Group 1 Automotive Enhances Dividend and Shows Strong Market Performance

Group 1 Automotive (GPI) has announced an increase in its annual dividend for 2025, raising it to $2 per share. This marks a 6% rise compared to the 2024 dividend of $1.88 per share. Shareholders can expect a quarterly dividend of 50 cents per share on March 17, 2025, for those owning shares by March 3, 2025.

This dividend hike reflects GPI’s financial health and dedication to returning value to shareholders, likely boosting investor confidence. Over the past five years, the company has declared dividend increases 11 times, achieving an annual growth rate of 12.5%. With a payout ratio of just 5%, the dividend appears sustainable.

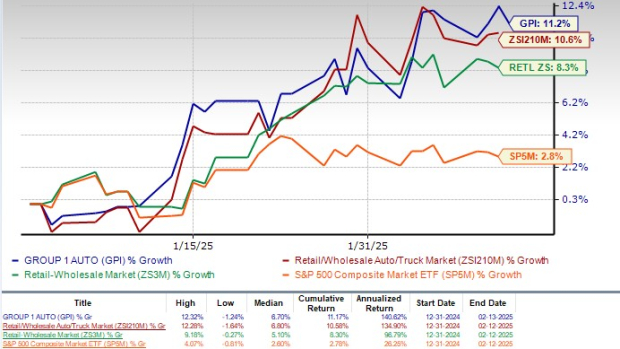

In 2023, GPI shares have risen by 11.2%, outperforming the Zacks Retail – Wholesale sector’s growth of 8.3% and the Zacks Automotive – Retail and Whole Sales sector, which saw a return of 10.6%. This increase can be attributed to GPI’s strategic acquisitions, robust U.S. operations, and enhanced aftersales services.

Year-to-Date Performance Snapshot

Image Source: Zacks Investment Research

With this context leading the way, is now the right time to invest in GPI stock? Let’s take a deeper look.

Currently, GPI shares are considered undervalued, sporting a Value Score of A. The stock is trading at a forward 12-month price-to-sales ratio of 0.29x, significantly lower than the sector average of 1.67x.

Price-to-Sales Ratio (F12M)

Image Source: Zacks Investment Research

Additionally, GPI is trading well above both the 50-day and 200-day moving averages, reflecting a positive market trend.

GPI Demonstrates Strong Moving Averages

Image Source: Zacks Investment Research

Acquisitions and Aftersales Drive Growth

Group 1 has aggressively expanded its operations by integrating 54 new stores and two corporate entities in the fourth quarter of 2024. In 2024, GPI’s total acquired revenues reached approximately $4 billion, including the successful acquisition of Inchcape, projected to add $2.7 billion in annual revenues. These strategic moves have fueled GPI’s top-line growth, alongside a stock buyback strategy that has seen the company repurchase 25% of its shares over the past three years.

GPI’s aftersales sector has emerged as a significant profitability driver, with fourth-quarter 2024 revenues and gross profits surpassing both sequential and year-over-year figures. Notably, there was a 6.5% increase in repair orders, alongside significant investments in technician hiring and retention, resulting in a 7% increase in technician headcount in the U.S. in 2024.

Robust Partnerships Enhance GPI’s Market Position

Group 1 has fortified its market position through partnerships with major automotive brands. Its U.K. operations expanded with the acquisition of various dealerships for brands like BMW, Volkswagen, Audi, Porsche, Mercedes-Benz, Toyota Motor (TM), Land Rover, General Motors (GM), and Ford Motor (F). These alliances enable GPI to offer a diverse range of in-demand vehicles to customers, enhancing its competitive edge.

Notably, sales from Toyota Motor, General Motors, and Ford Motor account for 19%, 9%, and 7% of GPI’s total revenues, respectively. This diverse brand alliance mitigates risks linked to market fluctuations and shifting consumer preferences.

Projected Earnings and Revenue for 2025

The Zacks Consensus Estimate for GPI’s first-quarter 2025 earnings per share (EPS) stands at $9.67, reflecting a 0.4% decline over the past month, yet indicating a year-over-year increase of 1.9%. Revenues for this quarter are projected at $5.29 billion, suggesting a year-over-year growth of 18.43%.

For the full year 2025, the consensus EPS estimate is $40.86, up 1.2% from the previous month, signaling an annual growth rate of 4.21%. Revenue estimates for 2025 are expected to reach $21.83 billion, marking a 9.52% increase from the previous year.

GPI has exceeded the Zacks Consensus Estimate for earnings in two of the last four quarters, with an average surprise of 3.02%.

Macroeconomic Challenges Ahead

Despite its growth, Group 1 faces hurdles in the current macroeconomic climate, particularly in the U.K. The automotive sector there is under pressure from government-mandated zero-emissions vehicle targets, which have proven challenging to meet. The expected share of battery electric vehicles for 2024 fell short at 22%, with the goal for 2025 raised to 28%, adding further strain on new vehicle sales.

Geopolitical uncertainties related to tariffs and trade restrictions present additional concerns. New tariffs from the U.S. administration could significantly affect GPI’s cost structure and pricing strategies, with potential implications for profitability.

Investment Outlook for GPI Stock

GPI has capitalized on its strategic acquisitions and burgeoning aftersales business, earning a Growth Score of B that makes it appealing for growth-focused investors. Furthermore, its commitment to shareholders boosts confidence.

However, ongoing macroeconomic and geopolitical uncertainties may weigh on the company’s prospects in 2025. Additionally, decreasing gross margins on new vehicle sales could impact overall profit margins.

Currently, GPI holds a Zacks Rank #3 (Hold), indicating it might be prudent to wait for a more advantageous entry point before accumulating shares. You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Identifies Top Growth Stock

Our experts have recently identified five stocks with the highest potential for doubling their value in the upcoming months. One top pick stands out, expected to see significant gains.

This leading choice is from a highly innovative financial firm, boasting a swiftly expanding customer base of over 50 million and offering a diverse range of advanced solutions. While not all selections guarantee success, this one could exceed previous winners like Nano-X Imaging, which soared by +129.6% within just nine months.

Free: Discover Our Top Stock and Four Other Contenders

For the latest recommendations from Zacks Investment Research, access today’s report on 7 Best Stocks for the Next 30 Days.

Ford Motor Company (F): Free Stock Analysis Report

Toyota Motor Corporation (TM): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.