The drumbeat of artificial intelligence (AI) has grown deafening. While tech giants have spearheaded this revolution, other players are stepping into the limelight with vigor.

Super Micro Computing (NASDAQ: SMCI) specializes in IT architecture, focusing on server rack design and storage clusters, closely intertwined with the AI behemoth Nvidia.

Despite Supermicro’s lofty stature and recent S&P 500 enlistment, a discerning eye reveals superior investment prospects elsewhere.

Let’s dissect Supermicro’s investment landscape vis-a-vis its contemporaries and explore the myriad choices available to investors.

Supermicro’s Soaring Trajectory – But Something’s Amiss

Supermicro’s fortunes have surged alongside Nvidia’s robust demand for graphics processing units (GPUs) and data center services, fostering annual revenue growth surpassing 100%. The upward momentum shows no sign of abating.

Yet, an intriguing anomaly emerges in Supermicro’s price behavior, mirroring Nvidia’s fluctuations. While both share a vital symbiosis, their fundamental distinctions are unmistakable.

Moreover, as Supermicro’s profit margins dwindle amid expanding revenues, the rationale behind its ascending stock price becomes a puzzling enigma.

Image source: Getty Images.

A Hidden AI Jewel Beckons…

Supermicro vies with IT architecture counterparts like IBM, Hewlett Packard Enterprise, Lenovo Group, and Dell Technologies (NYSE: DELL). These rivals, diversely rooted, seemingly offer more holistic solutions than Supermicro.

Dell recently unveiled its fiscal full-year 2024 results ending Feb. 2, registering a 14% annual revenue dip to $88 billion. Notably, the infrastructure solutions segment, encompassing storage, servers, and networking, saw a 12% yearly revenue slump to $33.9 billion.

Why, then, do I view Dell as a more enticing investment alternative, particularly as Supermicro flourishes and Dell wanes?

An Evident Disparity in Valuation

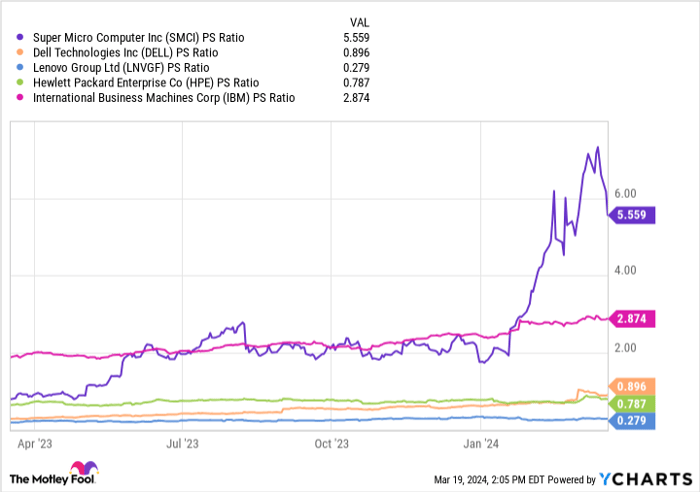

The chart below delineates the price-to-sales (P/S) ratios of various IT networking entities.

SMCI PS ratio data by YCharts.

Supermicro leads this peer group with a lofty P/S of 5.5, eclipsing the likes of IBM trading at nearly half that ratio.

The valuation chasm between Supermicro and its industry peers beckons attention. Although Dell’s P/S of 0.9 may seem modest in comparison, it notably exceeds the company’s five-year mean.

Dell’s stock portrays momentum akin to many AI-adjacent firms. While not overtly inexpensive, its long-term growth potential outshines Supermicro in my analysis.

Supermicro’s heavy reliance on Nvidia unveils a vulnerability – heightened competition anticipated in the near future. Should businesses broaden their data center and chip suppliers, Nvidia’s growth could decelerate, adversely impacting Supermicro.

Thus, whereas an exponential surge may elude Dell in the short haul, its integrated IT services landscape is poised for ascension. This could envisage a propitious rebound and sustained growth over the long run.

Given the substantial discount at which Dell stock trades versus Supermicro, Dell appears a wiser prospective buy. An astute approach involves monitoring Dell’s evolution over ensuing quarters, cognizant that AI is a marathon, not a sprint.

If Dell demonstrates competitive headway, adopting dollar-cost averaging could furnish exposure to this unique AI domain segment.

Considering a $1,000 investment in Dell Technologies?

Preceding any Dell Technologies purchase, deliberate on this:

The Motley Fool Stock Advisor experts pinpointed the top 10 stocks they believe hold immense potential for investors, and notably, Dell Technologies missed the list. The 10 selected stocks portend significant returns in the forthcoming years.

Stock Advisor furnishes a roadmap to prosperity, proffering portfolio building counsel, analyst updates, and bimonthly stock picks. Since 2002, the Stock Advisor service has tripled the S&P 500 returns*.

Explore the 10 stocks now

*Stock Advisor returns as of March 21, 2024

Adam Spatacco holds positions in Nvidia. The Motley Fool has positions in and endorses Nvidia. The Motley Fool suggests International Business Machines and reveals its disclosure policy.

The expressions and ideologies herein belong to the author and do not necessarily echo those of Nasdaq, Inc.