Google’s Growth Potential

My initial caution about Google’s stock performance has been proven wrong as the company outpaced the broader U.S. market since mid-May. Over time, Google has firmly established its position in the market, prompting a reevaluation of its investment potential. Google’s presence in the cloud and artificial intelligence (AI) fields is significant, and its primary business is flourishing, benefitting from favorable industry trends and poised for enhanced profitability. The company’s strong positioning allows for continued innovation and expansion within its extensive ecosystem, and my valuation analysis indicates that the stock is attractively priced, leading me to assign a “Strong Buy” rating to Google.

Key Earnings Update

The latest quarterly earnings, released on October 24, revealed that Google surpassed consensus estimates, with an impressive 11% year-over-year revenue growth and notable expansion in adjusted earnings per share (EPS) from $1.06 to $1.55. The company boasts a solid balance sheet with $120 billion in cash, minimal leverage, and a substantial $90 billion net cash position, providing ample room for strategic investments and acquisitions to unlock new revenue streams.

Historical Success and Projected Growth

Google has a strong track record of successful acquisitions, demonstrating its capacity for sound strategic moves. The company’s history of generating superior returns, with return on invested capital (ROIC) consistently above 20% over the last decade, instills confidence in its ability to reinvest in lucrative projects. Projected fiscal 2023 full-year revenue is poised for an 8.1% year-over-year growth, and with the company’s historical performance and the expected robust holiday season, this growth projection appears achievable.

Upcoming Opportunities

The earnings for the next quarter, scheduled for release on February 1, 2024, are anticipated to reflect a 12% year-over-year revenue growth, with a substantial expansion in adjusted EPS from $1.05 to $1.61. Google’s dominant position in digital advertising, accounting for 80% of its total revenue, positions the company to benefit from the projected 9.7% compound annual growth rate (CAGR) in the digital advertising market over the next decade.

Dominance in Digital Advertising and Innovation

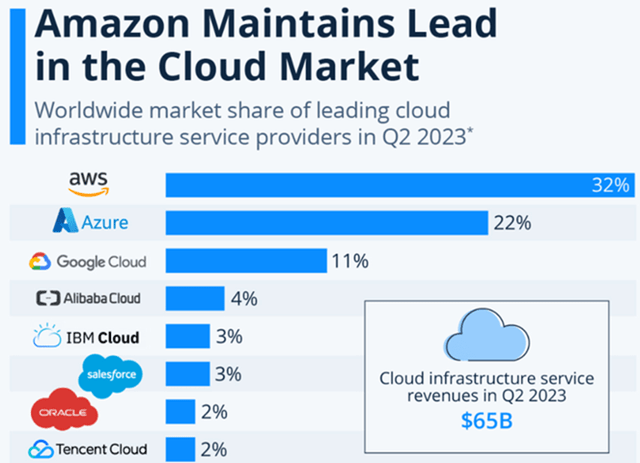

Google’s stronghold in digital advertising affords the company significant pricing power and unparalleled profitability, enabling it to fortify its financial position and invest in robust growth opportunities. Despite potential challenges in cloud computing and AI, Google’s substantial presence in the global cloud computing market and extensive ecosystem, with high switching costs for users, indicate promising future synergies. Additionally, the profitability from digital advertising provides Google with ample resources to invest in pioneering projects, such as its self-driving taxi subsidiary, Waymo, positioning the company for sustained success.

With Google’s solid financial standing and the growth potential presented by its diverse ventures, investors are presented with a compelling case to consider bolstering their position in the company’s stock. As such, the message to investors is abundantly clear: now is the time to load up on Google shares.

Google’s Invaluable Position in the Autonomous Ride-Sharing Industry

Google’s subsidiary, Waymo, is leading the charge in the autonomous ride-sharing industry, placing the tech giant in a prime position to dominate the global ride-sharing market, estimated to surpass half a trillion USD over the next decade. With an estimated capture of 10% of the global ride-sharing industry, Waymo could add an impressive $50 billion in annual revenue, potentially boosting Google’s fair value by $300 billion. However, the company faces high uncertainty given the early stage of Waymo’s monetization.

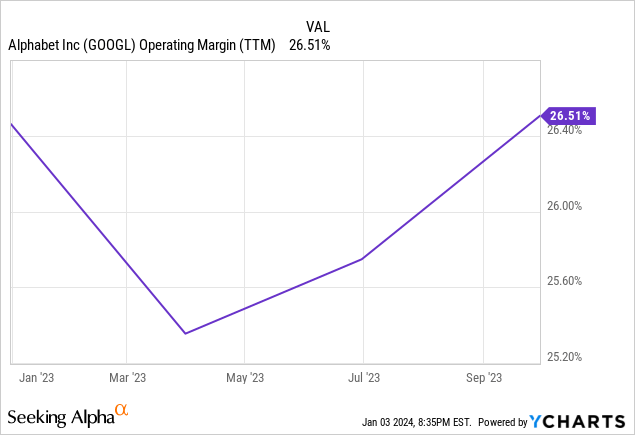

Despite the bright revenue prospects, Google’s management has displayed a commitment to financial discipline, as evidenced by its strategic headcount optimization. The company’s previous job cuts contributed to improved profitability metrics, prompting anticipation for a potential additional 30 thousand job cuts in 2024, which could further enhance operating margins. This move has garnered attention from prestigious investment firms such as Needham and Wedbush, both including GOOGL in their 2024 top picks lists.

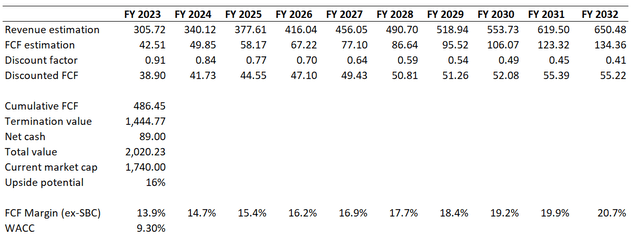

The Intricacies of Valuation

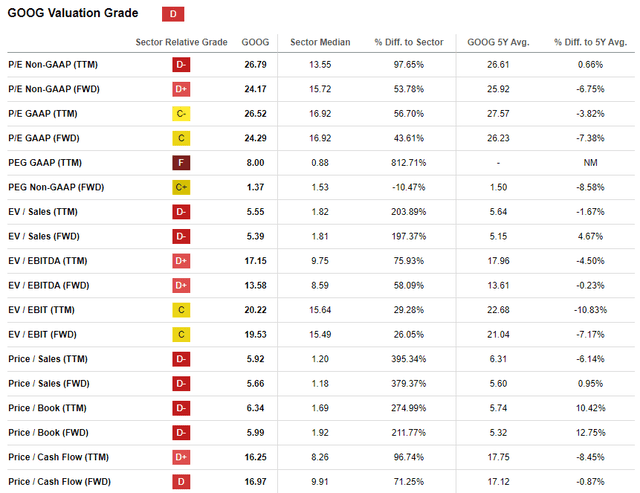

With a remarkable 57% rally in the last year, Google has significantly outperformed the broader U.S. stock market. Despite a low “D” valuation grade, the stock appears fairly valued when compared with historical averages. A discounted cash flow [DCF] simulation suggests Google’s undervaluation, indicating a fair value of $2 trillion, around 16% higher than the current market cap.

My target price for GOOGL is around $162, reflecting a 20% increase from the previous fair value estimate. This uplift is attributed to several positive developments, including monetary policy expectations, profitability rebound, and upgraded revenue estimates.

Navigating Risks

While Google stands to benefit from shifts in cloud computing and AI, significant antitrust issues loom over the company, given its dominant position in digital and search advertising. These challenges, coupled with tough competition from industry leaders like Microsoft and Amazon, present formidable hurdles for Google to overcome. The company’s delay in AI advancements compared to its counterparts further complicates its position in the market.

In Conclusion

In light of these factors, Google is considered a “Strong Buy,” positioned as a potential gift with a 16% undervaluation. The company’s commanding market presence and strong profitability warrant a substantial premium to its fair value. With its robust financial standing and exponential growth potential in various sectors, Google presents an enticing opportunity for investors in the foreseeable future.