GigaCloud Technology (NASDAQ:GCT) is an intriguing B2B commerce platform company based in the US. Recently, it transitioned to an S-Filer status, generating enhanced shareholder confidence and transparency. This decision reflects an assertive step towards bolstering its reporting requirements, analogous to domestic companies.

The company’s global platform specializes in facilitating cross-border commerce with a focus on technology. In the third quarter, product revenue was the primary revenue driver, constituting 71% of revenue. Notably, GigaCloud sees burgeoning opportunities in its third-party (3P) segment, signaling a strategic shift in focus towards expanding organic 3P gross merchandise volume (GMV) for business scaling.

GigaCloud’s success in attracting high-volume, high-quality buyers was underscored by significant growth in active buyers and average spending per active buyer. It boasts an end-to-end logistics and fulfillment platform, enhancing its competitiveness and serving as a vital conduit for manufacturers looking to connect to resellers in key global markets.

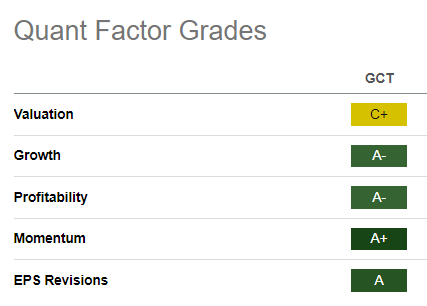

The company’s robust business model yielded a staggering 1-year total return of 285%, rewarding investors and generating positive buying sentiments. Furthermore, GigaCloud’s relatively attractive growth opportunity, coupled with its reasonable valuation, highlights substantial potential upside amid robust consumer spending.

Despite the caution surrounding its recent acquisitions’ impact on EBITDA margins, the company is focused on driving profitable growth over time, reflecting its commitment to shareholder value creation.

However, with short interest as a percentage of float standing at nearly 26% in mid-December, the burning question arises—have the short sellers gone too far?

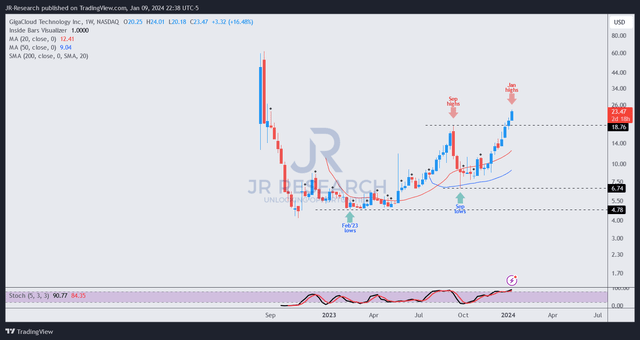

Assessing GigaCloud’s price chart reveals a compelling narrative of resilience and recovery. After bottoming out in early 2023, the stock witnessed a remarkable resurgence, outperforming the market over the past year. Notably, the inherent volatility in GigaCloud’s price action favors a strategy of buying the dips, leveraging supportive buying sentiments, rather than chasing continuous upwaves.

It’s evident that GigaCloud’s medium-term recovery maintains its trajectory, presenting the discerning investor with an opportunity to potentially capitalize on a more constructive pullback, emphasizing the essence of timing and cautious entry points.

Rating: Initiate Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Your constructive commentary, critical insights, and diverse perspectives contribute to a richer collective understanding. Share your thoughts and knowledge with the community to foster a learning environment for all!