General Motors Soars to New Heights: Q3 Results Propel Stock to 52-Week High

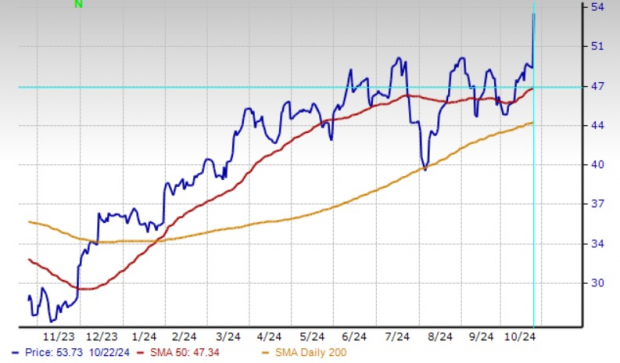

U.S. legacy automaker General Motors GM delivered stellar third-quarter results yesterday, which drove its shares to a 52-week high. The stock rose nearly 10%, marking its biggest daily percentage gain since 2020, as the company outpaced Wall Street’s expectations and raised its full-year 2024 guidance for the third time this year. GM stock is currently trading above its 50 and 200-day moving averages, indicating bullishness. This technical strength reflects positive market perception and confidence in General Motors’ financial health and prospects.

GM Stock Surges Past Key Moving Averages

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

At approximately $54 per share, GM is at a one-year peak. This moment prompts a careful look into the company’s fundamentals to determine whether it’s advisable to hold the stock or take profits. To provide context, here are some highlights from GM’s recent quarterly results.

Key Insights from General Motors’ Q3 Results

Strong Earnings and Revenue: General Motors reported third-quarter adjusted earnings of $2.96 per share, outperforming the Zacks Consensus Estimate of $2.49 for the ninth consecutive quarter. Revenues reached $48.75 billion, surpassing the $44.29 billion forecast. Compared to last year, earnings are up 30% and revenues increased by 10.5%.

Positive Outlook for 2024: Thanks to robust results in 2024’s first three quarters, along with strong vehicle demand and tight cost management, GM has raised its full-year outlook. Adjusted EBIT is now projected to be between $14-$15 billion, up from earlier guidance of $13-$15 billion. The anticipated adjusted EPS has also improved, now expected to be between $10-$10.5, compared to a previous range of $9.50-$10.

Strength in North America: GM’s North America division (GMNA) remains the company’s largest and most profitable segment, with a 14% increase in pretax earnings to $4 billion and revenues rising 14% to a record $41.2 billion. Strong demand for GM’s full-size and midsize pickups and effective pricing strategies played a significant role in this success.

Challenges in China: However, GM faces difficulties in China, reporting a $137 million equity loss in the third quarter compared to a profit of $192 million in the same period last year. Sales from joint ventures with SAIC Motor Corp. and Wuling dropped 21%, highlighting increased competition from domestic companies offering lower-priced electric vehicles (EVs). CEO Mary Barra has noted that efforts are underway to restructure operations in China, although comprehensive recovery plans have yet to be detailed.

Caution for Future Earnings: CFO Paul Jacobson has expressed caution for the fourth quarter, citing seasonal factors, reduced wholesale volumes for internal combustion engine (ICE) vehicles, and the transition to more electric vehicles. Anticipated downtime for production, particularly for the profitable full-size SUVs, may impact fourth-quarter earnings, alongside usual holiday production slowdowns.

Commitment to Shareholders: General Motors continues to emphasize shareholder returns through a robust buyback program. In the third quarter alone, the company repurchased $1 billion in shares, totaling 23 million shares. GM plans to retire an additional 25 million shares in the fourth quarter, part of a $10 billion accelerated share buyback initiative for a total of nearly 250 million shares retired. As of the end of the third quarter, GM reported $40.2 billion in automotive liquidity.

Looking Ahead for General Motors

GM is focused on strategic growth through careful inventory management, cost control, and achieving profitability for both gasoline and electric vehicles. By keeping inventory levels low and regularly updating vehicle designs, the company has effectively maintained strong pricing, boosting margins on ICE vehicles. GM aims for its EVs to be profitable by the end of 2024, with plans for around 200,000 electric vehicles to be produced this year.

During its investor day earlier this month, GM outlined plans to narrow EV losses by $2 billion to $4 billion next year, showing clear progress in cost reduction and production efficiency. The goal to cut outstanding shares below 1 billion by early 2025 underscores GM’s dedication to enhancing shareholder value while promoting operational growth.

Investor Considerations for GM Shares

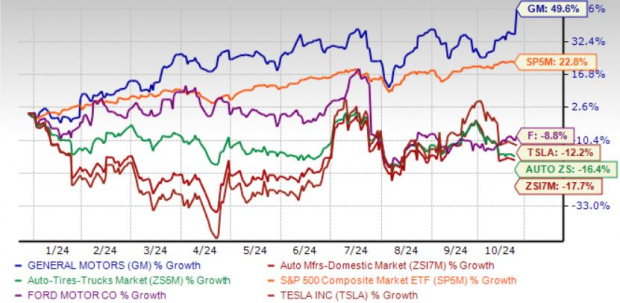

In 2024, General Motors shares have increased nearly 50%, outperforming its industry, sector, and the S&P 500. Conversely, GM’s close competitor Ford F has seen a decline of 9% in the same timeframe, while EV leader Tesla TSLA has lost 12.2% year-to-date.

Year-to-Date Price Performance Comparison

Image Source: Zacks Investment Research

Despite the impressive performance of General Motors shares, the stock trades at just 5.39 times forward earnings, which is lower than Ford’s 6.02 times. In comparison, Tesla is trading at a high P/E ratio of 90.97.

GM Stock May Be Undervalued

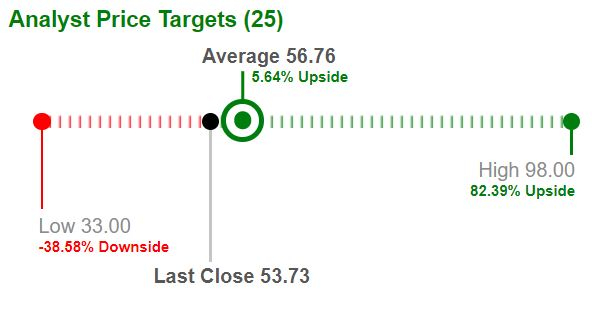

General Motors Poised for Further Growth After Earnings Rally

General Motors (GM) is showing strong potential with its recent earnings results. Following the announcement, its shares have rallied, and analysts believe there may be more growth ahead. Currently, the market has set an average price target of $56.76 for the stock, which suggests further upside. For investors, holding onto GM shares could be a wise strategy to benefit from the company’s ongoing growth initiatives.

Image Source: Zacks Investment Research

Looking ahead, the Zacks Consensus Estimate anticipates a 29% increase in GM’s Earnings Per Share (EPS) and a 3% rise in sales for 2024 when compared to the previous year. Currently, GM holds a Zacks Rank of #3 (Hold) along with a VGM Score of A, indicating its relatively stable investment outlook.

Expert Insight: A Top Stock with High Growth Potential

In addition to GM’s promising outlook, Zacks Investment Research has identified five stocks that are predicted to double in value soon. Among these, Research Director Sheraz Mian has spotlighted one particular stock that stands out for its potential growth.

This leading financial firm boasts a rapidly expanding customer base of over 50 million, paired with a diverse range of innovative solutions. While not all selected stocks will yield big returns, this one has the potential to outperform previous Zacks recommendations like Nano-X Imaging, which soared by +129.6% in just over nine months.

Free: Explore Our Top Stock And 4 Potential Contenders

For those interested in the latest investment opportunities from Zacks Investment Research, the report “5 Stocks Set to Double” is available for free. Click to access it.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.