Analyst Projections for Global X MSCI Argentina ETF Show Promising Upside

In our analysis at ETF Channel, we examined the underlying assets of the Global X MSCI Argentina ETF (Symbol: ARGT) to determine its potential for growth. Based on this assessment, the weighted average analyst target price for ARGT stands at $95.36 per unit.

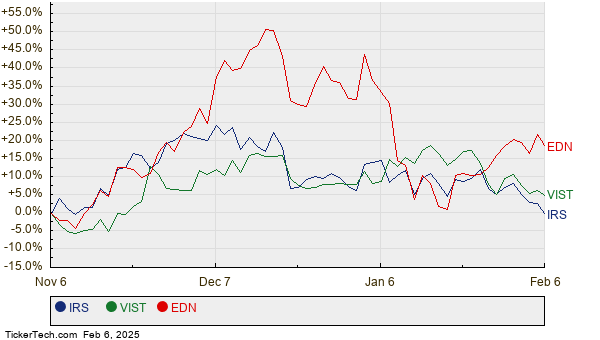

Currently trading around $85.59 per unit, ARGT presents an potential upside of 11.42%, according to the average analyst targets tied to its holdings. Notably, three key stocks within ARGT indicate significant upside potential: IRSA Inversiones y Representaciones S.A. (Symbol: IRS), Vista Energy S.A.B. de C.V (Symbol: VIST), and Empresa Distribuidora y Comercializadora Norte SA Edenor (Symbol: EDN). IRS is priced at $13.93 per share, but analysts project a target of $20.00, reflecting a possible increase of 43.58%. VIST, currently at $52.38, has a target price of $71.00, suggesting a 35.55% upside. Similarly, EDN’s recent price of $38.52 contrasts sharply with the estimated target of $48.50, indicating an increase of 25.91%. Below, you’ll find a twelve-month price history chart showcasing the performance of IRS, VIST, and EDN:

Together, IRS, VIST, and EDN comprise 7.84% of the Global X MSCI Argentina ETF. The following summary table outlines the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Global X MSCI Argentina ETF | ARGT | $85.59 | $95.36 | 11.42% |

| IRSA Inversiones y Representaciones S.A. | IRS | $13.93 | $20.00 | 43.58% |

| Vista Energy S.A.B. de C.V | VIST | $52.38 | $71.00 | 35.55% |

| Empresa Distribuidora y Comercializadora Norte SA Edenor | EDN | $38.52 | $48.50 | 25.91% |

Are these analyst targets realistic, or do they reflect misplaced optimism? Investors should consider whether these projections are well-informed by recent developments in the companies and their industries, or if they are outdated expectations. A high target price compared to a stock’s current price could hint at optimism, but it may also lead to future downgrades if market conditions change. It’s essential for investors to conduct thorough research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

SWSH Historical Stock Prices

MLSS Historical Stock Prices

Funds Holding XGN

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.