Market Turmoil Over Tariff Tensions: Mexico’s Surprising Move

As trading started on Monday morning, all three major stock indexes faced significant declines. The sharp drop came in response to President Trump’s tariffs set to take effect the following day.

The tariffs include a hefty 25% charge on imports from Canada and Mexico, while Canadian oil, natural gas, electricity, and other energy products will face a lower 10% tariff. Additionally, goods from China will also incur a 10% tariff.

There are three key reasons for the sell-off:

First is uncertainty. Wall Street is uncomfortable with unpredictability. The long-term impact of these tariffs, including their duration and global reactions, remains unclear.

Second, there are fears about declining corporate earnings. Higher tariffs may force consumers, who are sensitive to price increases, to reduce their spending. As stock valuations depend heavily on strong earnings growth, any hint of lower profits could make current prices seem inflated.

Third, there’s the specter of inflation. Consumers who continue to spend despite the price hikes may inadvertently trigger an inflationary cycle that would lead to even higher prices down the line.

By mid-morning, it seemed likely that the losses would deepen significantly.

A Concession from Mexico Alters Course

However, around 10:30 AM Eastern, news emerged that Mexican President Claudia Sheinbaum had ordered a troop deployment to the U.S./Mexico border, leading to a suspension of U.S. tariffs on Mexican goods for a month.

Here are key remarks from President Trump:

I just spoke with President Claudia Sheinbaum of Mexico. It was a very friendly conversation wherein she agreed to immediately supply 10,000 Mexican Soldiers on the Border separating Mexico and the United States. These soldiers will be specifically designated to stop the flow of fentanyl, and illegal migrants into our Country. We further agreed to immediately pause the anticipated tariffs for a one-month period during which we will have negotiations headed by Secretary of State Marco Rubio, Secretary of Treasury Scott Bessent, and Secretary of Commerce Howard Lutnick, and high-level Representatives of Mexico. I look forward to participating in those negotiations, with President Sheinbaum, as we attempt to achieve a ‘deal’ between our two Countries.

This surprising shift led to an immediate rebound in stock prices, raising hopes that tariffs may merely serve as a negotiating tactic rather than a permanent policy change. If so, concerns about inflation or dampened earnings could ease.

While markets reacted positively, Canada has not followed suit. Instead, Prime Minister Justin Trudeau announced on Saturday that Canada will impose its own 25% tariffs on various U.S. imports.

In summary, a major financial standoff seems to be underway. While Mexico has opted for a conciliatory approach, tensions with Canada appear to be escalating.

Looking Ahead: The January Barometer Indicates Potential for Growth

In brighter news, despite some volatility in January, the S&P 500 has risen by 2.7%, a positive signal pointing towards continued market gains throughout 2025.

Ryan Detrick, chief market strategist at Carson Research, shared insights:

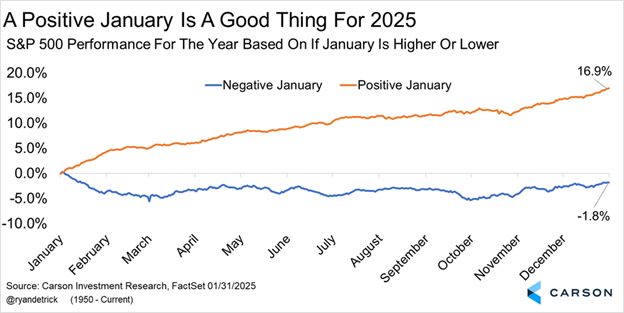

An effect widely known as the January Barometer looks at how January does and what it may mean for the next 11 months. It’s summarized by the saying, ‘So goes January, goes the year’ in the media. Historically speaking, when the first month is positive for stocks, the rest of the year averages a gain of 12.3%, occurring 86.7% of the time. In contrast, a negative January yields an average gain of only 2.1% and happens 60% of the time.

The chart below illustrates this trend since 1950, highlighting that a positive January usually leads to substantial market gains.

Source: Carson Research / @ryandetrick

These indicators suggest strong potential for growth in 2025.

As noted, the S&P recently achieved a new all-time high, which may suggest even greater highs are ahead within the year.

Understanding Market Highs vs. Personal Wealth

First, let’s review the positive side: several assets have recently reached record highs. Here are some examples:

- S&P 500: all-time high last month

- Bitcoin: all-time high last month

- Gold: all-time high as of now

- Cocoa: all-time high last year

- Silver: 12-year high last October

- Residential homes: all-time high last summer

This seems encouraging, but it’s essential to dig deeper.

When we assess price changes, we often refer to them as the inherent value of an asset, like real estate, represented in dollars.

Typically, we equate rising home prices to increasing value, with the dollar seen as a stable reference point. However, what if the dollar itself is losing value? Would that not skew our perception of the real estate market?

If the dollar is weakening while asset values remain steady, doing well in rising prices makes sense. The measurement—our depreciating currency—is changing, just as the federal government has printed trillions of dollars, affecting its worth.

Let’s consider how gold, which has just set a new record price, can provide a different viewpoint. According to CNBC:

Gold prices hit an all-time high on Monday, driven by concerns over inflation impacting economic growth further amplified by President Trump’s tariffs on Canada, China, and Mexico.

This perspective can significantly alter the interpretation of record highs.

Examining the Reality of “Illusory Gains”

Understanding Asset Value Against Gold: A 20-Year Analysis

Analyzing Price Ratios Over Time

Let’s explore the charts that display how the price of various assets has compared to gold over the past 20 years.

If the starting and ending values of an asset are similar, it indicates that the asset’s value has remained stable in relation to gold.

A rising line in the chart suggests the asset has increased in value compared to gold.

Conversely, a declining line implies that the asset’s value has decreased relative to gold, potentially creating a misleading perception of wealth during its peak values.

With this context, we will examine the average stock’s value, represented by the S&P 500 Equal Weight Index, in relation to gold over the last two decades.

Source: StockCharts.com

What About Housing?

Source: StockCharts.com

Now, let’s examine corporate bonds. While they haven’t hit all-time highs, they represent a significant asset class worth analyzing.

Source: StockCharts.com

The Tech Sector Dominance

Technology has been a favored investment choice for decades. If you haven’t invested in tech funds, you’ve likely lagged behind the market.

Let’s analyze the Technology Select Sector SPDR ETF (XLK), which reflects the tech industry. This fund includes major companies like Apple, Microsoft, Nvidia, Broadcom, Salesforce, and Oracle, showcasing its blue-chip status.

The chart below illustrates the XLK to gold ratio over the past 25 years, starting from 2000, during the peak of the Dot Com Bubble.

Source: StockCharts.com

This situation highlights why many may feel that their net worth is at record highs, even as monthly expenses feel tighter than ever.

Moreover, it reinforces the importance of including gold in your investment strategy, especially as new tariffs could escalate inflation.

For further context, here’s the XLK to gold comparison over the last two decades. This clearly shows that investing in tech has been crucial for stock performance.

Source: StockCharts.com

This analysis emphasizes that achieving significant wealth requires investments in high-performing stocks, as average stocks may not provide the necessary returns for financial independence. Given the rapid depreciation of the dollar, traditional stock returns may not suffice.

As I write this, the Nasdaq continues to struggle with tariff-related declines. If you’re considering investments, now may be a strategic moment to explore new opportunities.

Stay tuned for more insights in the Digest.

Wishing you a pleasant evening,

Jeff Remsburg