The retail landscape has long been considered a goldmine for investors, offering a diverse array of sectors ranging from grocery to e-commerce and consumer tech. With the industry’s valuation hitting an impressive $27 trillion in 2022 and projected to climb to $30 trillion this year, opportunities abound for those seeking long-term growth prospects.

Costco (NASDAQ: COST) has undeniably basked in success, witnessing a 213% surge in its shares since 2019. The wholesale giant has charmed consumers across over a dozen countries with its business model and promises an exciting future as it expands its reach.

Yet, the allure of Costco pales in comparison to the retail prowess of Amazon (NASDAQ: AMZN) and tech giant Apple (NASDAQ: AAPL). These titans not only dominate their respective retail spheres but also command the first and third largest slices of the e-commerce market pie.

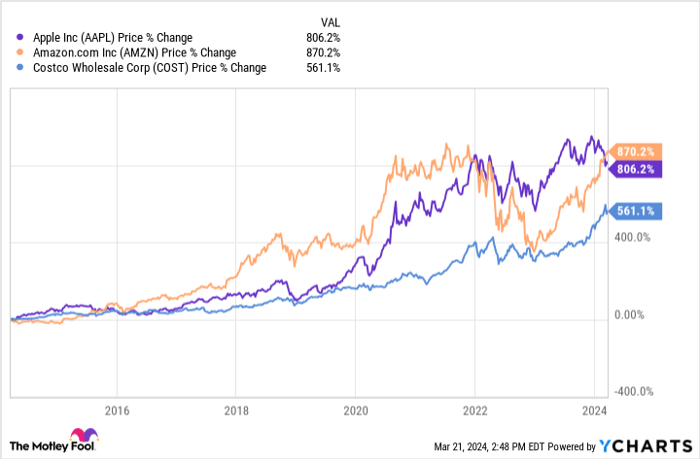

Witnessing the data by YCharts

Amazon and Apple have significantly outshone Costco in stock performance over the past decade, hinting at their potential as superior long-term investments. Bolstered by heavy investments in high-growth sectors like artificial intelligence (AI), these juggernauts seem poised to maintain their upward growth trajectory.

So, wave farewell to Costco and set your sights on these unstoppable stocks instead.

1. Amazon: A Sturdy Anchor in Troubled Waters

Amazon’s resilience in the face of adversity stands as a testament to its investment worthiness.

The economic turmoil of 2022 triggered a market-wide frenzy, causing the Nasdaq Composite to plummet by a staggering 33% during the year. Retail entities bore the brunt of the storm, grappling with soaring inflation that forced consumers to tighten their spending belts. Consequently, Amazon’s shares tumbled by 50% in 2022, coupled with sharp profit declines in its e-commerce domains.

However, the company orchestrated a remarkable turnaround, showcasing its reliability and fortitude. In the fiscal year 2023, Amazon witnessed a 12% surge in revenue year-over-year, amounting to $575 billion, while its operating income tripled to $37 billion.

A slew of cost-cutting initiatives and inflation respite fortified the company’s e-commerce operations, catapulting its free cash flow by a staggering 904% to $32 billion over the past 12 months.

Amazon’s stellar performance underscores the wisdom of embracing a long-term investment mindset. Those who hastily offloaded Amazon stock in 2022 missed out on its substantial growth thereafter.

Insights from the data by YCharts

Additionally, projections indicate Amazon’s earnings could reach approximately $7 per share over the next two fiscal years, while Costco may hit $19 per share. Although initially seeming to favor Costco, when factoring in forward price-to-earnings ratios (Amazon’s 43 and Costco’s 47), Amazon’s shares could skyrocket to $296, outstripping Costco’s $902. With robust e-commerce operations and burgeoning AI ventures, Amazon’s stock is a compelling choice at present.

2. Apple: Towering in the Realm of Consumer Tech

Apple stands as a formidable force in the consumer tech domain, reigning supreme across multiple product categories from smartphones to tablets, smartwatches, and headphones. Despite offering a narrower product spectrum than its peers, Apple commands the third-largest e-commerce market share in the U.S., trailing only Amazon and Walmart.

The widespread appeal of Apple’s products has cemented the company’s reliability and endowed it with the financial muscle to weather unexpected storms. With free cash flow soaring to $107 billion last year—decidedly higher than Costco’s $6 billion—Apple saw a 10% uptick in free cash flow in 2023, despite revenue setbacks.

Apple confronted some hurdles in the past year, contending with curbs on consumer spending, product constraints in China, and patent challenges concerning Apple Watch. Nevertheless, the company’s outlook remains robust, fueled by substantial cash reserves and forays into lucrative sectors such as AI and virtual reality.

A glance at the data by YCharts

The data above indicates that Apple’s stock offers discernible value compared to Costco’s shares, with Apple’s forward price-to-earnings ratio and price-to-free cash flow presenting a more attractive proposition. Lower figures in these valuation metrics typically spell better value.

In light of these insights, Apple’s stock emerges as a compelling contender, particularly when juxtaposed against Costco.

Considering an investment of $1,000 in Amazon right now?

Before diving into Amazon stock, ponder on this:

The Motley Fool Stock Advisor analyst team recently pinpointed what they deem as the 10 most promising stocks for investors presently… and Amazon failed to make the cut. These handpicked 10 stocks hold the promise of yielding substantial returns in the years ahead.

Stock Advisor lays out a straightforward roadmap to success for investors, offering insights on portfolio construction, analyst updates, and two fresh stock recommendations per month. Since 2002, the Stock Advisor service has tripled the S&P 500 return*

Explore the 10 stocks

*Stock returns as of March 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Dani Cook holds no positions in any of the mentioned stocks. The Motley Fool has vested interests in and recommends Amazon, Apple, Costco Wholesale, and Walmart. The Motley Fool upholds a disclosure policy.

The viewpoints and opinions articulated herein represent those of the author and may not necessarily align with those of Nasdaq, Inc.