Nvidia’s Competition is Heating Up: Why Micron Technology is Worth Your Attention

Nvidia has led the conversation in the AI market, capturing the interest of both investors and the media with an astonishing 2,190% increase in its stock over the past five years. For a time, it even held the title of the most valuable company globally, although it currently ranks second.

But Nvidia isn’t the only player in the AI or semiconductor fields. Recently, another chipmaker posted year-over-year data center revenue growth exceeding 400%, with overall revenue up by 84% to reach $8.7 billion for the quarter ending November 28.

Start Your Mornings Smarter! Sign up for Breakfast news to receive daily market updates in your inbox. Sign Up For Free »

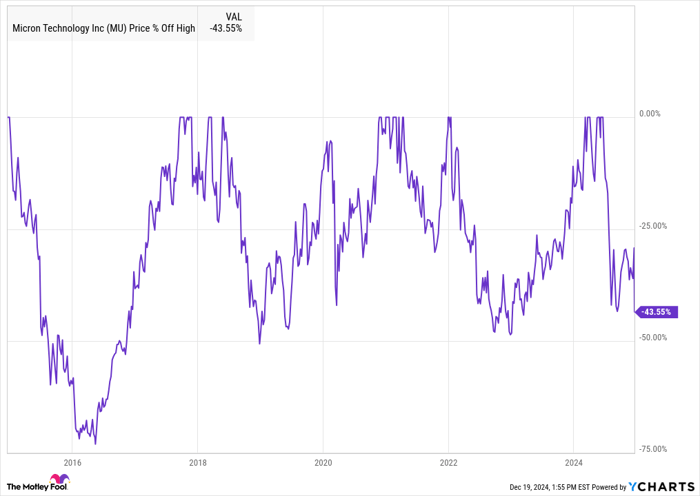

Micron Technology (NASDAQ: MU) is a memory-chip specialist that has surprisingly dipped 44% from its recent high, even after such impressive growth. This decline, combined with Micron’s AI potential, makes it a compelling stock to consider. First, let’s take a closer look at the company’s recent performance.

![]()

Image source: Getty Images.

Understanding Micron Technology

Micron is a leading manufacturer of memory chips, including DRAM, NAND, and high-bandwidth memory (HBM). Similar to Intel and Samsung, Micron is an integrated device manufacturer, which means it designs and produces its own chips.

The memory chip industry is cyclical, often facing price fluctuations and market saturation. Because Micron operates its own foundries, it experiences heightened exposure to these boom and bust cycles. Managing foundries needs substantial capital, yet this integrated model can lead to better profit margins during prosperous times.

The chart below illustrates Micron’s stock price in relation to its past highs, highlighting its historical volatility. Over the last decade, it has dropped by 40% or more on four separate occasions before reaching new all-time highs.

Data by YCharts.

Investing in Micron holds risks due to its cyclicality and volatility, but it’s important to note that the semiconductor sector is currently in a boom, largely supported by the rapid growth of AI. Although segments like PCs and smartphones are weaker, industry leader Taiwan Semiconductor Manufacturing reported a 36% revenue growth in the third quarter, reaching $23.5 billion, indicating strong performance in the sector.

With increasing demand for AI, management reported that data center revenue made up over 50% of total revenue in the quarter, following a path set by Nvidia. This suggests that AI computing significantly contributes to Micron’s financial health.

Reasons Behind Micron’s Stock Decline

Following its fiscal first-quarter earnings report on Wednesday, Micron’s stock dropped as much as 19% the following Thursday due to weak guidance for the second quarter. The company has a track record of conservative forecasting, and the recent weakness stems mainly from consumer markets like smartphones, while the AI sector continues to thrive.

The segment linked to AI, HBM, is experiencing noteworthy growth. Micron anticipates achieving its HBM targets for the fiscal year, expecting “substantial record” revenue along with improved profitability and free cash flow.

Revenue and adjusted earnings per share (EPS) forecasts for the second quarter show a decline from $8.7 billion to $7.9 billion, with adjusted EPS projected to slip from $1.79 to $1.43.

Despite this, management’s rationale for the soft outlook should provide some reassurance for investors. CEO Sanjay Mehrotra acknowledged the impact of seasonality and customer inventory adjustments, particularly in consumer sectors like smartphones, and expressed optimism that these changes are only temporary. He believes customer inventories will normalize by spring, setting the stage for stronger shipments in the latter half of fiscal and calendar 2025.

Thus, the reasons for the lowered guidance seem more like a short-term issue than a long-term obstacle. Consequently, the 17% decline feels like a misinterpretation by the market, presenting a buying opportunity for investors.

Why Micron is an Attractive Buy

A temporary sell-off can be a favorable buying opportunity, but Micron offers more than just that. The company is poised for gains from the AI boom, especially as its largest customer—believed to be Nvidia—now accounts for 13% of its revenue. A strong partnership with Nvidia, which reported a 94% year-over-year revenue growth in its Q3 report, benefits Micron considerably.

While Micron’s performance can be unpredictable, the conditions appear promising for substantial profits as AI technology expands. The market for HBM is set to soar from $16 billion in 2024 to $64 billion in 2028 and to $100 billion in 2030. If Micron maintains its current market share, its HBM revenue could quadruple in just four years and increase sixfold in six years.

Additionally, Micron’s stock is currently priced much lower than its peers in the AI and chip sectors, trading at a forward P/E of just 10 based on this year’s projections. Although these estimates may decrease following its guidance, Micron remains a strong value at this price point.

Investors should closely monitor the chip and AI industry cycles; however, there’s significant upside potential for Micron stock. Returning to its peak this past summer would signify a 75% increase, with further growth possible over the next couple of years if demand from data centers continues to expand.