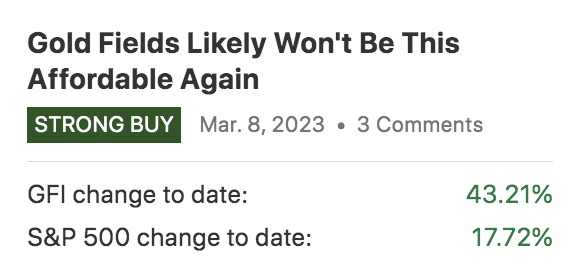

Today’s piece centers on Gold Fields Limited (NYSE:NYSE:GFI), a stock that has undergone its fair share of ups and downs. We previously delved into this company’s trajectory about nine months ago; since then, the stock has shown remarkable resilience, much to the delight of stakeholders. However, recent developments, such as a revised Salares Norte production outlook and uncertainties surrounding materials stocks, call for a fresh assessment. Hence, we have distilled our most recent findings on Gold Fields to offer an updated perspective to our readers and potential investors. Here are some crucial points to ponder for current and prospective investors in Gold Fields.

Challenges with Salares Norte Production

Gold Fields recently announced an unwelcome piece of news, revealing that it anticipates a delayed initial gold production from Salares Norte in Chile. According to Gold Fields’ statement, the project is 99.3% complete but will now commence production in April instead of its original target of December 2023. Additionally, Gold Fields has revised its Salares Norte gold production outlook to 220,000 – 250,000 thousand ounces from the previous 400,000 – 430,000 ounces.

Gold Fields attributed the delay to pre-commissioning safety measures, staffing availability, and the configuration of manufacturer equipment. While such delays are not uncommon in the mining industry, the prolonged nature of Salares Norte’s developments is noteworthy. As we previously highlighted in our coverage of Gold Fields, the Salares Norte project has encountered prior setbacks related to commissioning processes.

Despite its potential to lower Gold Fields’ cost base and deliver high-quality material, the market’s reaction to the production announcement suggests that continuous delays have become a significant concern. Further delays could potentially trigger a harsh response from the market.

November Production Report & Outlook

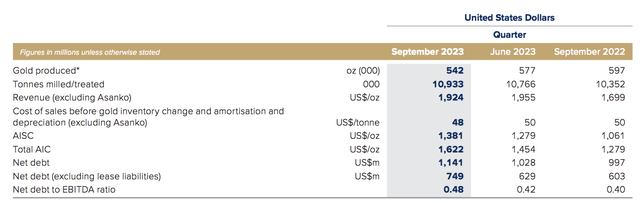

Gold Fields issued its third-quarter production report in November, unveiling underwhelming results as production declined and costs rose. However, the company stood by its outlook, attempting to dial down some of the negative sentiment. Let’s delve into the key aspects of its report and offer our insights on each.

Gold Fields’ overall gold production decreased by 9% year-over-year, with a 14% drop from its operations in Ghana, an 8% decline in South Africa, and a 5% dip in Australia.

We anticipate a robust performance from the company’s South Deep Mine in South Africa relative to the previous year, despite encountering regional labor disputes and electrical grid challenges in 2023. Moreover, while all-in-sustaining costs rose by 11% in the third quarter, we expect this trend to stabilize going forward, given the region’s lower inflation rates. Although we cannot predict the ore grade, it’s noteworthy that South Deep’s reef grades rank among the world’s best and are likely to remain robust in the long term.

We are cautious about Gold Fields’ Ghana operations as production at Damang is dwindling due to the narrowing of the pit, signaling the mine’s aging. In addition, heavy rainfall in Q3 hampered production at Tarkwa, leading to a 13% quarterly production decline to 129,000 ounces. While Tarkwa is expected to rebound under normal conditions, Gold Fields’ decision to offload its 45% stake in Asanko for $171 million raises questions about regional synergies and casts a shadow on the outlook for its operations in the area.

Lastly, concerning Australia, the 17% increase in Grueyere’s quarterly production (to 88,700 ounces) was offset by substantial decreases in production from Granny Smith (down 12% to 64,000 ounces), St Ives (down 15% to 78,200 ounces), and Agnew (down 10% to 57,200 ounces). Lower grades across the board and inventory sequencing had a significant impact. Looking ahead, we see no significant reasons for disruptions in Gold Fields’ Australian production in early 2024, especially with the waning risks of rainfall due to the phasing out of El Nino. Moreover, inflation in Australia is easing, which should help stabilize the growth in all-in-sustaining costs.

Gold Price Forecast

The future performance of Gold Fields hinges significantly on gold prices. Let’s delve into a brief discussion about our outlook on gold.

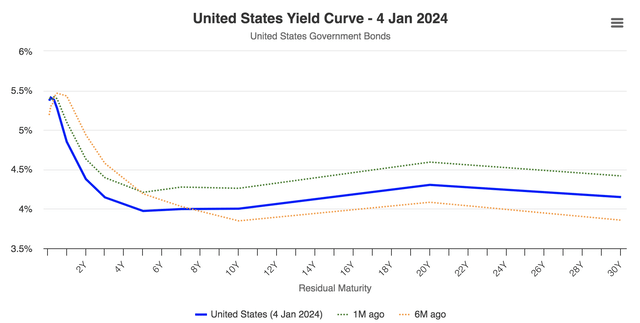

We anticipate an imminent rally in gold, premised on two factors. First, the U.S. yield curve hints at an impending decrease in U.S. interest rates, which could weaken the U.S. dollar and, concurrently, provide support to gold as a proxy for a reserve currency. Additionally, gold often serves as a safe-haven asset, which could become significant given the prevailing global geopolitical and economic dynamics.

Gold Fields: Navigating Volatile Markets

The gold market is akin to a high-stakes poker game, where one wrong move can topple an empire of wealth. When interest rates descend, the specter of recession looms. In such times, gold spot prices typically ascend, providing a potential buoy for investors.

Stock Valuation and Technical Concerns

While the horizon looks promising for Gold Fields in the context of near-term gold prices and underlying fundamentals, there exists a fault line in the stock’s valuation, showcasing ominous technical price levels.

With a forward price-to-book ratio of 2.67x, Gold Fields teeters on the brink of overvaluation. As mining enthusiasts often prioritize price-to-book metrics, the current figure raises concerns. It would take substantial efforts, possibly fueled by a confluence of lower interest rates, surging gold prices, and heightened industry M&A activity to realign the stock’s book value within an acceptable range. Additionally, the stock’s primary price multiples, excluding the price-to-earnings ratio, appear inflated, igniting further apprehension.

| Metric | Value | Versus 5-year AVG |

| FWD P/E | 15.10 | -21.95% |

| FWD EV/EBITDA | 5.51 | +10.98% |

| FWD P/CF | 7.48 | +27.50% |

| FWD EV/Sales | 2.98 | +19.74% |

Source: Seeking Alpha

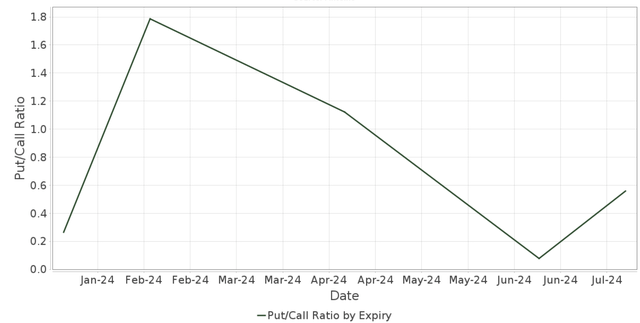

Furthermore, from a technical standpoint, Gold Fields’ stock appears overbought. The put-call ratio, at 0.32x, reflects a bullish sentiment among options traders. However, this metric, typically leveraged for its countercyclical implications, hints at an impending mean reversion. Moreover, the stock’s 10- and 50-day moving averages have dipped below its long-term 100-day moving average, signaling the inception of a bearish trajectory.

Lastly, let’s delve into Gold Fields’ dividends.

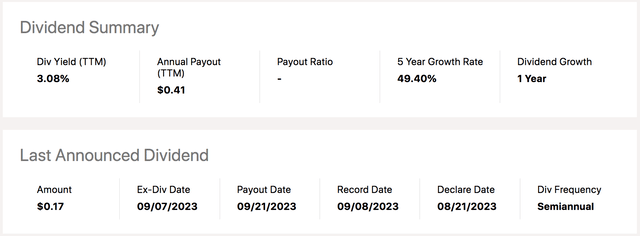

In 2023, the firm’s dividend policy entailed distributing between 30% and 45% of its normalized earnings, yielding an enticing dividend yield of 3.08%. With nine consecutive years of dividends and a 10-year dividend CAGR of 17.57%, Gold Fields embodies a stalwart dividend stock. Nonetheless, the recent price action has cast a shadow on the stock’s dividend component, a pivotal factor for dividend-focused investors.

Final Verdict

Our analysis indicates the potential for Gold Fields’ fundamentals to rebound following unfavorable production and cost dynamics in recent months. However, the stock’s recent surge has propelled it into a precarious territory, vulnerable to mean reversion.

While the market may have factored in the potential drawbacks related to Salares Norte, our revised outlook prompts a downgrade from a previous strong buy position to a more cautious hold, reflecting an absence of embedded value within the stock.