Analyst Sees Promising Future for Alphabet Inc Amidst Shifting Search Landscape

BofA Securities analyst Justin Post has reaffirmed a Buy rating for Alphabet Inc GOOG GOOGL with a price target set at $225.

Recent Search Market Trends

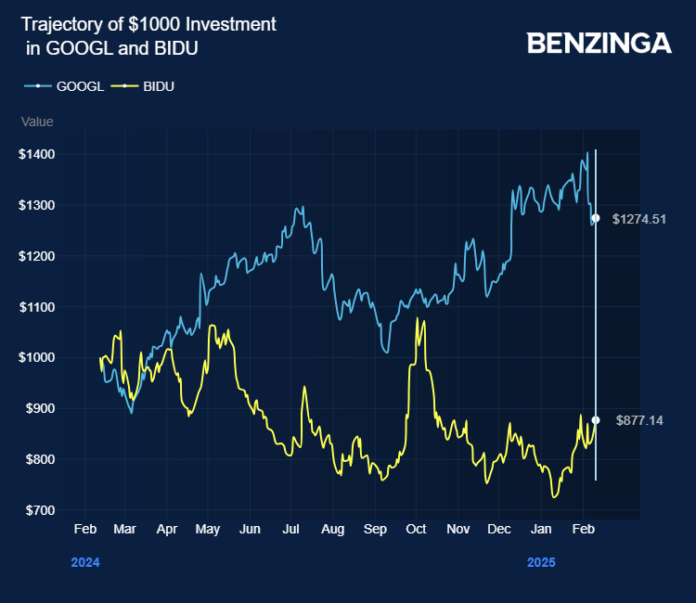

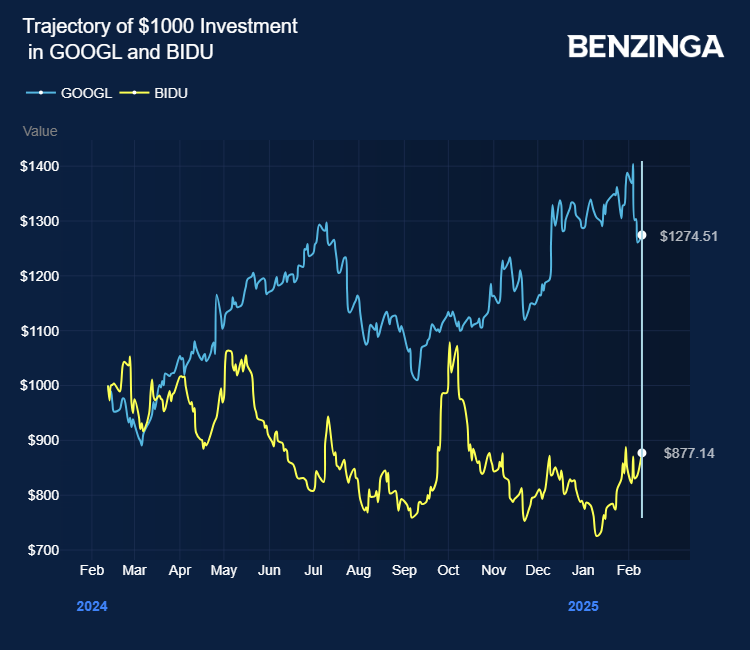

According to Statcounter’s January data, Google’s market share for global searches rose by 5 basis points (bps) month-over-month (M/M), though it is down 169 bps year-over-year (Y/Y), landing at 89.8%. Meanwhile, Bing saw a slight decline of 4 bps M/M (but up 51 bps Y/Y) bringing it to 3.9%. Others, including Yandex, Baidu Inc BIDU, and Naver, recorded a 1 bps increase M/M and an impressive 101 bps increase Y/Y, totaling 5.0%.

Shifts Observed in the U.S. Market

In the United States, Google’s search share declined by 5 bps M/M (down 12 bps Y/Y). Mobile searches fell by 5 bps M/M (down 64 bps Y/Y), while desktop searches managed to increase by 53 bps M/M (down 95 bps Y/Y). Conversely, Bing gained 7 bps M/M (down 49 bps Y/Y), and Yahoo has increased its share by 50 bps Y/Y.

Emerging AI platforms such as ChatGPT and Perplexity may be influencing internet traffic more than traditional search share metrics suggest. Daily web visits might serve as a better gauge of competition than purely search data.

Comparative Traffic Metrics

In January, Google experienced a 1% decrease Y/Y in global average daily visits, totaling 2.7 billion (up 1% M/M). By contrast, ChatGPT’s visits surged by 148% Y/Y (up 4% M/M) to 128 million, while Bing’s traffic rose 18% Y/Y (up 1% M/M), reaching 59 million.

In the U.S., Google visits remained flat Y/Y (up 2% M/M) at 542 million. On the other hand, ChatGPT’s visits climbed 96% Y/Y (up 4% M/M) to 18 million, whereas Bing saw a drop of 9% Y/Y (down 3% M/M), totaling 12 million.

While new AI platforms like Perplexity, which experienced a 279% increase in global traffic Y/Y (up 6% M/M) to 3.2 million, and Claude with a 439% increase Y/Y (up 4% M/M) to 2.5 million, show robust growth, combined they still account for less than 0.3% of Google’s visits.

Impact of AI on Google’s Future

Despite the observed growth among AI tools, Post noted that Google’s search traffic hasn’t suffered significantly, nor has it gained noticeably from AI Overviews. This suggests that while AI platforms capture some new traffic, Google remains largely unaffected.

Traffic estimates are inherently subject to variability. During the fourth-quarter conference call for 2024, Google management reiterated strong growth in search volumes, attributed in part to AI enhancements.

Post remains optimistic about Google’s ability to monetize AI capabilities in search, especially given that the fourth quarter reflected another surge in search revenue. His analysis indicates that advertisements in top positions within AI Overviews are yielding higher click-through rates (CTR), contributing positively to search pricing.

Future Projections

Looking ahead, Post forecasts fiscal sales of $328.59 billion in 2025 and $367.42 billion in 2026 for Alphabet.

Price Action: As of the latest update on Monday, GOOGL stock has increased by 0.94%, reaching $187.08.

Also Read:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs