As financial markets brace for a year of unpredictability, the strategies of fund selectors to construct portfolios are evolving. Emphasizing the preservation of return and management of risk, the game plan for 2024 involves tweaking existing allocations rather than a complete overhaul. In a recent study conducted by Natixis Investment Managers, insights from 500 investment professionals in 26 nations with a collective Asset Under Management (AUM) of almost $35 trillion shed light on the prevailing market sentiments.

Unveiling Opportunities Amidst Volatility

With heightened market volatility on the horizon, 62% of fund selectors are turning their attention towards large-cap investments to drive performance. Despite the anticipated turbulence, industry experts foresee consistent dispersions and correlations. According to Dave Goodsell, the executive director of the Natixis Center for Investor Insight, active strategies have taken center stage. An overwhelming 58% of fund selectors confirmed that active strategies outperformed passive ones last year, with a projected outperformance continuation this year.

Image source: Natixis Asset Managers

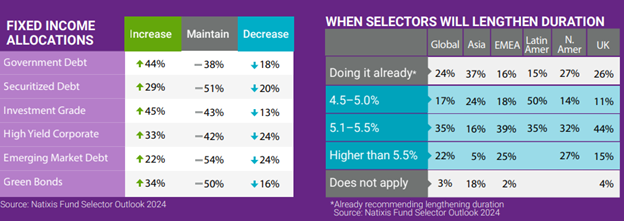

As the bond market navigates tricky waters, fund selectors are grappling with timing duration. While 62% anticipate long-duration bonds to fare better than short-duration ones, only a quarter have shifted to longer-duration bonds. Anticipating rate cuts from the Federal Reserve, 61% are currently invested in short-duration bond ETFs to counterbalance duration risk in their portfolios.

Image source: Natixis Asset Managers

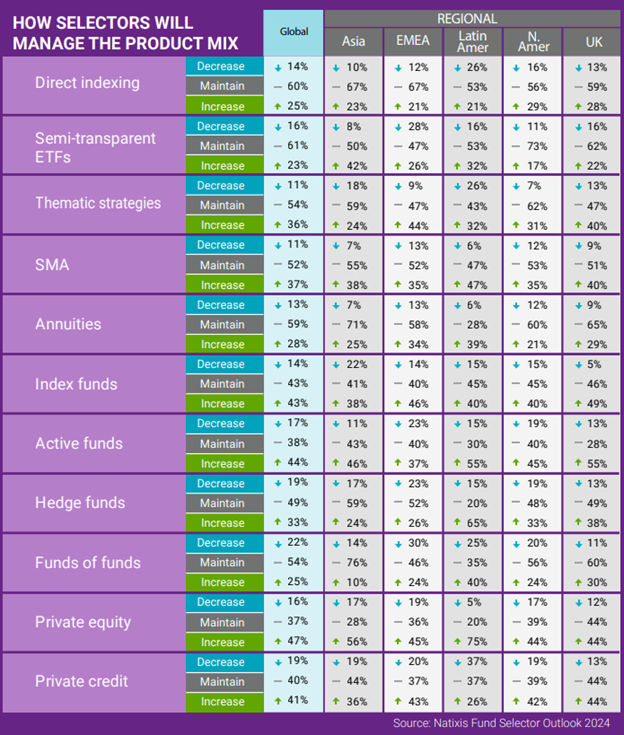

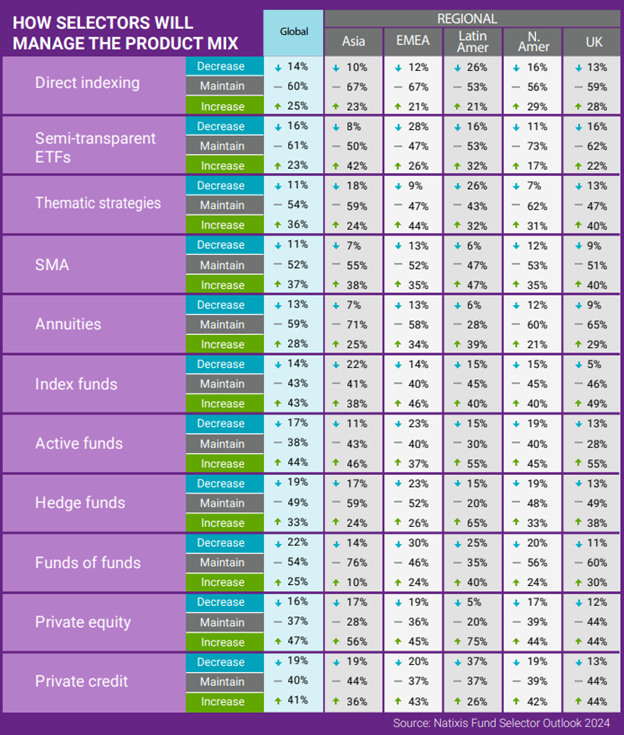

While the year 2023 saw alternatives thriving amidst ongoing market uncertainties, this year’s focus lies on maintaining current exposures and pinpointing areas of growth. The spotlight shines on private assets, notably private equity and private debt, with 55% and 57% of fund selectors respectively expressing optimism in these sectors.

Model Portfolios: A Radiant Beacon

Within the cohort of 500 fund selectors surveyed, 85% revealed that their firms provide model portfolio options, either developed in-house (65%) or sourced from third-party providers (26%). This year is expected to witness an uptick in market share for third-party model managers as firms seek to enrich their offerings to cater to clients’ evolving needs.

The surge in popularity of model portfolios is propelled by increasing enthusiasm from firms and a rising client demand. Noteworthy advantages for clients include additional due diligence layers and enhanced stability during volatile times. On the firm side, model portfolios streamline operations and fortify risk management practices.

Highlighting the pivotal role of model portfolios, Goodsell noted, “Models are instrumental in empowering advisors to cultivate deeper client relationships in an era where comprehensive planning is paramount.” The proliferation of model portfolios aligns with an uptick in specialty models, with a keen focus on high net worth, thematic, and ESG models.

For a plethora of news, insights, and analysis, explore the Portfolio Construction Channel.

Opinions expressed here are solely those of the author and do not necessarily mirror the views of Nasdaq, Inc.