U.S. stocks initiated modest gains midway through Thursday trading, with the S&P 500 edging up about 0.1%.

The Dow advanced 0.06% to 39,785.87, while the NASDAQ saw a 0.06% rise to 16,408.04, with the S&P 500 following suit by climbing 0.13% to 5,255.09.

Check It Out: Jim Cramer Likes Crown Castle, But Can’t Recommend Archer Aviation: It Has ‘No Earnings Power’

Leading and Lagging Sectors

Energy sector shares leapt by 0.6% on the day, while communication services shares saw a 0.2% decline.

Top Headline

Walgreens Boots Alliance Inc WBA delivered impressive second-quarter earnings and fine-tuned its FY24 guidance.

Revealing that second-quarter fiscal year 2024 sales had surged 6.3% year-over-year to $37.1 billion, up 5.7% on a constant currency basis, Walgreens superseded analyst expectations of $35.86 billion. The adjusted EPS showed a 3.4% increase to $1.20, up 2.8% on a constant currency basis, surpassing consensus estimates of 82 cents, according to data from Benzinga Pro.

Walgreens Boots Alliance narrowed its adjusted EPS guidance for fiscal year 2024 to $3.20-$3.35 from the previous range of $3.20-$3.50, compared to the consensus of $3.24.

Equities Trading UP

Avalo Therapeutics, Inc. AVTX saw its shares skyrocket by 385% to $23.05 after acquiring a Phase 2-ready anti-IL-1β mAb, referred to as AVTX-009, via the acquisition of privately held AlmataBio. The company also disclosed a private placement financing of up to $185 million.

Shares of Xilio Therapeutics, Inc. XLO surged 169% to $1.70 following the announcement of an exclusive license agreement with Gilead Sciences for a tumor-activated IL-12 program, alongside declaring an $11.3 million private placement equity financing.

Biodexa Pharmaceuticals Plc BDRX also witnessed a rise, with shares climbing 108% to $1.7880 on the promising performance of Biodexa’s MTX110 against aggressive brain cancers.

Equities Trading DOWN

Primech Holdings Ltd. PMEC experienced a 53% decline to $1.8317 after issuing financial updates and corporate highlights for the six months ended Sept. 30, 2023.

Shares of urban-gro, Inc. UGRO dropped 25% to $1.37 post reporting worse-than-expected fourth-quarter financial results.

Data Storage Corporation DTST saw a 23% decline to $5.85 following its fourth-quarter results.

Also Check This Out: Bitcoin Trades Above $70,000 Following GDP, Jobless Claims Data; GateToken Emerges As Top Gainer

Commodities

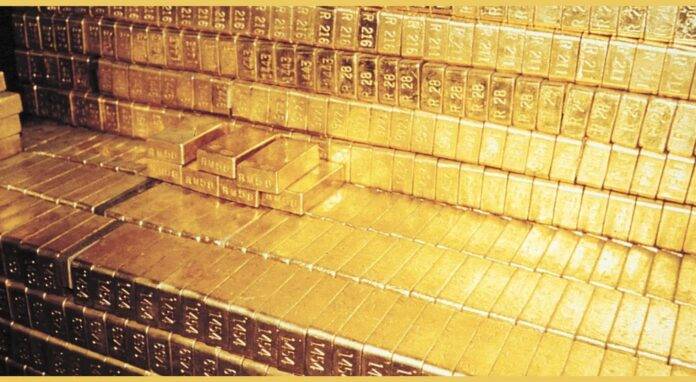

In the commodities realm, oil surged 1.7% to $82.73, while gold made a 1% jump landing at $2,235.10.

Silver rose 1% to $25.01 on Thursday, with copper also climbing 0.3% to $4.0120.

Euro zone

European markets saw gains today—the eurozone’s STOXX 600 rose 0.28%, London’s FTSE 100 gained 0.51%, Spain’s IBEX 35 Index declined 0.12%, and the German DAX, French CAC 40, and Italy’s FTSE MIB Index all displayed rises of 0.15%, 0.13%, and 0.10%, respectively.

Bank lending to households in the Eurozone escalated by 0.3% year-over-year to €6.87 trillion in February. The manufacturing confidence index in Italy increased to 88.6 in March from a revised reading of 87.5 in the prior month. German jobless rate remained unchanged at 5.9% in March, whereas German retail sales fell by 1.9% month-over-month for February.

The British economy exhibited a 0.2% year-over-year contraction in the fourth quarter, with the UK’s current account gap widening to £21.2 billion in the fourth quarter of 2023 compared to a revised £18.5 billion gap in the previous period. UK car production improved by 14.6% year-over-year to 79,907 units in February.

Asia Pacific Markets

Asian markets closed on a mostly high note on Thursday, with Japan’s Nikkei 225 dropping by 1.46%, Hong Kong’s Hang Seng Index rising 0.91%, China’s Shanghai Composite Index gaining 0.59%, and India’s S&P BSE Sensex posting a 1.4% increase.

Bank loans in Singapore rose to SGD 801.5 billion in February from SGD 794.3 billion in the prior month. The Domestic Supply Price Index in Singapore noted a 2.8% year-over-year decline for February.

Economics

The U.S. economy exhibited 3.4% annualized growth in the fourth quarter, marking an improvement from the previously reported 3.2%.

Initial jobless claims in the U.S. fell by 2,000 to 210,000 in the week ending March 23, surpassing market estimates of 215,000.

The Chicago PMI dipped to 41.4 in March from 44 in the prior month.

U.S. pending home sales ticked up by 1.6% from the prior month in February versus a revised 4.7% decline in the preceding month.

The University of Michigan consumer sentiment saw an increase to 79.4 in March from a preliminary reading of 76.5.

Now Dig Into This: $5M Bet On Snowflake? Check Out These 4 Stocks Insiders Are Buying