The Future of AI: Can CrowdStrike Outshine Palantir?

In a year where artificial intelligence stocks have dominated the market, Palantir Technologies (NASDAQ: PLTR) and CrowdStrike (NASDAQ: CRWD) stand out for different reasons. While Palantir garners praise for its success in enterprise software, CrowdStrike faced challenges due to a major platform glitch affecting its customers earlier this year.

Despite this setback, I maintain a positive outlook on CrowdStrike’s long-term prospects, believing it could surpass Palantir in value within the next decade.

Palantir’s Meteoric Rise in AI Software

As of now, Palantir stock has surged 287% in 2024, making it the second-best performing stock in the S&P 500.

The key factor behind Palantir’s success is the strong demand for its Artificial Intelligence Platform (AIP). Prior to this release, many viewed Palantir merely as a consultancy for government contracts, with limited software offerings. However, the past year has seen a remarkable change in this perception.

Over the last 12 months, Palantir has boosted its customer base by 39%. Notably, its commercial partnerships grew by over 50% through the trailing-12-month period ending September 30.

This rise in customers is naturally leading to increased revenue. More importantly, Palantir is not just expanding its revenue; it is also enhancing profit margins. The company has started generating positive free cash flow and net income alongside this revenue growth.

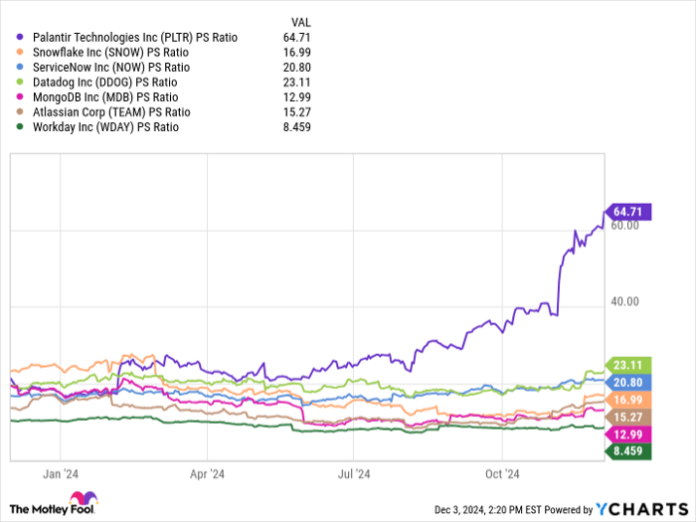

However, Palantir’s rapid valuation increase raises some concerns. For example, its price-to-sales (P/S) ratio has ballooned to 65, significantly higher than its peers. While some argue this premium is justified, the valuation growth seems excessively rapid. This trend may explain the recent decisions by some hedge funds to reduce their exposure to Palantir stock.

CrowdStrike’s Strength in the Face of Challenges

It’s important to highlight that CrowdStrike is not a cheap investment. Even after a downturn due to the security outage earlier this summer, its stock trades at a notable premium compared to competitors.

Despite recent challenges, CrowdStrike’s market position during the COVID-19 pandemic was impressive. Demand for its cybersecurity solutions increased during this period, driven largely by businesses needing to protect remote work setups.

The necessity for robust cybersecurity measures is likely to grow, regardless of economic climates. While data analytics from Palantir may lose appeal in tough times when budgets are tight, the demand for cybersecurity remains constant.

Final Thoughts: Where Do We Stand?

CrowdStrike’s security outage occurred on July 19, and a month later, it reported $3.9 billion in annual recurring revenue (ARR) for Q2 of fiscal 2025 (ending July 31). By Q3, its ARR increased to over $4 billion.

This growth in ARR, despite reputational setbacks, showcases the robustness of CrowdStrike’s offerings and the essential role it plays for its clients.

Both Palantir and CrowdStrike are currently high-priced stocks. However, Palantir’s valuation seems stretched, requiring substantial proof of sustainable growth amidst fierce competition in the enterprise software sector. Conversely, the increasing importance of cybersecurity may position CrowdStrike for sales acceleration, margin expansion, and profit growth in the coming years.

For these reasons, I believe CrowdStrike could have a better chance to increase its valuation compared to Palantir, especially if the latter struggles to maintain its growth trajectory.

Should You Invest $1,000 in CrowdStrike Now?

Before investing in CrowdStrike, consider the following:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to invest in right now. Notably, CrowdStrike isn’t included in that list. The recommended stocks are expected to offer substantial returns in the future.

For example, if Nvidia had made this list back on April 15, 2005, a $1,000 investment would now be worth approximately $872,947!*

Stock Advisor provides a straightforward blueprint for investment success, featuring guidance on portfolio building and monthly stock picks.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024.

Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends Atlassian, CrowdStrike, Datadog, Fortinet, MongoDB, Okta, Palantir Technologies, ServiceNow, Snowflake, Workday, and Zscaler. The Motley Fool recommends Palo Alto Networks. For more details, please refer to the Motley Fool disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.