Wall Street Stands Firm on Amazon Despite Revenue Forecast Shortfall

Overview of Analysts’ Confidence: Garry Black, Managing Partner of The Future Fund LLC, emphasized Wall Street’s strong support for Amazon Inc. AMZN, even as the company announces a below-expectation revenue projection for the first quarter of 2025.

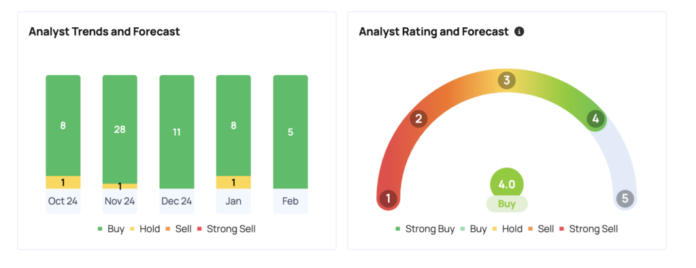

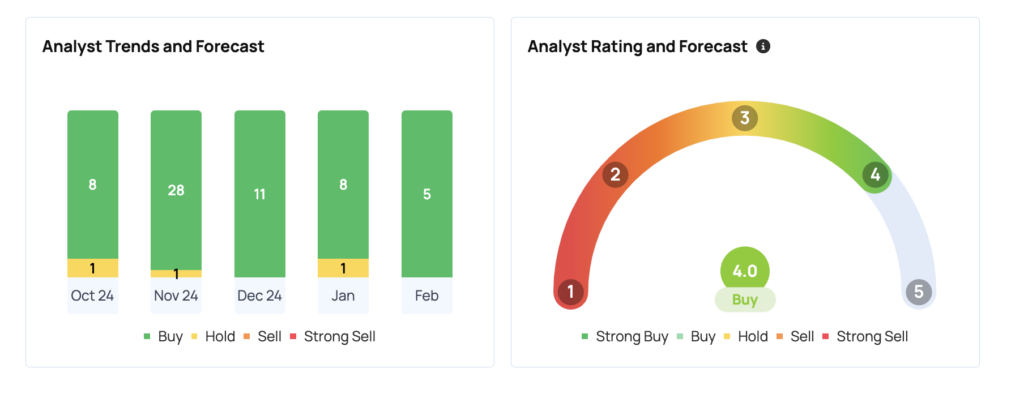

Key Insights: In a recent post on X, Black shared that out of 84 analysts, 79 rated Amazon as a ‘Buy’. This positive sentiment remains strong despite the e-commerce giant’s guidance for first quarter 2025 revenue, which fell below market expectations.

Notably, several analysts have recently upped their price targets for Amazon, signaling an optimistic perspective on its future. Piper Sandler increased its target from $225 to $265, DA Davidson adjusted to $280 from $285, and Canaccord Genuity revised its target to $280 from $265, as noted in Black’s update.

Related Developments: Amazon’s Rufus Has Revolutionized Shopping — Insights from Andy Jassy on the AI Assistant Combatting Information Overload.

Significance of Current Events: Amazon’s fourth-quarter earnings report, released on February 6 after the market closed, revealed a 10% increase in revenue year-over-year, reaching $170 billion, alongside net income nearly doubling to $20 billion. However, the forecast for the first quarter of 2025, projecting sales of $151 billion to $155.5 billion, failed to meet expectations of $158.5 billion. This shortfall was attributed to significant negative impacts from foreign exchange rates, resulting in a 2.65% drop in Amazon’s stock during pre-market trading.

Despite this initial dip, Black reports that the reaction from Wall Street analysts reflects a profound trust in Amazon’s strategic investments in AI and cloud computing. These areas are believed to be crucial for driving future revenue growth and enhancing profit margins. The revised price targets highlight Wall Street’s focus on Amazon’s potential for long-term growth, rather than its immediate revenue challenges.

The consensus price target for Amazon.com Inc stands at $256.98, based on ratings from 41 analysts tracked by Benzinga Pro.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs