General Motors Faces Stock Slip Amid Job Cuts and EV Strategy Adjustments

Shares of General Motors (GM) fell today as the company announced plans to cut 1,000 salaried positions to boost efficiency and productivity, according to Bloomberg. The layoffs will mainly occur in North America but will affect global operations as well. In a fiercely competitive auto industry, cost-cutting measures are essential for GM to stay ahead of rivals.

This decision comes even after GM reported a 10.5% rise in Q3 sales and improved profitability, which benefitted from cost reductions in its electric vehicle (EV) sector. CEO Mary Barra emphasized that while EV costs are becoming stable, additional cuts are crucial for enhancing the profit margins of internal combustion engine (ICE) vehicles, which constitute 80% of GM’s U.S. sales. With the changing political landscape, GM may also gain from increased sales of ICE vehicles, as former President Trump’s election victory could lead to relaxed regulations in that area.

Despite potential advantages for legacy automakers like GM, challenges loom over their EV sectors. According to Reuters, Trump’s transition team plans to eliminate the $7,500 tax credit for EV purchases. Interestingly, representatives from Tesla (TSLA) have expressed support for terminating this subsidy. Earlier this year, Tesla CEO Elon Musk pointed out that eliminating the tax credit would hurt U.S. competitors in the EV market while having a minimal impact on Tesla’s sales.

GM’s Recall Announcement

In a different matter, GM issued a recall for 462,000 diesel-powered pickups and SUVs over issues related to transmission control valves, which may lead to harsh gear shifts or rear-wheel lockup. The recall impacts models such as the Chevy Silverado and GMC Sierra. To address the issue, GM dealers will provide software updates and warranty coverage for repairs.

Analyzing GM’s Stock Target

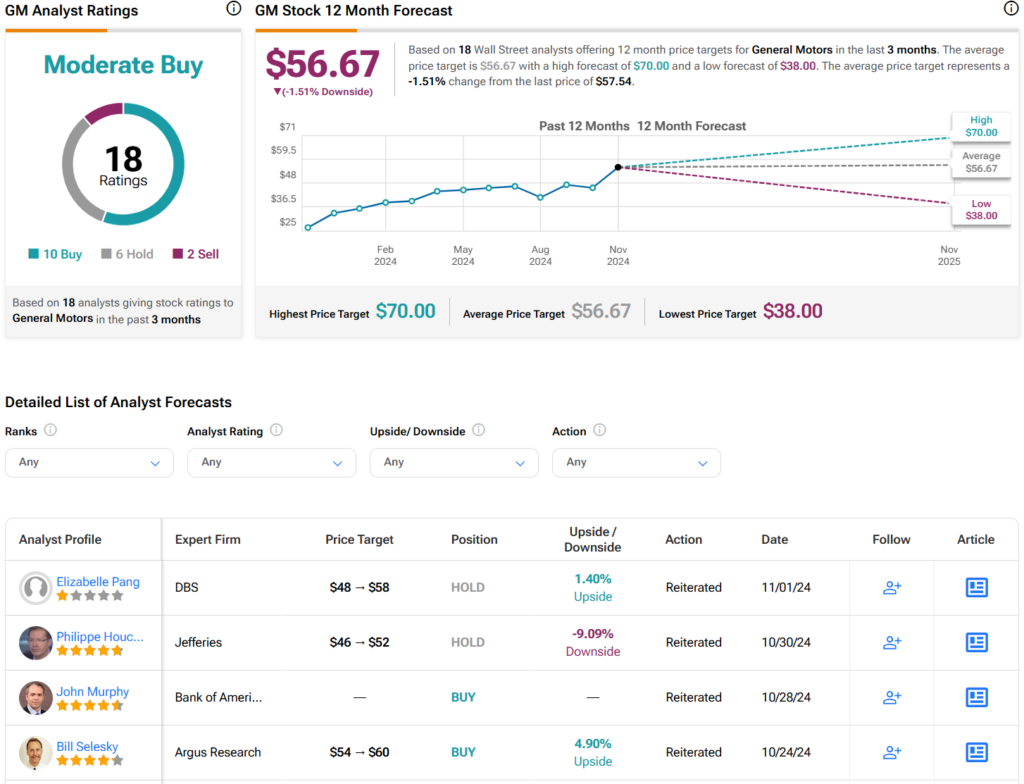

On Wall Street, analysts currently have a Moderate Buy consensus rating for GM stock. This is based on 10 Buy recommendations, six Holds, and two Sells over the past three months. Following a remarkable 110% increase in its share price within the last year, the average price target for GM is $56.67 per share, indicating a potential downside risk of 1.5%.

See more GM analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.