Ally Financial (NYSE: ALLY) thrived during the COVID-19 pandemic, benefiting from robust demand for automotive loans and enhanced consumer savings. Stimulus checks allowed borrowers to repay their loans on time, while low interest rates drove customers toward online banking solutions, including Ally’s offerings. However, 2022 brought significant challenges as rising interest rates increased costs for the bank, leading to a decline in automotive loan repayments and a slide in earnings per share (EPS) and stock value. Despite a recovery in 2023, Ally’s stock remains down 30% from its all-time highs in 2021.

Assessing Ally’s Path to Recovery

Could Ally be back on track? With interest rates beginning to decline and the automotive market stabilizing, there is potential for recovery. The next few years will be crucial for the company’s stock performance.

Restructuring the Lending Focus

Historically concentrated on automotive loans, Ally has been pivoting to diversify its portfolio. It ventured into home mortgages and credit cards; however, credit cards have struggled to be profitable and mortgage loans are currently a drag on earnings due to their low interest rates.

To concentrate on its strengths, Ally has decided to exit the credit card market and stop originating new home mortgage loans, allowing its existing mortgage portfolio to draw down naturally. This strategic shift aims to refocus on profitable services like automotive loans, dealer insurance, and a smaller corporate lending segment.

In 2024, Ally originated nearly $40 billion in car loans and achieved record premiums in its insurance business. Retail automotive loans in 2024 have shown improved performance compared to the previous years, with better credit quality and increased yields. Both insurance and corporate finance are expected to drive profits as Ally rebuilds its core operations.

Will Consumer Deposits Rebound?

Ally has consistently grown its customer base and deposits since launching its online bank over a decade ago. A growing deposit base is vital since deposits are a cheaper source of funding than capital market loans. Essentially, an increase in deposits benefits Ally’s overall financial health.

However, deposit growth has slowed in recent years. Ally ended 2021 with $135 billion in retail deposits, which only rose to $143 billion by the end of 2024. This plateau in growth coincided with the Federal Reserve’s interest rate hikes and increased competition from other banks like SoFi, which have attracted depositors by offering higher interest rates. While Ally offers a current interest rate of 3.7%, competitive offerings from rivals have made retention more challenging.

Despite these pressures, it appears Ally is overcoming past challenges. With the Federal Reserve halting interest rate hikes and beginning to lower rates, Ally is expected to pay less to depositors in the future—opening up opportunities to attract new customers. More deposits will enable Ally to expand its lending capabilities, potentially boosting earnings.

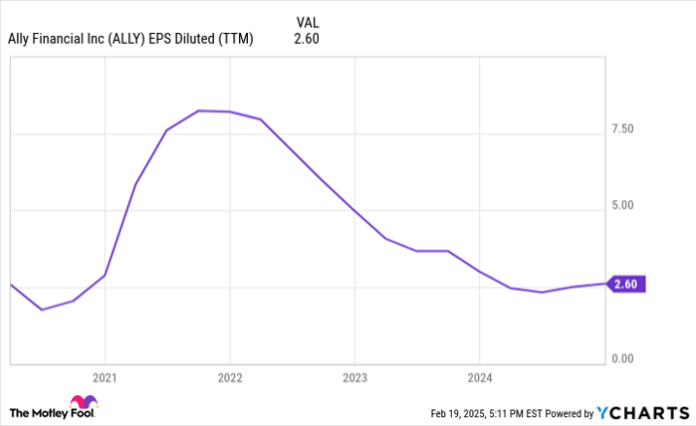

ALLY EPS Diluted (TTM) data by YCharts

Anticipating Earnings Normalization

Currently, Ally’s stock is valued with a price-to-earnings (P/E) ratio of 15, suggesting it is not an exceptionally low-cost buy. However, this valuation reflects suppressed earnings influenced by the aforementioned challenges. Ally’s EPS stood at $2.60 over the past year, down from over $7.50 at its peak in 2021. Although returning to $7.50 seems unlikely within the next five years, an EPS of $5 or more appears achievable.

This potential can be realized through the company’s focus on relieving itself of non-core operations and capitalizing on improved automotive loan performance. Given its solid corporate finance and insurance operations, Ally is projected to achieve consistent earnings growth in the coming years.

At an EPS of $5, Ally would trade at a P/E ratio of under 8 based on its current price of $39, which indicates an attractive valuation. Furthermore, with an expected dividend yielding around 3%, prospective returns could be significant.

A Second Chance for Investors

Have you ever felt you missed out on a great investment opportunity? Now could be a perfect moment to reconsider.

Our analysts frequently issue a “Double Down” stock recommendation for companies poised for growth. If you’ve had concerns about missing your chance to invest, now may be an excellent time to act, as trends point to potential upside:

- Nvidia: if you invested $1,000 when we intensified our recommendations in 2009, you’d have $348,579!*

- Apple: if you invested $1,000 in 2008,you’d have $46,554!*

- Netflix: if you invested $1,000 when we reassessed in 2004,you’d have $540,990!*

Presently, we are rolling out “Double Down” alerts for three promising companies, suggesting that similar opportunities may be coming soon.

Learn more »

*Stock Advisor returns as of February 21, 2025

Ally is an advertising partner of Motley Fool Money. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.