General Motors Achieves Strong Performance with Share Buybacks in 2025

General Motors (NYSE: GM) has had an impressive year in 2024, experiencing a 9% increase in full-year revenue. The company led the U.S. auto market in total, retail, and fleet deliveries, while also expanding its total market share. Notably, GM doubled its electric vehicle (EV) market share throughout the year, with its EV portfolio becoming profitable in terms of variable profit by the fourth quarter.

In 2025, GM took a significant step to enhance shareholder value: the company initiated share buybacks. This move could have important implications for investors.

Where to invest $1,000 right now? Our analyst team has revealed what they believe are the 10 best stocks to buy now. Learn More »

Returning Value to Shareholders

To address concerns about tariffs and unprofitable EVs, GM decided to return value to its shareholders. Recently, the automaker announced a 25% increase in its dividend, raising it to $0.03 per share. Furthermore, GM authorized a $6 billion share repurchase program and committed to an accelerated share repurchase initiative, executing $2 billion of this authorization promptly.

Mary Barra, chair and CEO of GM, emphasized the effectiveness of the company’s capital allocation strategy: “The GM team’s execution continues to be strong across all three pillars of our capital allocation strategy, which are reinvesting in the business for profitable growth, maintaining a strong investment-grade balance sheet, and returning capital to our shareholders.”

Investors should appreciate GM’s commitment to returning value, particularly through share buybacks. This strategy is straightforward; by purchasing shares at market price and often retiring them, the earnings per remaining share increase. Companies typically favor buybacks when their shares are undervalued, and GM has been trading at notably low price-to-earnings (P/E) ratios in recent years. Despite a 48% gain in 2024, GM shares still maintain a modest P/E ratio of 7.4.

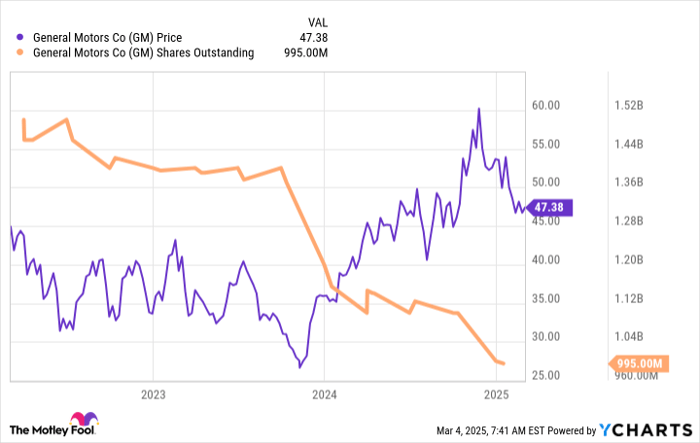

Since the end of 2023, GM has repurchased approximately $22 billion worth of shares, contributing significantly to its 48% gain during 2024. This buyback amount is substantial, considering GM’s market capitalization is around $49 billion. The graphic below illustrates the impact of previous repurchases.

GM data by YCharts.

Is GM a Buy?

With momentum from its strong 2024 performance, GM appears poised for continued growth, although potential tariffs on Canadian and Mexican imports may pose challenges. Beyond the recent highlights, GM reported positive equity income for the fourth quarter in China before restructuring costs. This marks a significant advance in a challenging market, where domestic brands are increasing their share amid a fierce price war.

One compelling reason to consider GM is the return of value through substantial share buybacks while the stock is still trading at a low P/E ratio. The new share repurchase authorization was announced despite looming tariffs, indicating GM’s confidence in navigating potential obstacles—a reassuring sign for investors.

As GM enhances the profitability of its EV lineup and continues its strong financial and product execution, there are opportunities for growth ahead. In my view, GM remains one of the leading automakers to invest in at present.

Should You Invest $1,000 in General Motors Now?

Before purchasing stock in General Motors, it is essential to consider the following:

The Motley Fool Stock Advisor analyst team recently recognized the 10 best stocks for investors to buy now, and General Motors did not make the list. The selected stocks may offer significant returns in the coming years.

Consider that when Nvidia was recommended on April 15, 2005, a $1,000 investment would be worth $690,624 today!

Stock Advisor equips investors with a clear roadmap for success, including guidance on building a portfolio and regular updates from analysts, along with two new stock picks each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times.* Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

Daniel Miller has positions in General Motors. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.