If delving into the investments of top hedge fund managers sparks an interest in you, the Goldman Sachs Hedge Industry VIP ETF (NYSEARCA:GVIP) might just be the perfect fit for your portfolio.

Despite its modest $176.8 million in assets under management (AUM), GVIP offers a promising investment opportunity. Stemming from the distinguished Goldman Sachs (NYSE:GS), this underdog ETF shines with commendable performance metrics and a unique approach that distinguishes it from the conventional investment options, extending beyond the overused Magnificent Seven picks. It opens doors for investors to explore a plethora of fascinating, lesser-known stocks quietly driving exceptional returns.

The Distinctive Strategy of GVIP

GVIP stands out as an extraordinary ETF with an innovative strategy. According to Goldman Sachs, the fund aims to mirror the GS Hedge Fund VIP Index, comprising key holdings (“Very Important Positions”) frequently observed among the top 10 equity assets of fundamentally driven hedge fund managers.

The selected “fundamentally driven hedge fund managers” are U.S.-based, holding 10 to 200 positions in U.S. equities as per their latest 13F filings. The ETF excludes managers with equity assets under $10 million.

Goldman Sachs elucidates that the equity holdings of these remaining hedge funds are ranked by descending market value within each manager’s portfolio. The top 50 stocks most commonly found in the top 10 positions across this group then form the Index constituents.

Equal-dollar weighted and rebalanced quarterly, the fund’s methodology ensures a diverse portfolio, steering clear of over-dependence on a few holdings.

Hedge Fund Favorites Portfolio

GVIP comprises 47 stocks, with minimal concentration risk given that the top 10 holdings represent only 23.7% of the fund. Below are summary details of GVIP’s top 10 holdings based on TipRanks’ holdings tool.

Delving into the holdings, besides the prominent Nvidia (NASDAQ:NVDA), lesser-known gems like Vertiv (NYSE:VRT), Tenet Healthcare (NYSE:THC), AerCap Holdings (NYSE:AER), and APi Group (NYSE:APG) create an intriguing mix. Boasting impressive returns and stellar Smart Scores from TipRanks, they form the backbone of GVIP’s success story.

Further enriching the fund are holdings in companies like Energy Transfer (NYSE:ET), Progressive (NYSE:PGR), Taiwan Semiconductor (NYSE:TSM), and Broadcom (NASDAQ:AVGO), each flaunting remarkable Smart Scores and lucrative returns, accentuating the allure of GVIP as an investment avenue.

GVIP’s Consistent Performance

With a commendable five-year annualized return of 13.9% as of February 29 and a 14.6% return since its inception in 2016, GVIP sustains a remarkable track record within the ETF landscape.

Understanding GVIP’s Expense Ratio

Charging a 0.45% expense ratio, GVIP offers investors a reasonable fee structure that, although not the lowest, still falls below the average ETF expense ratio. Over a ten-year span, an investor in GVIP would incur $567 in fees on a $10,000 investment.

Analysts’ Take on GVIP Stock

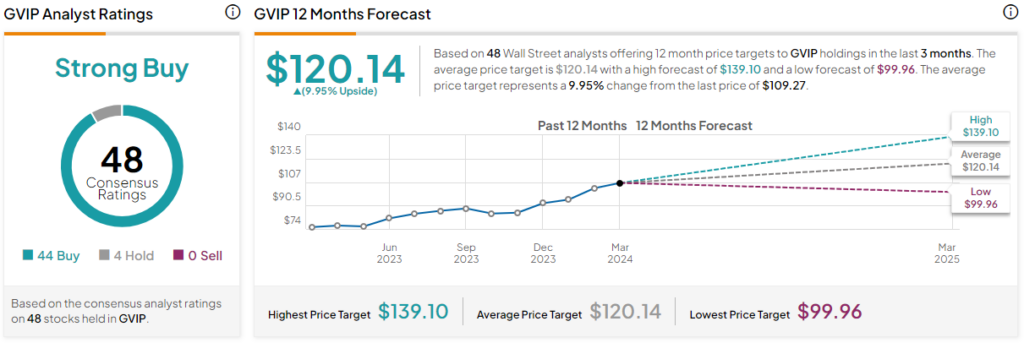

Wall Street analysts back GVIP with a Strong Buy consensus rating, supported by 44 Buy recommendations against four Holds, indicating a positive sentiment towards the fund. Forecasts suggest a 10% upside potential, with an average price target of $120.14 for GVIP stock.

Exploring the Market’s Hidden Gems

GVIP emerges as a compelling ETF, showcasing a distinctive strategy that unveils an array of financial treasures not commonly found in the prevalent ETF offerings saturating the market.

With GVIP painting a promising picture through its robust five-year performance and careful curation of stocks like Tenet Healthcare, AerCap Holdings, and APi Group, there is certainly a sense of excitement in the air. The diverse mix of non-tech stock winners further accentuates the allure of GVIP, offering investors a fresh perspective on market opportunities.

Given its remarkable performance and unique investment approach, GVIP stands tall as an inviting opportunity in the vast world of ETF investments.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.