The mighty General Electric Company has once again demonstrated its prowess in the electric power domain. This time, the GE Power Conversion arm, under the GE Vernova umbrella, has clinched a significant deal with ST Engineering Marine Limited, a prominent shipbuilding company based in Singapore. The pact entails supplying Integrated Full Electric Propulsion (IFEP) equipment for six vessels as part of the Republic of Singapore Navy’s (RSN) Multi-Role Combat Vessel (MRCV) initiative.

ST Engineering Marine Limited, a titan in the engineering landscape, has long been a stalwart in shipbuilding, ship repair, and commercial vessel conversion markets across the globe. Its footprint, stretching across Europe, the Americas, Asia, and the Middle East, testifies to the company’s far-reaching impact.

These six MRCVs are set to revolutionize the RSN fleet, replacing the aging mechanical drive Victory-class missile corvettes with state-of-the-art IFEP technology from GE Vernova. The electric grid package will encompass a range of critical components, from generators and transformers to propulsion motors, control systems, and power management systems. Over the next decade, GE Vernova will deliver these cutting-edge electric propulsion systems for the new naval vessels.

A marvel of modern engineering, GE Vernova’s electric grid promises to optimize the vessels’ operational systems with precision, ensuring enhanced energy efficiency and seamless power distribution across the ship’s network – a transformative upgrade for the RSN’s maritime arsenal.

Bolstering Strength Amidst Stock Fluctuations

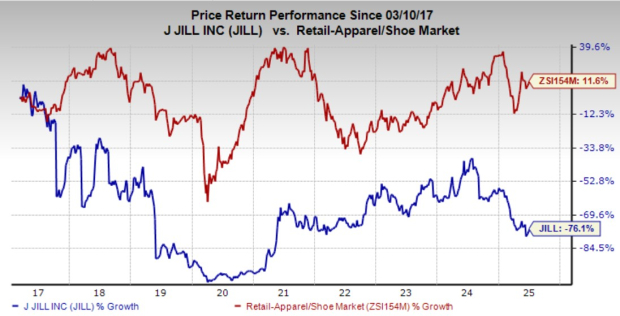

While General Electric currently holds a Zacks Rank #3 (Hold), the company’s stock performance in the past year has been nothing short of remarkable. Boasting an 87.8% surge, GE has outpaced industry growth at 11.5%, a testament to its enduring resilience amidst market fluctuations.

The company’s Aerospace segment, in particular, has been a beacon of success, buoyed by robust demand for commercial engines and services. Driven by heightened revenues in commercial services, orders for LEAP engines, and solid operational execution, the Aerospace arm has been a key driver of GE’s recent financial performance.

Image Source: Zacks Investment Research

Despite these victories, General Electric continues to grapple with the challenges posed by high operational costs and expenses. However, the company’s strategic resilience and innovative endeavors, such as the recent IFEP contract, illustrate its unwavering commitment to pushing the boundaries of technological progress.

Exploring Promising Investment Avenues

For investors seeking promising opportunities in the market, several companies stand out as worthy contenders:

Griffon Corporation (GFF) currently holds a Zacks Rank #1 (Strong Buy) and boasts an impressive trailing four-quarter earnings surprise average of 42%. With a rising Zacks Consensus Estimate for fiscal 2024 earnings, Griffon Corporation signals substantial growth potential in the current market landscape.

Carlisle Companies Incorporated (CSL) is another standout player with a Zacks Rank #1, delivering a solid 7.6% earnings surprise average over the past four quarters. With a promising outlook for 2024 earnings, CSL presents a compelling investment opportunity for discerning investors.

Vector Group Ltd (VGR), sporting a Zacks Rank #1, has showcased an impressive earnings surprise average of 10.2% in the trailing four quarters. The positive trajectory of VGR’s 2024 earnings estimate further cements its position as a stock to watch in the coming months.

Embarking on an Infrastructure Renaissance

With the imminent deployment of a massive infrastructure revitalization initiative in the U.S., investors are poised to witness a renaissance in the infrastructure stock market. Backed by bipartisan support and bolstered by substantial investments, this infrastructure boom presents a wealth of opportunities for proactive investors.

The key question remains: Which stocks will emerge as the frontrunners in this transformative journey? As trillions are earmarked for infrastructure overhaul, astute investors stand to reap substantial rewards by identifying the prime stocks positioned to capitalize on this monumental shift.

Zacks Investment Research has unveiled a Special Report designed to assist investors in navigating this infrastructure wave effectively. This invaluable resource spotlights five companies poised to harness the full potential of infrastructure development, offering a unique insight into the forthcoming landscape of construction, transportation, and energy transformation on an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

General Electric Company (GE) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Vector Group Ltd. (VGR) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.