The recent plunge in the stock market saw investors grappling with their worst week in 2024 so far. However, the unveiling of robust jobs data today paints a different picture. In fact, this dip may just be the golden ticket every investor has been seeking.

Unveiling the Latest Jobs Figures

The official numbers are in, the U.S. economy saw a whopping 303,000 new jobs added last month. This figure significantly surpasses the expected 202,000 and even trumps the job creation rate recorded in February, standing tall at around 275,000 new positions. Remarkably, the last time the economy witnessed such an influx of jobs was way back in May 2023.

Such figures are music to the ears of many who have been bracing for recession talks that have been looming in recent times. However, this batch of job data should firmly put those recession fears to rest.

Evaluating the Employment Data

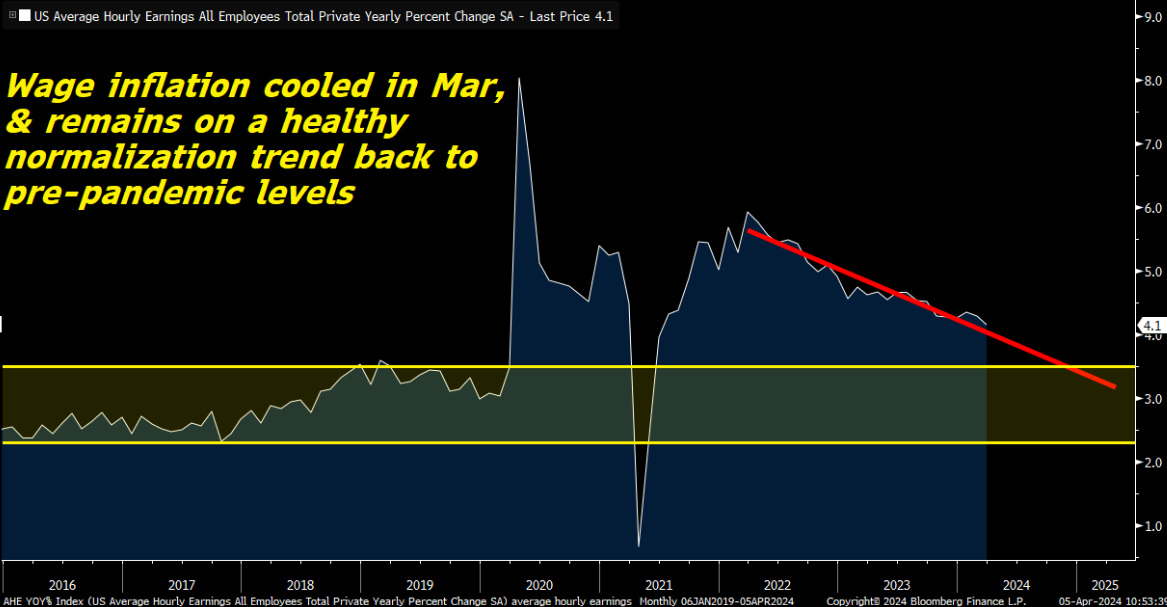

The recent job data not only showcases healthy job growth but also signals a relief in wage inflation. Last month, the average hourly earnings witnessed a modest 4.1% year-over-year increase, down from the 4.3% surge observed in February. This trend of subsiding wage inflation sets the stage for a balanced job market, often referred to as a “Goldilocks” scenario. It’s a market that’s “just right” – a sweet spot for stocks to rally.

The positive momentum is reflected in the stock market today. With March’s job report displaying optimistic “Goldilocks” trends that alleviate concerns around recession and inflation, the previously tumultuous week ends on a high note. This might just be the ideal moment to dive back into the market.

The Ripple Effect of the Current Market Movement

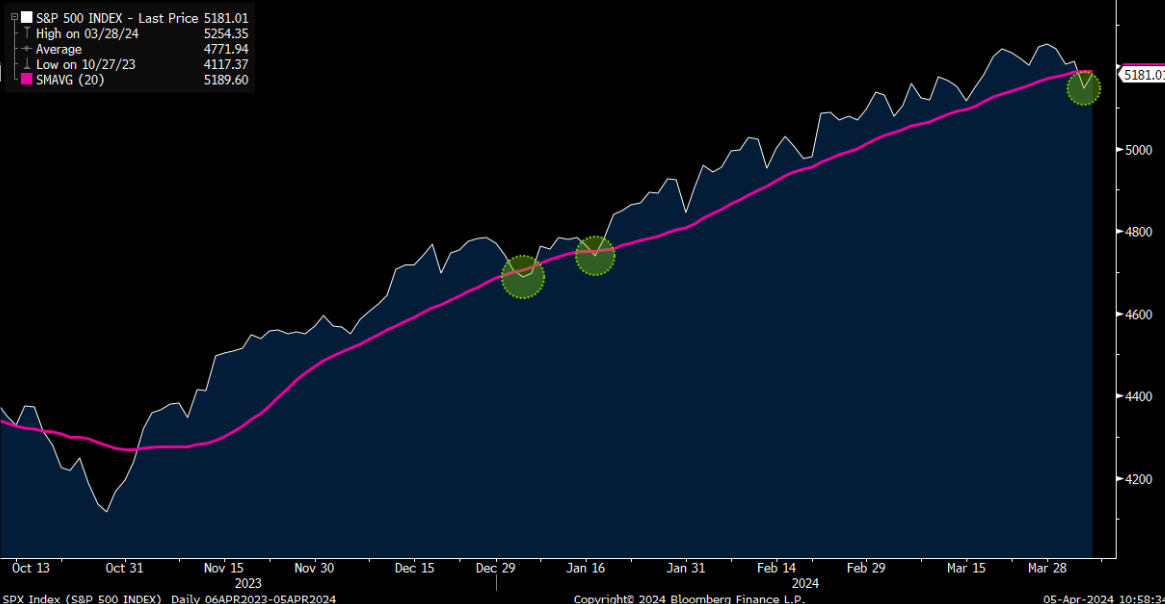

From a technical standpoint, the S&P 500 has found newfound strength in its 20-day moving average (MA) since the spooky season of 2023. This support line has proven its mettle time and again, ushering the market through fluctuations and uncertainties. The recent market bounce off the 20-day MA reaffirms this pattern, underlining a lucrative buying opportunity amidst the market turmoil.

As the market braces for a rebound, one pressing question lingers: are you backing the right stocks in this resurgence? The market landscape has split into winners and strugglers, with AI and tech stocks dominating the former category. Focusing on these tech darlings will likely reap the greatest rewards during this market revival.

In Conclusion

As we navigate through this market rejuvenation post a turbulent spell, seizing the right investment opportunities holds the key to maximizing returns. The evolving AI landscape, with big players delving into the next generation of AI, presents a promising avenue for growth. It’s time to stay abreast with these shifting tides and position your portfolio for success in this new era of technological innovation.

“The market operates in mysterious ways. Embrace the volatility, but do your homework. The ‘Goldilocks’ market may just hold the proverbial pot of gold for savvy investors.”