Progressive: A Steady Performer in the Insurance Industry

The stock market has historically been a major source of wealth creation. Over the past century, the S&P 500 index has returned approximately 10% annually, rewarding investors who adopt a buy-and-hold strategy.

Some companies consistently outperform the S&P 500 for extended periods. These companies possess strong business models and effective risk management, allowing them to generate impressive cash flows regardless of economic conditions.

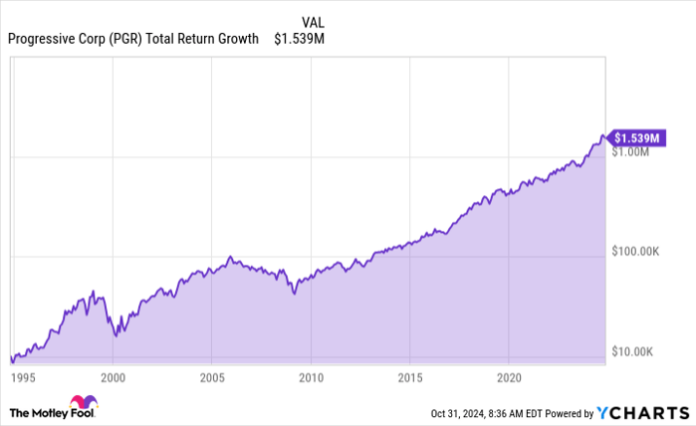

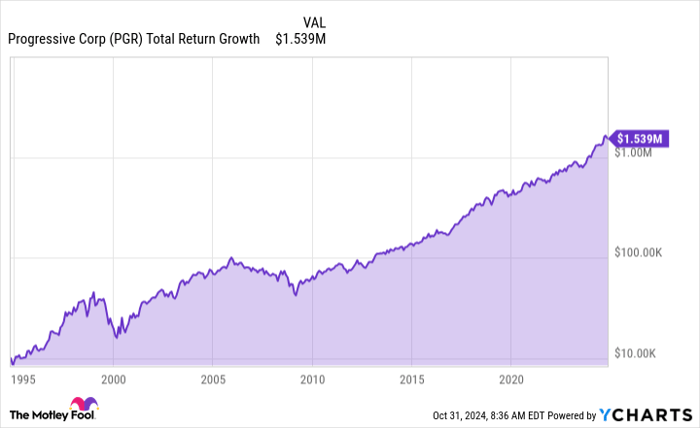

One standout company is Progressive (NYSE: PGR). Over the past thirty years, this insurance provider has yielded remarkable returns of 18.3% compounded annually. In practical terms, an investment of $10,000 in Progressive three decades ago would now exceed $1.5 million. Here’s why Progressive is likely to continue its momentum.

PGR Total Return Level data by YCharts

Why Insurance Stocks Are Essential

Investing in insurance stocks may not seem as thrilling as tech innovations, but they play a crucial role in a diversified portfolio. Insurance companies enjoy reliable cash flow due to constant demand from individuals and businesses seeking protection against significant losses. Even the esteemed investor Warren Buffett, CEO of Berkshire Hathaway, acknowledges the importance of insurance in their business model.

However, not all insurance companies are created equal. The sector is fiercely competitive, making it challenging for firms to excel. On average, insurers barely break even; they collect just enough premiums to cover claims and expenses. Here’s where Progressive stands apart.

In 1965, Peter B. Lewis, son of one of Progressive’s founders, became CEO and focused on growing the company by consistently underwriting profitable insurance policies. This approach differed from the then-standard practice of breaking even on policies and deriving profits from investments.

Progressive’s Risk Pricing Expertise

Progressive set a target of earning $4 for every $100 in premiums collected, a goal it pursues vigorously. This translates to maintaining a combined ratio of 96%, which measures the ratio of a company’s claims and expenses to premiums collected.

Over the past 22 years, Progressive has maintained a combined ratio of 96% or lower. Its average combined ratio during this period is 91.8%, significantly better than the industry average of 100%. This strong performance has held steady through various recessionary periods and market fluctuations. Notably, last year, while other automotive insurers faced their worst quarterly loss ratios in two decades, Progressive still achieved its goals.

This impressive underwriting performance reflects Progressive’s commitment to leveraging technology within the automotive insurance market. For instance, Progressive was a pioneer in utilizing telematics, analyzing driver data like mileage, speed, and braking to customize rates for individual drivers.

Future Growth Prospects for Progressive

Progressive is strategically positioned for growth as the economy expands. The company is expected to perform well even in an inflationary environment. JPMorgan Chase CEO Jamie Dimon has highlighted potential risks such as growing government deficits and geopolitical tensions, which could lead to increased inflation and interest rates. The steady demand for automotive insurance provides Progressive with pricing power, enabling it to adjust to rising costs.

Additionally, if interest rates stay high, Progressive stands to gain. The company boasts a $72.3 billion investment portfolio primarily consisting of fixed-income assets like U.S. Treasuries. This year, Progressive reported $1.3 billion in investment income, an increase from $874 million the previous year.

Progressive’s consistent performance sets it apart from peers, especially evident last year when it successfully navigated a tough operating climate. The company has shown resilience across multiple market cycles, making it an attractive option for long-term investors.

Considering an Investment in Progressive?

Before purchasing shares of Progressive, it’s wise to evaluate your options:

The Motley Fool Stock Advisor team recently identified their top 10 best stocks for investors to consider, yet Progressive is not among them. The stocks selected have the potential for significant returns in the future.

For example, when Nvidia was recommended on April 15, 2005, a $1,000 investment then would now be worth $813,567!*

Stock Advisor offers an accessible plan for investment success, with portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Discover the 10 stocks »

*Stock Advisor returns as of October 28, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Berkshire Hathaway, JPMorgan Chase, and Progressive. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.