Goldman Sachs Boosts BioNTech’s Rating: Analysts Predict Significant Value Growth

Fintel reports that on November 8, 2024, Goldman Sachs upgraded BioNTech SE – Depositary Receipt (LSE:0A3M) from Neutral to Buy.

Analysts Expect Share Price to Rise by Over 24%

As of October 23, 2024, the average one-year price target for BioNTech SE – Depositary Receipt stands at 133.69 GBX per share. Predictions vary, with estimates ranging from a low of 89.99 GBX to a high of 177.75 GBX. The average target indicates a potential increase of 24.53% from its latest closing price of 107.35 GBX per share.

Discover which companies are projected to have the largest price target increases.

The anticipated annual revenue for BioNTech SE – Depositary Receipt is 3,963MM, reflecting a robust increase of 30.36%. Additionally, the projected annual non-GAAP EPS is 2.77.

Is There Strong Fund Interest?

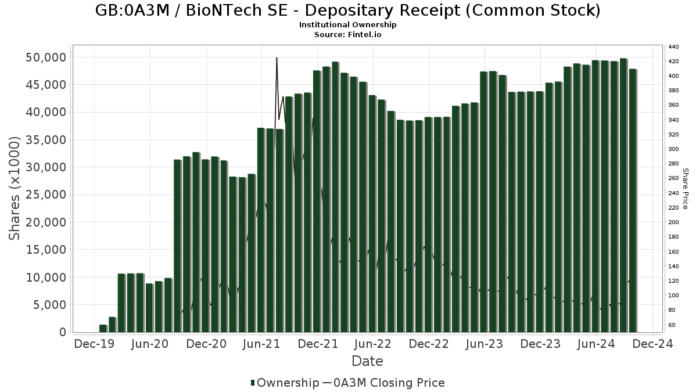

Currently, 396 funds or institutions report holdings in BioNTech SE – Depositary Receipt, marking a slight increase of one owner or 0.25% in the last quarter. The average allocation for all funds in 0A3M is 0.27%, showing a rise of 9.19%. Total institutionally owned shares have decreased by 3.33% in the past three months, totaling 47,671K shares.

How Are Other Shareholders Adjusting Their Holdings?

Baillie Gifford now holds 8,308K shares, having increased its stake from 8,276K shares, which is a 0.38% growth. However, the firm’s portfolio allocation in 0A3M has decreased by 46.42% over the last quarter.

Primecap Management owns 4,517K shares, down from 4,790K shares—representing a 6.04% reduction. This firm, however, has increased its portfolio allocation in 0A3M by 41.54% this past quarter.

Flossbach Von Storch has 4,360K shares, a minor decline from its previous holding of 4,379K shares (0.46%). Yet, this firm increased its allocation in 0A3M by 37.66% recently.

In contrast, Harding Loevner’s holdings dropped from 3,818K shares to 2,927K shares, reflecting a 30.46% decline. This firm also reduced its portfolio allocation in 0A3M by 40.28% over the last quarter.

VHCOX – Vanguard Capital Opportunity Fund Investor Shares now holds 2,372K shares, slightly up from the previous 2,357K shares (0.65% increase). However, its portfolio allocation in 0A3M dipped by 14.07% this past quarter.

Fintel offers comprehensive investment research tools for individual investors, traders, financial advisors, and small hedge funds.

Our data spans global markets and includes fundamental analysis, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more. Additionally, Fintel’s exclusive stock picks are based on advanced, backtested quantitative models aimed at improving profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.