response processes. The AI models are trained on over 2 trillion security events daily, ensuring continuous improvement in accuracy.

Last year, the company introduced Charlotte AI, a virtual assistant integrated with Falcon. This tool can autonomously summarize incidents and respond to specific inquiries, easing the workload for cybersecurity managers by saving an average of two hours a day for clients.

Image source: Getty Images.

Anticipation for the Q3 Results

The rebound in CrowdStrike’s stock is significant, rising by 58% since its lowest point. This increase largely followed the release of the second-quarter results on August 28. Investors expect continued upward movement after the Q3 results on November 26, potentially regaining a previous all-time high of 14%, contingent on several factors.

First, CrowdStrike must meet or exceed the revenue forecast of $981.9 million for it to demonstrate customer loyalty. Also, any revision of the full-year revenue forecast, either upward or unchanged, would signal management’s confidence in future sales.

Ultimately, Kurtz’s reassuring comments will play a critical role. Investors need assurance that the issues from July 19 are now resolved and that the adverse effects are waning. Based on recent remarks from Kurtz, there is a positive outlook for these developments.

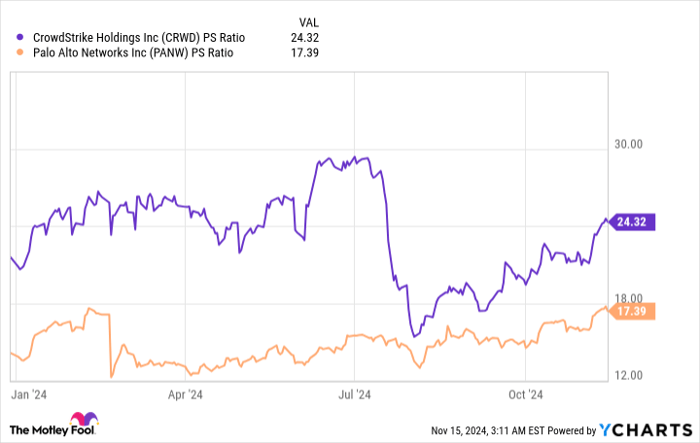

However, investors should note potential risks. The stock’s current price-to-sales ratio of 24.3 is comparatively high against its rival, Palo Alto Networks, which stands at 17.3.

CRWD PS Ratio data by YCharts.

Despite this, with a 32% revenue growth compared to Palo Alto’s 12%, CrowdStrike holds a justified premium. This aligns with management’s ambitious target of $10 billion in revenues by fiscal 2031, indicating potential long-term value for investors.

Thus, the outlook for CrowdStrike stock appears positive in the aftermath of the November 26 report.

Is Now the Time to Invest $1,000 in CrowdStrike?

Before deciding to invest in CrowdStrike, here are some considerations:

The Motley Fool Stock Advisor analysts have identified what they believe are the 10 best stocks to buy now, and CrowdStrike is not on that list. The stocks that made it could yield significant returns in the coming years.

For example, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would have approximately $870,068 now!*

Stock Advisor offers investors a clear path to success with guidance on portfolio building, frequent analyst updates, and two new stock picks each month. Since its launch in 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Microsoft. It also recommends Delta Air Lines and Palo Alto Networks and suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool’s disclosure policy applies.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.