Fortinet’s Earnings Surge as Demand for Cybersecurity Solutions Grows

Fortinet Inc. (FTNT) delivered impressive third-quarter 2024 results, with both earnings and revenue surpassing expectations. Key metrics showed substantial year-over-year growth.

Earnings and Revenue Highlights

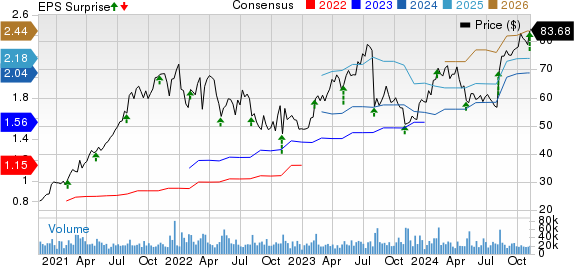

Fortinet’s non-GAAP earnings per share (EPS) for the third quarter was 63 cents, easily beating the Zacks Consensus Estimate by 23.53%. This reflects a significant 53.7% increase compared with 41 cents from the same quarter last year.

Total revenues reached $1.51 billion, surpassing the estimated mark by 2.1% and representing a 13% year-over-year increase. This growth was primarily driven by strong performance in service revenues and a return to growth in product revenues.

During the quarter, Fortinet onboarded over 6,000 new customers, showcasing the resilience of small enterprise customers and a strong channel partner ecosystem.

Financial Metrics Overview

Remaining Performance Obligations (RPO) grew by 15% to $6.1 billion, while total billings increased by 6% to $1.58 billion. Notably, Security Operations saw growth of 32%, and Unified SASE (Secure Access Service Edge) increased by 14%.

Segment Performance Breakdown

Looking at the segments, Product revenues finally returned to growth after five quarters, increasing by 2% to $474 million. Meanwhile, software license revenues continued to grow at a double-digit rate, particularly in SecOps solutions.

The combined revenues from software licenses and services surged by 33%, totaling more than $900 million in annual revenue. Service revenues, which accounted for 69% of total revenues, grew 19% to $1.034 billion, spurred by an increase in SaaS solutions.

Growth in Unified SASE and Security Operations

In the third quarter, Unified SASE accounted for 23% of the company’s business, fueled by a remarkable 220% growth in security service edge (SSE) billings. The growth in SSE and other cloud technologies benefitted from a robust SD-WAN customer base.

With impressive traction, Unified SASE and Security Operations achieved a 74% growth rate in organic Annual Recurring Revenue (ARR).

Profit Margins and Operating Income Performance

Total gross margin increased by 630 basis points (bps) to a record 83.2%, exceeding the guidance range. Product gross margin reached a record 71.6%, a significant improvement driven by better cost management and contract renegotiations.

For the quarter, non-GAAP operating income soared to $544.7 million, representing a non-GAAP operating margin of 36.1%, compared to $371.4 million and a margin of 27.8% in the same quarter of 2023.

Cash Flow and Future Outlook

At the close of the third quarter, Fortinet had $3.6 billion in cash and short-term investments, an increase from $3.3 billion at the end of the previous quarter. Cash flow from operations was $608.1 million, compared to $551.2 million in the same quarter last year.

In October 2024, the Fortinet board authorized a $1.0 billion increase in stock repurchases, with approximately $2.03 billion remaining available for future buybacks as of November 7, 2024.

Looking Ahead

For the fourth quarter, Fortinet anticipates revenues between $1.56 billion and $1.62 billion, with billings expected between $1.9 billion and $2 billion. Non-GAAP EPS is projected within 58-62 cents.

For fiscal year 2024, the revenue forecast is between $5.856 billion and $5.916 billion, with an expected non-GAAP EPS in the range of $2.2 to $2.28.

Market Position and Competitors

Currently, Fortinet holds a Zacks Rank of #2 (Buy). Other notable stocks in the technology sector include Shopify (SHOP), BiliBili (BILI), and NVIDIA (NVDA), with Shopify rated #1 (Strong Buy) and the others at #2.

As of now, shares of Shopify are up 4.9% year to date, with quarterly results expected on November 12. Meanwhile, Bilibili shares have soared 82% and will report on November 14, and NVIDIA has surged 194% with its report due on November 20.

Conclusion

Fortinet’s robust quarterly performance highlights its strong position in the cybersecurity market. With rising demand for digital security solutions, the company is well-positioned for future growth.

For more insights and stock analysis, readers can explore additional reports on NVIDIA, Fortinet, Shopify, and Bilibili.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.