Bulls Are Back in Town

Fortis Healthcare (NSEI:FORTIS) has undergone a remarkable 9.94% price target surge to reach 494.11 / share, signaling an inspiring upswing from the previous estimate of 449.45 as of January 16, 2024. This revision, undoubtedly music to investor’s ears, is the crescendo of a bullish movement within the market.

Diving into Dividends

In the midst of this price target soar, Fortis Healthcare keeps the dividend fires burning with a steady 0.22% yield. Furthermore, with a dividend payout ratio of 0.14, the company maintains a safe balance between rewarding shareholders and ensuring sustainable financial health. Such a delicate dance in dividend distribution is music to conservative investors’ ears.

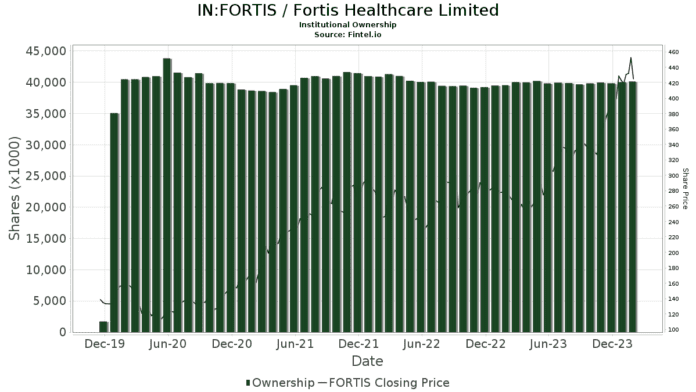

Following the Herd

As the bulls stampede, investment funds and institutions are not far behind. With 44 entities actively invested in Fortis Healthcare, an increase of 1 owner(s) or 2.33% in the last quarter, the stock is clearly a crowd favorite. These funds boast an average portfolio weight increase of 5.05%, demonstrating growing faith in the company’s future prospects.

Among the notable players in this shareholder symphony:

VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares leads the pack with 6,788K shares, a solid 0.90% ownership of Fortis Healthcare. While the firm exhibited a slight decrease in shares owned, it still shows a bullish outlook by increasing its portfolio allocation by 3.27% over the last quarter.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares is not far behind, holding 6,693K shares (0.89% ownership) with an increase of 2.84% in shares owned. The firm’s 5.26% growth in portfolio allocation underscores its bullish stance on Fortis Healthcare’s future.

EMGAX – Wells Fargo Emerging Markets Equity Fund and IEMG – iShares Core MSCI Emerging Markets ETF also play crucial roles in this shareholder orchestra, each maintaining their positions with a mix of steady holding and strategic adjustments.

India Fund, however, sings a different tune, reducing its portfolio allocation by 4.27% over the last quarter. While not every performance in this shareholder symphony hits a high note, the collective melody paints a picture of confidence and optimism in Fortis Healthcare’s trajectory.

Fintel stands as a beacon of light for investors, providing comprehensive research tools to navigate the intricate world of finance with confidence and clarity. With access to a wealth of data, analysis, and exclusive stock picks, Fintel empowers investors of all sizes to make informed decisions in their financial journeys.

For investors looking to harmonize their portfolio with reliable insights and data, Fintel is the virtuoso of investing platforms, offering a symphony of information to guide your financial decisions.

When the Fortis Healthcare market symphony starts playing, wise investors tap their feet – and their keyboards – to the tune of financial success.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.