AI Investment Boom: Rising or Repeating History?

Over the past two years, artificial intelligence (AI) has drawn more investment interest than any other sector. The frenzy truly ignited on November 30, 2022, when OpenAI launched ChatGPT.

Since that pivotal day, the S&P 500 index (SNPINDEX: ^GSPC) has soared by 49%, while the tech-rich Nasdaq Composite (NASDAQINDEX: ^IXIC) has surged an impressive 75% (as of market close on Dec. 11).

In such high-stakes environments, investors may fall prey to “bubble psychology,” a mindset where they believe the market will endlessly rise. This aligns with the Greater Fool Theory, which posits that investors might pay inflated prices for assets, hoping to sell them to someone else at an even higher price, thus becoming the “greater fool.”

In this article, I will explore how previous megatrends have performed historically, including the capital markets following similar periods of rapid growth.

Will AI stocks continue to rise in 2025, or is there a risk of becoming the Greater Fool? Let’s dive into the details.

Examining Recent Megatrends

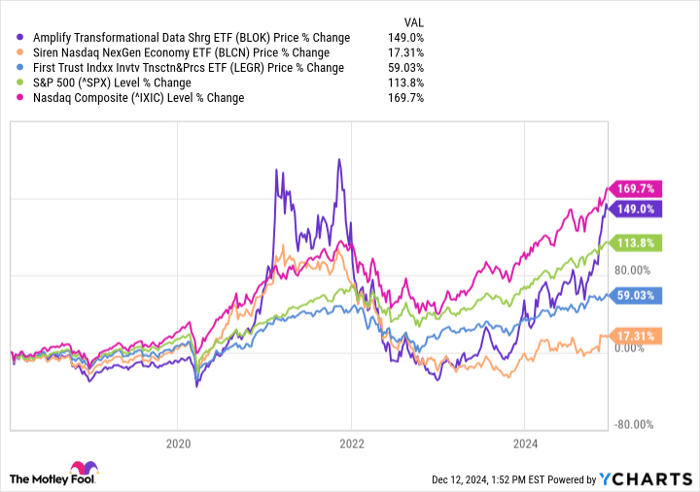

The last significant megatrend before the current AI excitement was blockchain technology. Think of blockchain as a vast digital ledger for transactions. Though blockchain concepts have existed for decades, the technology has only become mainstream in the last ten years. The chart below compares various blockchain exchange-traded funds (ETFs) against the S&P 500 and Nasdaq over recent years.

BLOK data by YCharts.

The Amplify Transformational Data Sharing ETF has performed comparably with the Nasdaq and even surpassed the S&P 500 since 2018. Additionally, the First Trust Indxx Innovative Transaction & Process ETF recorded an impressive 59% return. Let’s look at the contents of these ETFs before concluding that blockchain is a better investment than the overall market.

- Amplify Transformational Data Sharing ETF: Key holdings include Core Scientific, Galaxy Digital Holdings, Coinbase, MicroStrategy, Robinhood, and PayPal. Notably, MicroStrategy has skyrocketed nearly 3,000% since January 2018, largely due to its bitcoin holdings. Hence, if bitcoin prices rise, MicroStrategy’s shares tend to rise as well.

- First Trust Indxx Innovative Transaction & Process ETF: Major holdings include JD.com, Baidu, Alibaba, Intel, Micron, and Advanced Micro Devices. Interestingly, many of these stocks have reported negative returns since 2018. Despite this, AMD’s nearly 1,200% gain driven by AI has bolstered the ETF’s overall performance.

Image source: Getty Images.

Lessons from Historical Market Trends

Alongside analyzing megatrends, it’s crucial to assess historical capital market performance more broadly. AI, which serves many industries, has primarily benefited stocks in the technology sector. Thus, let’s look at the Nasdaq Composite index’s performance over the years.

Since its launch in 1971, the Nasdaq has only seen consecutive years of negative returns on two occasions, neither happening in over 20 years. This suggests potential continued gains for the Nasdaq in 2025.

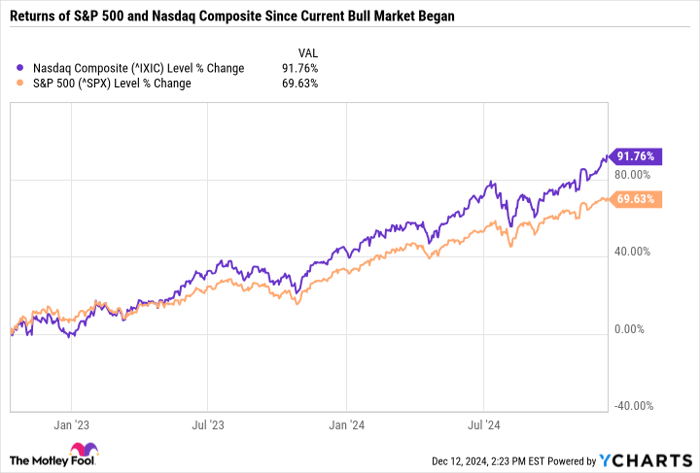

The chart below illustrates the gains experienced by the S&P 500 and Nasdaq Composite since the current bull market’s onset on Oct. 12, 2022. Such impressive performance may have you contemplating whether to reduce your equity exposure. After all, how much higher could markets realistically climb?

^IXIC data by YCharts.

The apparent answer is much higher. Historically, the S&P 500 continues to thrive in both the near and long term once it reaches an all-time high, as it has now.

The Complexity of Investment Trends

Considering everything discussed, investing in any megatrend presents a mixed picture. Blockchain has seen its winners, but strong cases are few. Significantly, the outliers I discussed, AMD and MicroStrategy, aren’t primarily blockchain companies.

Moreover, timing plays a critical role in determining profitability in these funds or their constituent stocks. While blockchain is not a “bad” investment by any means, it may not be wise to jump into many specific stocks mentioned earlier.

Although past performance doesn’t ensure future outcomes, historical data strongly indicates that the Nasdaq and S&P 500 should continue to rise in 2025.

From my analysis, while the markets are likely to grow next year, not every megatrend or affiliated company will yield positive returns. If you’re considering investing in AI stocks, I recommend focusing on established companies or passive index funds with reliable holdings rather than speculating on which stocks may take off next.

A Second Chance for Valuable Investments

Do you ever feel like you’ve missed the chance to invest in the most successful stocks? If so, you may want to pay attention.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies they believe are set to rise. If you’re concerned you’ve missed your opportunity, this might be the right time to invest before prices rise again. The numbers support this:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $348,112!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,992!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,539!*

Currently, we’re issuing “Double Down” alerts for three incredible companies, and opportunities like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Adam Spatacco holds positions in Coinbase Global. The Motley Fool holds positions in and recommends Advanced Micro Devices, Baidu, Coinbase Global, Intel, and PayPal. The Motley Fool also recommends Alibaba Group and JD.com, along with the following options: long January 2027 $42.50 calls on PayPal, short December 2024 $70 calls on PayPal, and short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.