By RoboForex Analytical Department

Gold Prices Drop as Dollar Strengthens Post-Trump Victory

Gold prices fell over 3% to 2650 USD per troy ounce due to a rising US dollar, which was influenced by Donald Trump’s decisive win in the presidential election. As of Thursday, gold remains near three-week lows, showing continued pressure from a strong dollar.

Investors are adjusting their expectations, looking for a more cautious Federal Reserve regarding interest rate cuts. Trump’s win, seen as pro-inflation because of his protectionist policies, may lead the Fed to keep rates higher to combat any inflation threats, making non-yielding assets like Gold less attractive.

All eyes are on the Fed’s upcoming interest rate decision. A 25-basis-point cut is expected, which has already been factored into the market, impacting current Gold prices.

The future direction of Gold prices will largely rely on the Fed’s statements and rate decisions. While forecasts suggest rates will decrease, the speed and scale of these changes will be crucial for Gold’s attractiveness.

Technical Analysis of XAU/USD

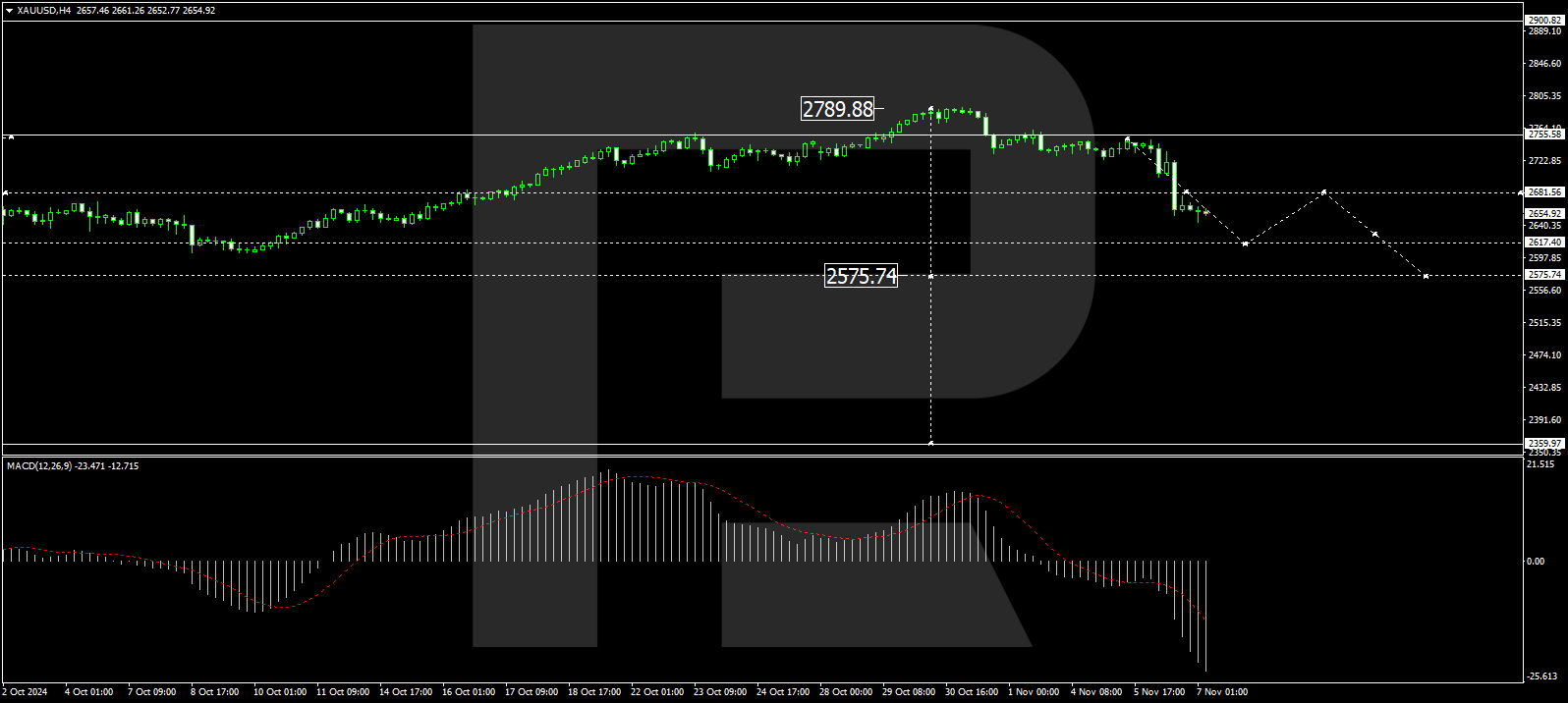

Gold recently reached a high of 2790.00 and has since formed a consolidation range below this level. A downward breakout from this range has opened the door for significant corrections, with Gold beginning its first corrective wave. The immediate downside target is 2617.40, which could extend to 2575.75 if the downward trend continues. The MACD indicator supports this bearish view, showing a downward trend below zero that indicates further declines are likely.

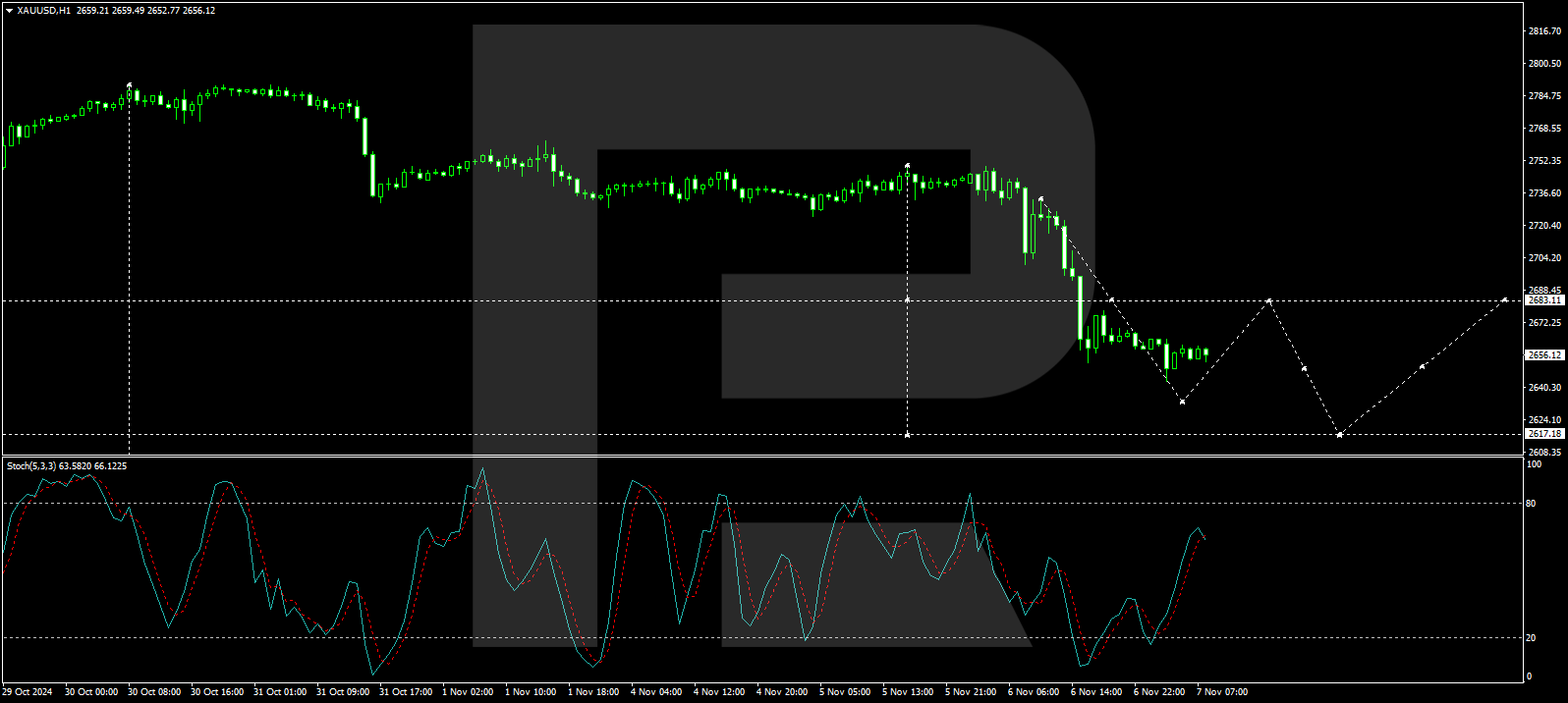

The hourly chart shows a downward wave targeting 2635.65. If this target is reached, a corrective rally to 2683.11 might follow before the market retreats again toward 2617.17, which is the main target in this bearish phase. The Stochastic oscillator hints at potential short-term gains, as its signal line approaches the 80 level, indicating a brief uptick before continuing the downward trend.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs