Broadcom’s Bright Future: Can It Keep Growing?

Broadcom (NASDAQ: AVGO) has seen remarkable growth over the past three years, with its shares skyrocketing by 240%. In comparison, the PHLX Semiconductor Sector index gained just 27% in the same period.

With such impressive gains already achieved, investors are curious if Broadcom can continue this momentum. This article will look into the drivers of Broadcom’s growth for the next three years, assess the potential for further upswing, and examine its valuation to determine whether it remains a sound investment for those considering a semiconductor stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Strong Drivers Could Fuel Broadcom’s Growth

Recently, Broadcom announced its financial results for the fourth quarter of fiscal 2024, which concluded on November 3. The company recorded an annual revenue increase of 44% year-over-year, reaching an all-time high of $51.6 billion. Excluding its acquisition of VMware from last November, Broadcom achieved an organic revenue growth rate of 9% for the year.

In terms of fiscal 2024’s non-GAAP (adjusted) earnings, Broadcom reported $4.87 per share, up 15% from the previous year. Furthermore, the company’s outlook for the first quarter of fiscal 2025 indicates a promising trajectory, with forecasts of $14.6 billion in revenue for the current quarter, representing a 22% increase compared to the same quarter last year.

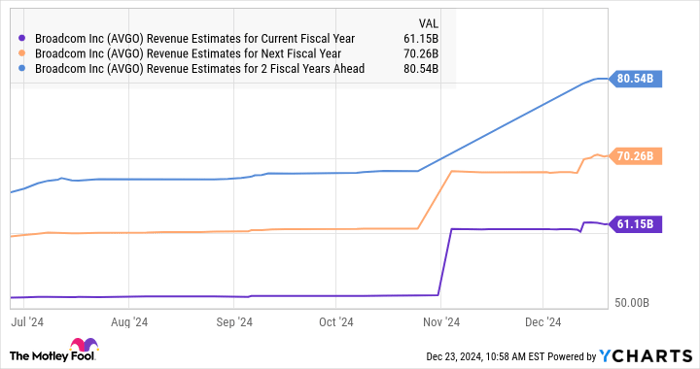

While Broadcom has not provided full-year guidance, analysts anticipate that the company’s revenue will increase by nearly 19% this fiscal year, resulting in $61.1 billion. Growth estimates remain robust, with expectations of a 15% growth rate over the next couple of fiscal years.

AVGO Revenue Estimates for Current Fiscal Year data by YCharts

Notably, revenue forecasts for Broadcom have significantly increased for all three fiscal years, bolstered by the rising demand for the company’s AI chips. These chips serve crucial functions in data centers for training AI models and improving connectivity between servers to handle AI tasks.

In fiscal 2024, Broadcom’s AI revenue reached an impressive $12.2 billion, reflecting a remarkable 220% increase. Further growth is expected in the current quarter, as the company forecasts a 65% year-over-year increase in AI chip revenue to $3.8 billion. Broadcom’s prospects look bright as it gains additional customers for its custom AI processors.

The company has stated that its addressable market for custom AI accelerators and networking chips could range from $60 billion to $90 billion by fiscal 2027. If the market’s size reaches the midpoint estimate of $75 billion and Broadcom maintains a sustained market share of 50%, its AI revenue could reach $37.5 billion by fiscal 2027, nearly tripling its previous revenue from AI sales.

Is Broadcom Still a Good Investment?

Broadcom currently trades at a price-to-earnings ratio of 35 for its forward earnings, a figure that appears attractive when compared to the Nasdaq-100 index, which has a similar P/E ratio.

Additionally, the company’s price/earnings-to-growth (PEG) ratio stands at a favorable 0.63 according to Yahoo! Finance, based on anticipated earnings growth over the next five years. A PEG ratio lower than 1 indicates that a stock is potentially undervalued with respect to its projected growth.

Investors looking to add a reasonably priced AI stock with a strong growth potential to their portfolio should consider Broadcom, as it looks well-positioned to thrive even further.

Should You Invest $1,000 in Broadcom Now?

Before making any investment decisions, keep in mind that the Motley Fool Stock Advisor analyst team recently identified the 10 best stocks to buy at this time, and Broadcom was not included. The selected stocks could see significant growth in the coming years.

Consider that when Nvidia was recommended on April 15, 2005… if you invested $1,000 at that time, you’d have $859,342!

Stock Advisor provides investors with a straightforward guide to building a successful portfolio, featuring regular analyst updates and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

JPMorgan Chase is an advertising partner of Motley Fool Money. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.