Cloudflare’s Stock Soars After Upgrade from Goldman Sachs

Cloudflare Inc NET shares are rising on Thursday after analyst Gabriela Borges of Goldman Sachs upgraded the stock from Sell to Buy. The price target increased significantly from $77 to $140.

Market Perspective on Security Stocks

According to Borges, the performance of security stocks in 2024 will heavily depend on how well the market perceives each company as a platform rather than just a point product.

Future Growth for Cloudflare

Borges identified two key catalysts for Cloudflare’s stock in 2025. These include enhanced sales and marketing productivity following two years of adjustments aimed at improving enterprise platform sales. Additionally, Cloudflare’s Act III products could gain traction as the company leverages its core edge network architecture for new AI inferencing applications.

Updated Revenue Projections

The recent price target increase corresponds to a rise in the valuation multiple from 11x to 20x based on projected Q5-Q8 revenue. Borges raised his 2026 revenue estimates by 2%, supported by expectations of improved sales productivity and the impact of Act III.

Check Point Software Technologies Downgrade

In contrast, Borges downgraded Check Point Software Technologies CHKP from Buy to Neutral, raising its price target slightly from $204 to $207.

Investment Focus for Check Point

Borges sees 2025 as a pivotal year of investment for Check Point, particularly as its new CEO re-evaluates growth strategies and the company enhances its new SASE products. The analyst noted that earnings per share (EPS) growth may face challenges in 2025, as the stock generally reflects EPS trends. However, there is potential for positive momentum in 2026 if Check Point can translate its investments into revenue growth.

Comparative Analysis

The analyst drew comparisons between Check Point and other software companies that exhibit less than 10% revenue growth but have higher EPS. With a median 2025 P/E ratio of 17x among its peers, Check Point’s revenue growth is estimated at 6% according to analysts—on par with its competitors. Its “Rule of 40” score stands at 47, compared to 35 for peers.

Borges also compared Check Point to the S&P 500, which trades at 22x 2025 EPS while showing approximately 10% EPS growth. In this light, Check Point’s performance appears competitive in terms of earnings growth across market cycles.

Revised Earnings Estimates for Check Point

EPS estimates for Check Point have been adjusted, with 2024, 2025, and 2026 figures changing from $9.10, $9.75, and $10.95 to $9.10, $9.45, and $10.65. Additionally, Borges introduced a 2027 EPS estimate of $12.25, reflecting trends in operating expenditures.

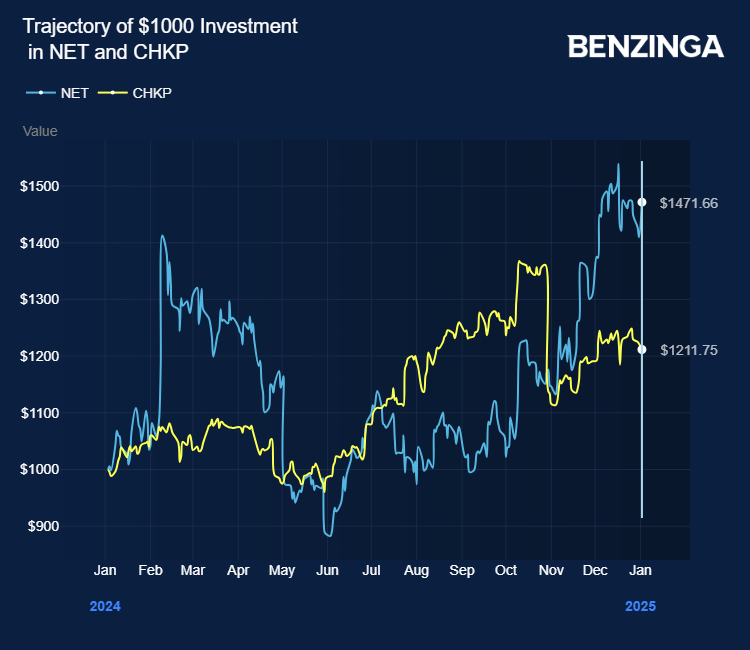

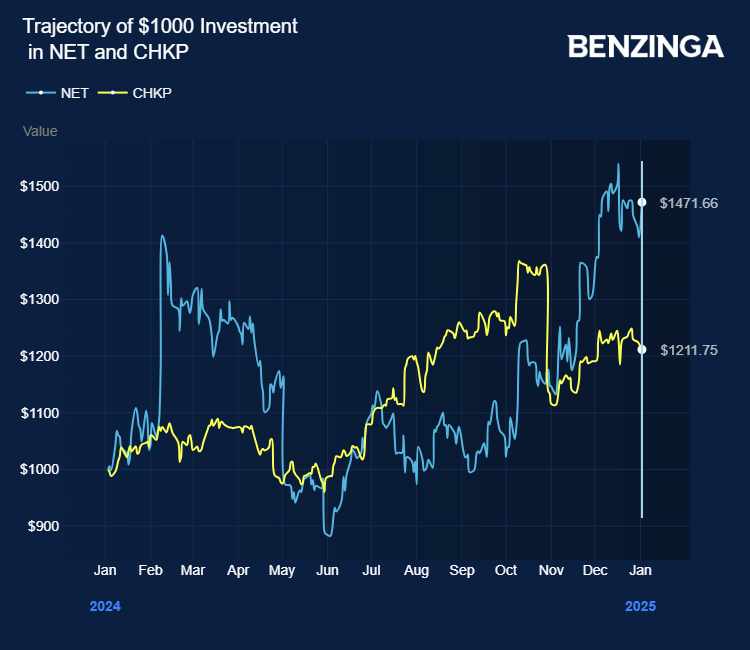

Current Stock Performance: As of the last update, NET stock has risen by 4.59%, trading at $112.62. Meanwhile, CHKP has seen a slight decline of 0.80%.

Additional Insights:

Photo via T. Schneider/Shutterstock.com.

Market News and Data brought to you by Benzinga APIs