Growth and Challenges in the Lithium Market: What’s Ahead for 2025

In recent years, lithium prices have dropped approximately 80% from their peak levels due to an influx of new supply. Producers in Australia and other regions are still adjusting to these changes and their impacts on the market.

According to Adamas Intelligence, a battery metal and EV consultancy based in Toronto, the Asia Pacific region, especially China, is projected to continue leading the global EV market. Currently, electric vehicles (EVs) make up more than 50% of all vehicle sales in China.

While there is optimism for a rebound in EV sales in the Americas and Europe, potential trade restrictions from the EU on Chinese-made cars and the planned tariffs by the incoming Trump administration pose significant uncertainties for the market.

With lower battery material costs, the price of EVs is expected to become more affordable. Tesla aims to build an additional 500,000 EVs in 2025, partly due to the anticipated launch of a low-cost passenger vehicle, followed by the introduction of its robotaxi.

In Europe, automakers will face stricter CO2 standards beginning next year, which is expected to drive the production of more affordable mass-market EVs.

China’s EV market will likely remain the primary source of lithium demand, buoyed by government economic stimulus and ongoing incentives for consumers to transition from gasoline cars.

The Rise of EVs and Energy Storage

In China, the growth of extended range plug-in hybrid electric vehicles (PHEVs) has bolstered lithium demand recently, thanks to their larger battery sizes.

On the battery front, lithium-iron-phosphate (LFP) batteries, which do not use nickel or cobalt, are dominating the market, favoring lithium carbonate over lithium hydroxide. However, market dynamics vary by region.

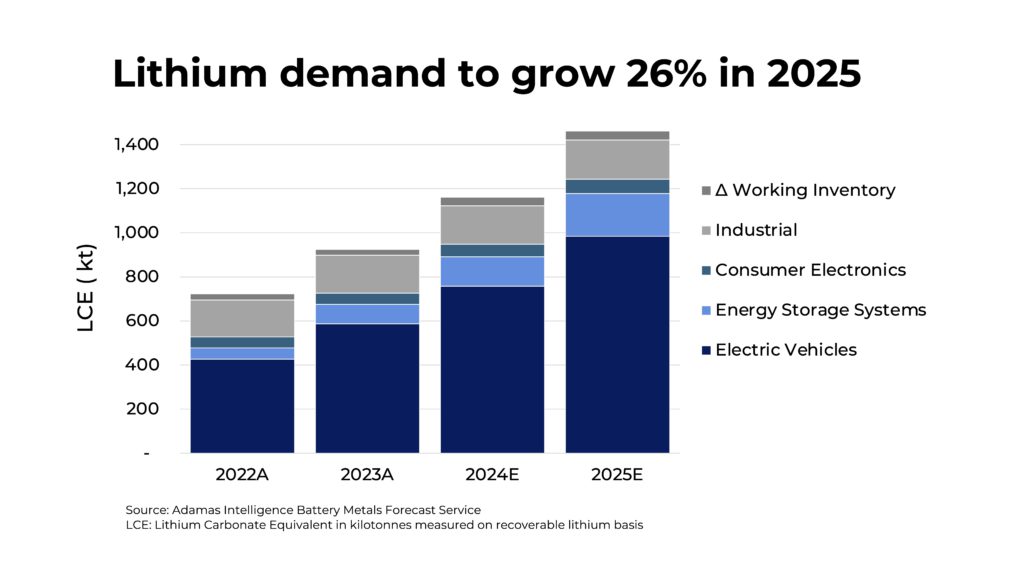

Outside of the electric vehicle sector, we anticipate global lithium demand for energy storage systems to rise significantly in 2025, making up 13% of overall lithium demand and growing at 45% year-on-year.

Globally, lithium demand is projected to rise by 26% to 1.46 million tonnes in 2025, compared to an estimated 1.15 million tonnes this year.

Supply Challenges: Short-Term Adjustments

This year’s uncertainty about the marginal supplier has led many boardrooms to focus on positive long-term demand forecasts, which increased the existing supply glut.

Despite the low prices, China continues to produce lepidolite and Zimbabwean spodumene, while Australian producers have made only slight reductions in output, opting to improve cost efficiency instead.

A delayed response from higher-cost hard rock miners resulted in minimal supply cuts until late 2024 when operations began to experience losses.

CATL’s decision to cut back on operations at its Jianxiawo mine challenges the assumption that many expensive Chinese lepidolite operations could continuously supply the market.

China’s lepidolite production has decreased by half since its peak in June 2024, aligning it more closely with market fundamentals. We expect further reductions in production next year.

Challenges with African Supply Chains

Projects in Africa that rushed to market may struggle to survive if prices remain low.

Although Zimbabwean mines, primarily controlled by Chinese interests, have stabilized, there are still signs of trouble due to their strategy to enter the market quickly.

This rush led to inefficiencies, low product quality, and high transportation costs due to poor infrastructure.

As a result, high-cost petalite mines like Sinomine’s Bikita are shutting down, and more remote operations, including Yahua’s Kamativi mine, may not produce commercial quantities until market conditions improve.

Challenges for Australian Lithium Producers

In Australia, only one lithium mine, Greenbushes, is generating positive cash flow. This situation led Mineral Resources (ASX: MIN) to place its Bald Hill operation into care and maintenance in November, following Pilbara Minerals’ (ASX: PLS) earlier suspension of its Ngungaju plant.

The industry is now postponing the advancement of new supply projects like Arcadium’s (NYSE: ALTM; ASX: LTM) Fenix 1B and Galaxy initiatives to preserve capital. This could lead to greater volatility when supply deficits occur in the future.

As large-cap resource companies like Rio Tinto (NYSE: RIO: LSE: RIO: ASX: RIO) or ExxonMobil become more involved, we might expect more stable transitions during supply cycles.

Opportunities Ahead for South America and DLE

Brine-sourced lithium operations, currently profitable, are expected to expand in line with rising demand in 2025, particularly in Chile and various projects in Argentina and China.

Direct lithium extraction (DLE) technology is promising better recoveries and faster production timelines for lithium brines. Developers will keenly monitor Eramet’s ramp-up at its Centenario site in Argentina, especially following Tsingshan’s withdrawal from the project in October.

The slow scalability of evaporative brine projects, alongside the rapid growth of the industry over the past decade, means that DLE must prove its viability to maintain market share.

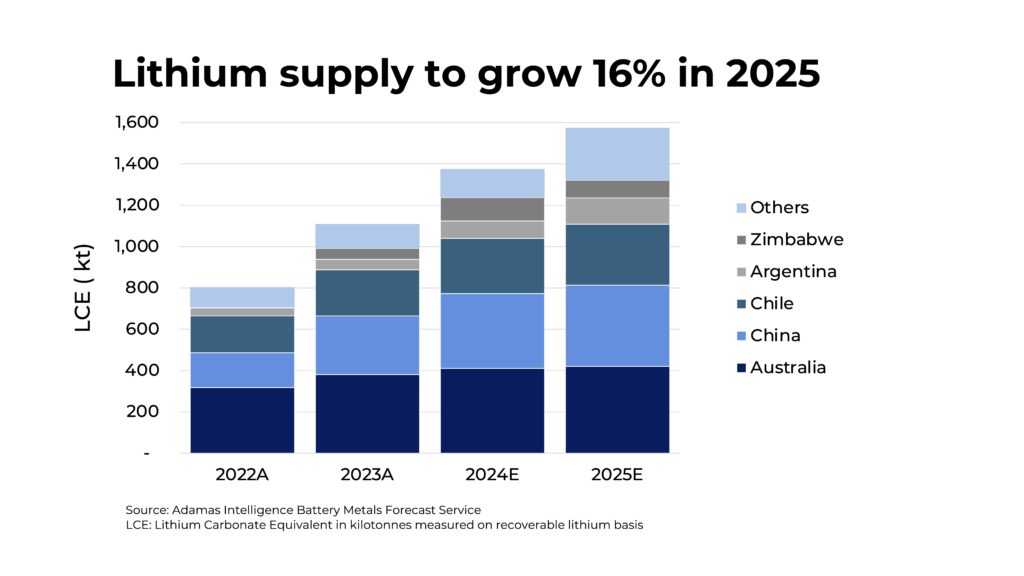

Looking forward, global lithium supply is expected to rise by 16% to 1.58 million tonnes (LCE) in 2025, up from an estimated 1.36 million tonnes this year.