Amazon’s Path to a $10 Trillion Market Cap: An Investor’s Perspective

Three companies have hit the milestone of a $3 trillion market cap: Apple, Microsoft, and recently, Nvidia. This surge in the technology sector over the past decade has excited investors, particularly with recent advancements in artificial intelligence (AI) driving further gains. While many stocks now exceed trillion-dollar values, one is poised to break past the $10 trillion mark, and it’s not one of those three giants.

Amazon (NASDAQ: AMZN) is primed to be the first to reach a $10 trillion market cap and reclaim its status as the world’s most valuable company. Here’s why this could happen.

Unexpected Profits from E-commerce

For a long time, investors questioned the profitability of Amazon’s e-commerce business. Operating with a vast network of warehouse workers and delivery drivers comes with significant costs. The core e-commerce model offers slim margins, which are unlikely to change. Nonetheless, Amazon has successfully layered additional profitable ventures on top of this platform.

One major contributor is the Amazon Prime subscription service, seeing a revenue of $43 billion over the past year—a significant increase from just $2.76 billion in 2014. Amazon could let these profits bolster its bottom line if it chooses not to reinvest in growth.

Additionally, the company has seen a robust $54 billion in annual advertising revenue, primarily from sponsored listings on its e-commerce site. This high-margin revenue can flow directly to the company’s profits, just like subscription income.

When combined, these two revenue streams suggest nearly $100 billion in earnings potential, even if the core e-commerce side—including third-party sellers and physical locations—produces no profit.

Advantageous Position in Cloud and AI

The largest contributor to Amazon’s profits is its cloud computing segment, Amazon Web Services (AWS). This division generates around $100 billion in revenue, yielding $36 billion in earnings, equating to a profit margin of about 36%. AWS stands out as one of the most profitable businesses globally, acting as a subsidiary of Amazon.

The growth in cloud computing is accelerating, particularly due to increased spending related to AI. AWS seems well-positioned to capitalize on this trend, even investing in developing its computer chips to reduce dependency on firms like Nvidia. Analysts project cloud spending growth of 22% annually from 2024 to 2030, fueled by AI.

If AWS maintains its profit margins and market share, it could exceed $100 billion in earnings come 2030. While ambitious, this target seems attainable if the current AI momentum continues.

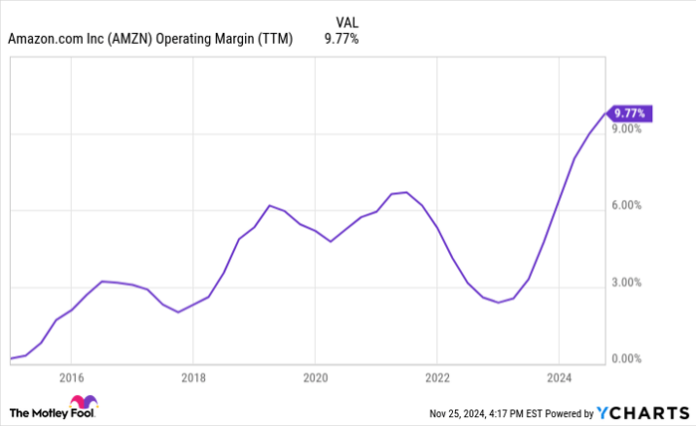

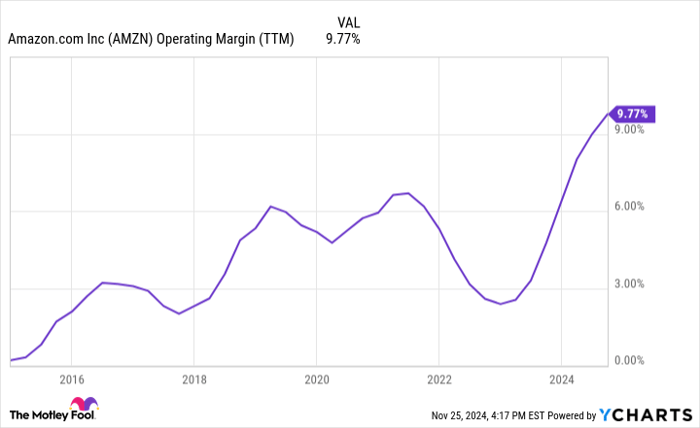

AMZN Operating Margin (TTM) data by YCharts

Calculating a $10 Trillion Market Cap

When looking at all segments, Amazon has the capacity to generate around $300 billion in annual earnings by 2030. This figure could exceed expectations if new ventures in healthcare, pharmacy, and satellite internet through Project Kuiper succeed. With strong momentum building, Amazon is likely to see significant growth in the next five years.

Aiming for a $10 trillion market cap based on $300 billion in earnings results in a price-to-earnings ratio (P/E) of 33. While this figure is high, it’s not unreasonable given the current P/E ratios of both Apple and Microsoft, which exceed 33.

With several positive trends and rising profit margins—operating margin reached a record 10% in the past year—Amazon appears ready to be the first company to cross the $10 trillion mark.

Is Now the Right Time to Invest $1,000 in Amazon?

Before moving forward with an investment in Amazon, consider this:

The Motley Fool Stock Advisor team has identified what they consider the 10 best stocks for investors right now, and Amazon is not on that list. The selected stocks have the potential for significant returns in the years ahead.

For reference, when Nvidia made the list on April 15, 2005, an investment of $1,000 would have grown to $839,060!*

Stock Advisor provides investors a straightforward guide to success, including advice on portfolio addition, updates from analysts, and new stock picks twice a month. Since 2002, Stock Advisor has achieved returns that have more than quadrupled the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Note: John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Brett Schafer is an Amazon investor. The Motley Fool holds positions in and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool also recommends options involving Microsoft. Please review their disclosure policy for more details.

The views and opinions expressed herein reflect the views of the author and do not necessarily represent those of Nasdaq, Inc.