NVIDIA Readies for Fiscal Q4 2025 Earnings Amid Market Fluctuations

AI giant NVIDIA (NVDA) finds itself in the limelight, preparing to unveil its fiscal fourth-quarter 2025 results after the market closes on February 26. Once a stalwart in powering the bullish market, the chipmaker has encountered challenges recently as it approaches its earnings announcement.

Current Market Performance

NVIDIA’s stock has declined by 4.3% over the past three months, contrasting with a slight growth of 4.1% in the broader industry. Although NVIDIA shares reached an all-time high in early January, they have faced headwinds following the emergence of DeepSeek, a competing AI startup from China. Investors hope that a strong earnings report could restore confidence in the company’s performance (read: AI Winners Following the DeepSeek Disruption).

As the earnings report date approaches, several ETFs with significant NVIDIA allocations will attract attention. Notable funds include the Strive U.S. Semiconductor ETF (SHOC), VanEck Vectors Semiconductor ETF (SMH), VanEck Fabless Semiconductor ETF (SMHX), YieldMax Target 12 Semiconductor Option Income ETF (SOXY), and the Columbia Semiconductor and Technology ETF (SEMI).

Earnings Insights

NVIDIA currently has an Earnings ESP of 0.00% along with a Zacks Rank of 2 (Buy). Based on our methodology, a positive Earnings ESP combined with a Zacks Rank of 1 (Strong Buy), 2, or 3 (Hold) suggests a higher likelihood of an earnings beat. Investors can utilize our Earnings ESP Filter to identify the best stocks to buy or sell before earnings are reported.

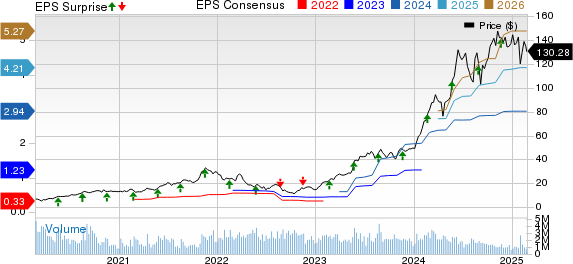

Over the past month, there have been no changes to the earnings estimates for NVIDIA’s fourth quarter. The Zacks Consensus Estimate anticipates a 70.7% growth in revenue and a 61.5% increase in earnings for the quarter. Historically, NVIDIA has delivered an average earnings surprise of 9.79% over its last four quarters.

Price and Earnings Surprise Analysis

NVIDIA Corporation price-consensus-eps-surprise-chart | NVIDIA Corporation Quote

The company holds a Growth Score of B and ranks within the top tier of its Zacks industry (top 23%), indicating strong growth potential.

Wall Street analysts maintain an optimistic outlook for NVIDIA, assigning an average rating of 1.23 on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on evaluations from 44 brokerage firms. Among these, 38 recommend Strong Buy, with two recommending Buy, leading to ratios of 86.36% and 4.55% for Strong Buy and Buy ratings, respectively.

The average price target based on short-term estimates from 42 analysts sits at $177.43, with predictions ranging from a low of $135.00 to a high of $220.00.

Impact of DeepSeek Competition

NVIDIA experienced a dramatic drop of nearly 17%, translating to a loss of about $600 billion in market value—this marked the largest single-day loss in U.S. stock market history—following DeepSeek’s announcement of its potential to disrupt the AI sector. Since this dip, NVIDIA’s stock has seen a recovery, bolstered by analysts predicting further positive momentum (read: DeepSeek Shakes US Tech Dominance: Impact on Stocks & ETFs).

Interestingly, rising demand for DeepSeek’s low-cost AI models has inadvertently benefitted NVIDIA. Chinese firms are increasingly ordering NVIDIA’s H20 AI chip, which may counterbalance fears of potential declines in AI chip demand.

Future Growth Driven by AI

NVIDIA stands as a global leader in the AI chip sector, controlling between 80% and 95% of the market, according to Reuters. This success is attributed to its cutting-edge graphics processing units (GPUs) that excel at powering AI systems, including generative AI technologies used in platforms like OpenAI’s ChatGPT. Many analysts predict that NVIDIA will continue to increase its value as it maintains its dominance in the lucrative AI chip market.

During its last conference call, CEO Jensen Huang noted that “The age of AI is in full steam, driving a global transition to NVIDIA computing.” In January, NVIDIA made headlines by launching several new chips and software aimed at strengthening its position in AI computing. This included the introduction of the GeForce RTX 50 Series for gaming systems, comprising the RTX 5090, RTX 5080, RTX 5070 Ti, and RTX 5070 (read: NVIDIA Regains Momentum on AI Growth: ETFs to Tap).

The company also announced NVIDIA Cosmos, a new platform designed to accelerate physical AI development, and Project Digits, a high-performance PC powered by the NVIDIA GB10 Grace Blackwell Superchip with the Linux-based NVIDIA DGX operating system. CFO Colette Kress stated that production of the Blackwell chips is set to begin in the fourth quarter of fiscal 2025 and will scale up in fiscal 2026. She mentioned that “Demand for Blackwell is expected to exceed supply for several quarters.” Furthermore, management anticipates a rebound in NVIDIA’s gross profit margin as its Blackwell chip line ramps up production.

For the upcoming fourth quarter of fiscal 2025, NVIDIA forecasts revenues of $37.5 billion, with a margin of error of 2%.

NVIDIA Valuation Analysis

NVIDIA is currently trading at a P/E ratio of 31.95, slightly below the Semiconductor – General industry average of 32.26. Additionally, its PEG ratio of 1.60 is lower than the industry average of 2.24. A lower PEG ratio suggests a better valuation, indicating that investors would pay less for each unit of earnings.

ETFs Worth Watching

Strive U.S. Semiconductor ETF (SHOC) – NVIDIA exposure: 19.5%

VanEck Vectors Semiconductor ETF (SMH) – NVIDIA exposure: 19%

VanEck Fabless Semiconductor ETF (SMHX) – NVIDIA exposure: 19.7%

YieldMax Target 12 Semiconductor Option Income ETF (SOXY) – NVIDIA exposure: 18.1%

Columbia Semiconductor and Technology ETF (SEMI) – NVIDIA exposure: 17.7%

Investing in Single-Stock ETFs

For investors willing to take on more risk, single-stock ETFs with 200% exposure to NVIDIA are available, such as the T-REX 2X Long NVIDIA Daily Target ETF (NVDX) and the GraniteShares 2x Long NVDA Daily ETF (NVDL). Additionally, the Roundhill NVDA WeeklyPay ETF (NVW) aims to provide weekly income that equates to 1.2 times (120%) the weekly total return of NVIDIA shares.

Stay Updated with Key ETF Information

Zacks’ free Fund Newsletter provides weekly updates with essential news and analysis, as well as insights on top-performing ETFs.

To stay informed about the latest recommendations from Zacks Investment Research, you can download the report titled “7 Best Stocks for the Next 30 Days” for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

Columbia Semiconductor and Technology ETF (SEMI): ETF Research Reports

Strive U.S. Semiconductor ETF (SHOC): ETF Research Reports

VanEck Fabless Semiconductor ETF (SMHX): ETF Research Reports

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.