Chemical Performance: Chevron’s Earnings Report Highlights Challenges Ahead

Chevron Corporation CVX released its first-quarter 2025 earnings last Friday, posting results that beat expectations on adjusted earnings but fell short on revenue. Adjusted earnings stood at $2.18 per share, slightly exceeding estimates but down 26% from the previous year. Revenues also declined, down 2.3% year over year to $47.6 billion, missing forecasts as well. Investors reacted cautiously, weighing the mixed signals from Chevron’s earnings report, its valuation, and the broader macroeconomic environment.

Currently trading above $135, Chevron’s stock hovers near its 52-week low of $132.04. Over the past three years, shares have dropped around 15%, significantly lagging behind rival ExxonMobil XOM, which has increased by 24% in the same timeframe. This divergence has raised doubts about Chevron’s market positioning, particularly amid ongoing pressures in the energy sector, geopolitical uncertainties, and a pending arbitration case related to its proposed acquisition of Hess Corporation HES.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Q1 Earnings Indicate Mixed Results

Chevron’s earnings beat presents a complex picture. The positive performance stemmed mainly from better-than-expected U.S. natural gas production, while oil realizations and refining margins disappointed. Upstream earnings fell 28.3% year over year, largely due to lower oil prices and stagnant production levels. Profits in the downstream segment plummeted nearly 60%, attributed to reduced margins. Free cash flow was recorded at $1.3 billion, significantly below prior-year figures, although Chevron returned $6.9 billion to shareholders through dividends and buybacks.

Moreover, Chevron has lowered its second-quarter buyback target to $2.5-$3 billion from $3.9 billion in Q1, a decision reflecting the uncertain macro landscape and the decline of Brent crude towards $60. This reduced buyback target raises concerns about the sustainability of Chevron’s capital return strategy if commodity prices remain low.

Strong Assets And Capital Discipline

Chevron retains investor interest due to its robust asset base. The company enjoys solid operational performance in the Permian Basin, where approximately 80% of its acreage has low or no royalty obligations, enhancing long-term returns and production efficiency. Additional strengths arise from the Tengiz field in Kazakhstan and new deepwater projects like Ballymore in the Gulf of America.

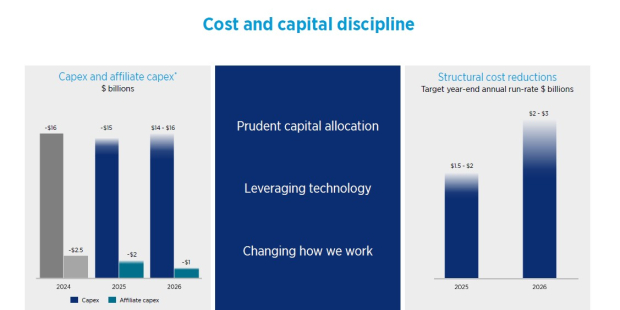

On the cost management front, Chevron demonstrates commendable capital discipline, spending just $3.9 billion in Q1 while advancing major projects. The company is also targeting a $2–$3 billion cost reduction initiative through 2026. With a debt-to-capital ratio near 16.6%, Chevron’s balance sheet remains among the strongest in the global oil sector.

Image Source: Chevron Corporation

Image Source: Chevron Corporation

Despite the challenges, Chevron continues to project $10-$20 billion in annual share buybacks, although the realization of this plan depends significantly on commodity prices. The company offers a solid dividend yield of 5%, complemented by 38 consecutive years of dividend growth—a reassuring factor for income-focused investors.

Hess Acquisition and Legal Uncertainties

A significant concern looming over Chevron is the $53 billion acquisition of Hess. The acquisition includes Hess’s 30% stake in the Stabroek block offshore Guyana, a notable oil discovery operated by ExxonMobil. However, ExxonMobil and partner CNOOC have initiated arbitration against Chevron, claiming a right of first refusal. The arbitration’s outcome, with hearings scheduled for late May, could be pivotal for Chevron’s major growth prospects.

If the deal collapses, Chevron risks missing out on a crucial addition to its reserves and production. Still, management asserts that even without Hess, the company retains a solid project pipeline and financial resources to achieve growth. However, this uncertainty contributes to inherent risks that investors should closely monitor.

Market Conditions and Valuation Insights

The current market environment is also challenging for Chevron. Declining oil prices—prompted by global trade issues, potential demand weakness, and OPEC+ developments—are exerting pressure on upstream earnings. Recent adjustments to the Zacks Consensus Estimates for Chevron’s 2025 and 2026 earnings reflect diminishing confidence in the short-term outlook.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Yet, Chevron’s valuation provides some resilience. The company trades at an EV/EBITDA multiple of 5.83, which is attractive compared to ExxonMobil and below its five-year historical average. Chevron also enjoys a Zacks Value Score of B, indicating that long-term investors seeking a well-managed energy firm may still find this stock appealing.

Conclusion: Holding Strategy for CVX Stock

Chevron’s Q1 results underscore both its strengths and challenges. The company continues to excel in cost control and operational efficiency while maintaining a shareholder-focused capital return strategy. However, external pressures, declining oil prices, uncertainty regarding the Hess acquisition, and reduced buybacks cloud the near-term outlook.

Given Chevron’s solid balance sheet, disciplined capital management, and reasonable valuation—coupled with its muted growth prospects and legal hurdles—CVX stock appears appropriately priced at present. Investors might consider holding their existing positions while awaiting clearer signals on oil prices, the Hess acquisition outcome, and future earnings trends. Consequently, Chevron stock currently holds a Zacks Rank #3 (Hold).

Experts Identify 7 Top Stocks Poised for Growth

Investors are advised to focus on seven elite stocks selected from a current list of 220 Zacks Rank #1 Strong Buys. These stocks have been labeled as “Most Likely for Early Price Pops,” indicating their potential for significant price movement in the near future.

Historical Market Performance

Since 1988, the comprehensive list of Zacks Rank #1 Strong Buys has outperformed the market by more than two times, achieving an impressive average annual gain of +23.9%. This track record highlights the importance of considering these carefully selected stocks.

Top Stock Selections

Among the stocks highlighted, notable mentions include:

- Chevron Corporation (CVX): Free Stock Analysis Report

- Exxon Mobil Corporation (XOM): Free Stock Analysis Report

- Hess Corporation (HES): Free Stock Analysis Report

Ongoing Market Insights

For those interested in gaining deeper insights, additional resources on analyzing these stocks are available. Keeping abreast of market movements and expert recommendations can enhance investment strategies and outcomes.

The views and opinions expressed herein are of the author and do not necessarily reflect those of Nasdaq, Inc.