Vanguard Growth ETF Outshines S&P 500 in 2024: A Look Ahead to 2025

The S&P 500 (SNPINDEX: ^GSPC) is off to an impressive start this year, boasting a 27.3% gain—over double its average annual return since 1957.

Surprisingly, the Vanguard Growth ETF (NYSEMKT: VUG) is faring even better, with a year-to-date increase of 30.9%. The tech sector, aided by trends like artificial intelligence (AI), is driving both indices, but the Vanguard ETF dedicates a larger portion to these stocks.

Historically, the Vanguard ETF has outperformed the S&P 500 since its inception in 2004, suggesting it may continue to do so going into 2025.

Image source: Getty Images.

Strong Holdings in Top Growth Stocks

The Vanguard ETF focuses solely on large-cap U.S. growth companies, containing 182 stocks across 12 sectors. Notably, the tech sector makes up the majority, weighing in at 58% of its portfolio.

In contrast, the S&P 500 includes 500 companies, with technology comprising 31.7%. This concentrated focus can lead to increased risk during technology downturns.

Three of the ETF’s top holdings are tech giants, together making up over a third of its total value. The top five also feature Amazon from the consumer discretionary sector and Meta Platforms from communication services. Below are their weightings compared to the S&P 500:

|

Stock |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

11.71% |

7.11% |

|

2. Nvidia |

10.94% |

6.76% |

|

3. Microsoft |

10.80% |

6.26% |

|

4. Amazon |

6.00% |

3.61% |

|

5. Meta Platforms |

4.70% |

2.57% |

Data source: Vanguard. Portfolio weightings are accurate as of Oct. 31, 2024, and are subject to change.

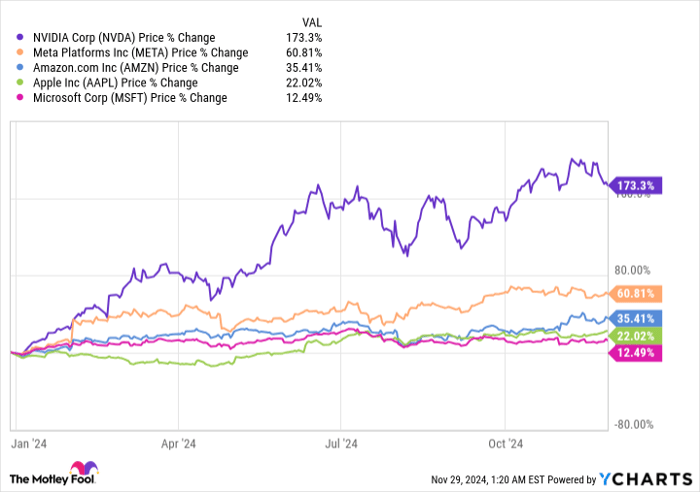

These prominent companies are at the helm of the AI wave, leading in both hardware and software sectors. Collectively, their stocks have surged by an average of 61% in 2024, aided by Nvidia‘s remarkable appreciation of 173%, spurred by high demand for its AI chips.

NVDA data by YCharts

The Vanguard ETF’s elevated holdings in these key stocks help explain its superior performance in 2024. Beyond the top five, the ETF includes other notable stocks like Tesla, Alphabet, and Broadcom.

Additionally, the ETF isn’t solely technology-focused; it includes major companies such as Eli Lilly, Visa, Costco Wholesale, and McDonald’s among its 20 largest investments.

Why the Vanguard ETF May Again Outperform S&P 500 in 2025

Since launching in 2004, the Vanguard ETF has achieved a compound annual return of 11.4%, surpassing the S&P 500’s 10.1% over the same timeframe.

This trend has strengthened in recent years, with the Vanguard ETF returning 15.2% annually over the past decade, compared to the S&P’s 13.2% average gain.

If AI investments persist in driving market growth through 2025, the Vanguard ETF is well-positioned to outperform the S&P 500 again, given the significant weighting of these stocks in its portfolio. Yet, a market correction could pose challenges, as investors might shift from growth stocks to safer options during downturns.

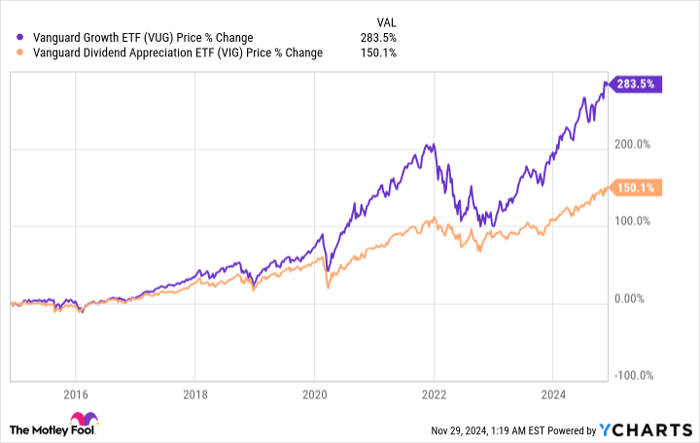

Historically, the Vanguard Growth ETF has consistently outperformed the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG). However, it tends to decline more sharply during challenging market periods, indicating that growth stocks might lag behind dividend stocks in adverse conditions.

VUG data by YCharts

The S&P 500 currently appears expensive, with a price-to-earnings (P/E) ratio of 24.7—about 36% above its historical average of 18.1 since the 1950s. Growth stocks contribute significantly to this premium, as all five of the Vanguard ETF’s top holdings possess higher P/E ratios compared to the S&P.

While a market correction is a possibility in 2025, the resilience of the U.S. economy could lead to a brief buying opportunity, with growth stocks likely rallying again.

A Second Chance for Investors

Have you ever felt like you missed out on investing in top-performing stocks? Opportunities do come again.

In select circumstances, our analysts recommend a “Double Down” stock, highlighting companies poised for significant growth. If you feel you missed previous chances, now might be the right time to invest. The data is compelling:

- Nvidia: investing $1,000 back when we doubled down in 2009 would yield $358,460!*

- Apple: a $1,000 investment from 2008 would be worth $44,946!*

- Netflix: if you invested $1,000 in 2004, it would have grown to $478,249!*

Currently, we have “Double Down” alerts for three exciting companies, and this may be a unique opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Microsoft, Nvidia, Tesla, Vanguard Dividend Appreciation ETF, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.