Goldman Sachs Stock Faces Challenges Amid Trade War Concerns

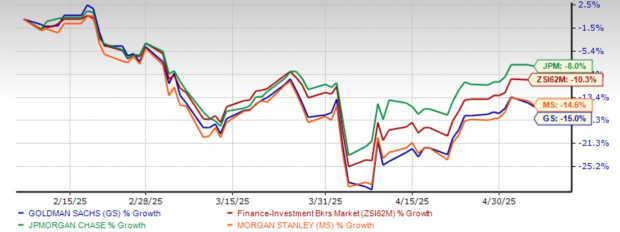

The Goldman Sachs Group, Inc. (GS) shares have dropped 15% over the last three months, contrasting the industry average decline of 10.3%. This decline reflects rising trade war concerns, with tariffs fueling fears of increasing inflation and a potential global economic slowdown.

Recent Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In line with the broader market trend, GS competitors JPMorgan (JPM) and Morgan Stanley (MS) also saw share price declines of 8% and 14.6%, respectively, during the same period.

Given this recent downturn, investors are questioning whether holding onto GS stock is prudent. Below, we explore key factors influencing the company’s outlook.

Goldman Sachs and the Investment Banking Landscape

A revival in merger and acquisition (M&A) activity was anticipated for 2025, driven by a potentially pro-business Trump administration, expectations for regulatory rollbacks, and pent-up market demand. However, developments have proven more complex.

The expected timeline for a rebound in M&As has shifted to the latter half of 2025, largely due to tariff-related market volatility. With persistent inflationary pressures, a slowdown or recession in the U.S. economy appears likely. Consequently, many companies are reconsidering their M&A strategies, despite existing capital resources and stabilizing interest rates.

As a result, Goldman Sachs’ investment banking (IB) revenues fell by 8% year over year in Q1 2025. In contrast, JPMorgan and Morgan Stanley saw their IB fees rise by 12% and 7.7% in the same quarter.

Despite these challenges, Goldman’s authoritative position in deal-making signifies strong client trust. Additionally, an increase in its IB backlog suggests that a recovery in revenues may occur once market conditions improve, thus providing Goldman with a strategic advantage over peers.

Strategic Focus on Core Operations

Goldman Sachs is strategically divesting from its non-core consumer banking business, refocusing on sectors where it enjoys a competitive edge—namely IB, trading, and asset and wealth management (AWM).

Reports indicate that last November, Goldman received a proposal from Apple to conclude their consumer banking partnership. A January 2025 report from Reuters suggests this collaboration may dissolve prior to its 2030 expiration, affecting two products—Apple Card and Apple Savings account.

In 2024, Goldman transferred its GM credit card business to Barclays and divested its home-improvement lending platform, GreenSky. Earlier in 2023, it also sold off its Personal Financial Management unit.

These strategic exits underscore Goldman’s intent to redirect capital and resources towards more profitable and scalable opportunities.

This focus is positively impacting the AWM division, which is increasingly crucial to the company’s long-term growth strategy. AWM is diversifying into fee-based revenue streams to mitigate the volatility associated with the IB business. As of March 31, 2025, AWM managed over $3.2 trillion in assets and is gaining traction in alternative investments and tailored wealth solutions for ultra-high-net-worth individuals.

In Q1 2025, Goldman reported notable net inflows into its wealth management platform, affirming the growing confidence of clients in this segment.

Goldman’s Strong Liquidity Position

Goldman Sachs maintains a robust balance sheet, with Tier 1 capital ratios significantly above regulatory requirements. This financial fortitude empowers the firm to aggressively return capital to shareholders through buybacks and a healthy dividend yield of 2.14%.

As of March 31, 2025, cash and cash equivalents amounted to $167 billion, while near-term borrowings were $71 billion.

In July 2024, Goldman raised its common stock dividend by 9.1% to $3 per share. Over the past five years, the company has boosted its dividends four times, achieving an annualized growth rate of 23.6%. The current payout ratio stands at 28% of earnings.

Comparatively, JPMorgan has raised its dividend five times during the same period, with a payout ratio of 27%, while Morgan Stanley has increased its dividend four times and reported a higher payout ratio of 43%.

Goldman’s board of directors has also authorized a plan for share repurchases, approving up to $40 billion in common stock buybacks in Q1 2025. Earlier, in February 2023, it announced a separate $30 billion repurchase program without a set expiration date. At the close of Q1, GS had $43.6 billion in available repurchase authorization.

Navigating the Future of Goldman Stock

While the outlook for Goldman’s IB business appears uncertain in the short term, the company remains well-positioned for long-term growth. Its leadership in IB and trading, coupled with a diversified business strategy and global reach, provides a strong competitive advantage. Furthermore, its robust liquidity position enhances its ability to distribute capital effectively.

From a valuation perspective, GS stock appears compelling. It trades at a forward price-to-earnings (P/E) ratio of 12.06X, below the industry average of 12.88X. Compared to peers, JPMorgan and Morgan Stanley currently show P/E ratios of 13.59X and 13.57X, respectively.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

Despite current challenges in the IB sector, Goldman is projected to achieve year-over-year growth in 2025 and 2026, highlighting the company’s efforts in business diversification.

Sales Estimates

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Goldman Sachs Stock Analysis: Earnings Estimates and Insights

Earnings Estimates

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Given its robust fundamentals, Goldman Sachs presents a solid option for investors looking to maintain or increase their equity stake. Currently, the company holds a Zacks Rank #3 (Hold), signaling a cautious yet stable outlook. For further insights, you can access the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

According to our expert team, five stocks stand out as having the highest potential for over 100% gains in the near future. Among these, Director of Research Sheraz Mian has identified a particular stock that is projected to achieve the greatest ascent.

This leading pick is recognized as one of the most innovative firms in the financial sector. With an expanding customer base exceeding 50 million and a diverse range of advanced solutions, this stock is well-positioned for significant growth. While not all elite selections succeed, this stock could potentially outperform past Zacks recommendations like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Morgan Stanley (MS): Free Stock Analysis Report

This analysis was originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.