“`html

Market Insights: Riding the Current Boom and Expecting Future Challenges

Plus, understanding why the last 30 minutes could be the most crucial.

Editor’s Note: On Saturday, InvestorPlace analyst Luke Lango highlighted that while a buy-and-hold investment strategy can still be effective, navigating today’s complex market landscape presents new challenges for many investors.

To address these challenges, Luke developed a new investment approach called Auspex, aimed at identifying the “best stocks at the best times,” no matter the market conditions. Impressively, this strategy has outperformed the market for five consecutive months.

On Wednesday, December 11, at 1 p.m. Eastern Time, Luke will host The Auspex Anomaly Event, where he will share insights on leveraging this strategy.

Click here to register for the event.

In the section below, Luke argues how Auspex can help you capitalize on the current “Trump Boom” while remaining cautious of potential downturns.

Here’s Luke…

With Donald Trump’s recent election win, I’ve embraced a simple motto.

Embrace the boom… beware the bust..

Since Election Day, the S&P 500 has risen about 6.2%, the Russell 2000 index has increased approximately 9.7%, the tech-heavy Nasdaq-100 has climbed about 7.2%, and Bitcoin ( BTC-USD ) has soared around 32%, reaching an all-time high of over $100,000 earlier last week.

Trump’s focus on deregulation and tax reform aims to reshape the U.S. economy through policies that encourage growth. These changes have ignited investors’ optimism, indicating that the market may continue to rise during the early days of his administration.

Embrace that boom.

However, there are legitimate concerns regarding the Trump administration (and the global landscape).

A blanket 20% tariff could greatly disrupt operations for American companies that produce goods overseas.

The appointment of Robert F. Kennedy Jr. to lead the Department of Health and Human Services (HHS) creates uncertainty in the biopharmaceutical sector.

The global economy remains unpredictable and tumultuous.

Beware those potential busts.

Implementing caution is more challenging than it sounds.

That’s why my team and I have spent the past year developing Auspex, a strategy that transitions from mere caution to a well-structured plan.

This method requires approximately 10 minutes of work each month, focusing on around 10 stocks at any given time.

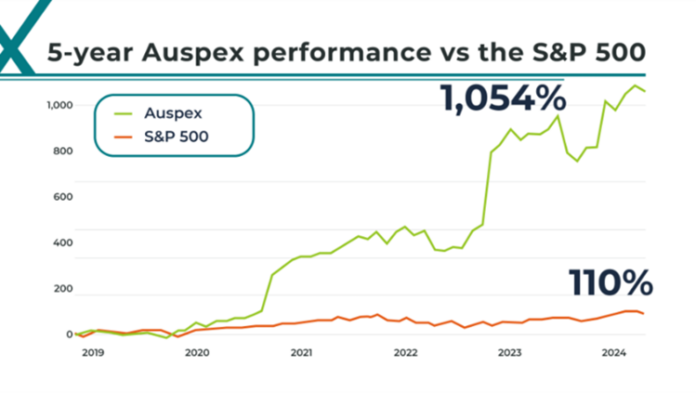

Historical data indicates that from September 2019 to September 2024, this system, if balanced monthly, could yield a return of 1,054%!

In contrast, during the same five-year period, the S&P 500 has recorded gains of only 109%, showing an outperformance of nine times.

This approach has successfully beat the market every month since we began live trials with a select group of members in July.

To learn more about why Auspex is considered among the most effective trading strategies, and to sign up for the upcoming broadcast, click here.

Before that, let’s explore how long the Trump boom might last.

Every investor should consider joining in now, as we inch closer to a potential downturn (notably, the last 30 minutes of a movie often deliver the most excitement).

Additionally, I will discuss how the Auspex system can help you avoid significant losses and even achieve market-beating returns amidst downturns.

Current Market Boom

The U.S. stock market has experienced significant growth over the past two years, largely due to the AI Revolution and recent interest rate cuts from the Federal Reserve.

Tech giants like Meta Platforms Inc. (META), Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOGL) are investing billions into infrastructure, aimed at supporting next-generation AI technologies.

This big push towards AI has contributed to a major economic expansion.

Following an aggressive rate-hiking period spanning almost 50 years, the Fed finally lowered rates in September, easing financial burdens on consumers and businesses. This relief has further fueled the AI-driven market boom.

This ideal setup has led to robust stock performance.

After hitting its lows in October 2022, the S&P 500 has skyrocketed by 70%. It’s now poised for its second consecutive year of over 20% gains.

In 2023, the S&P rose 24%. So far in 2024, it has climbed 27%. If these trends continue, this will be only the fourth instance since the Great Depression—approximately 100 years ago—where the S&P 500 has achieved back-to-back 20% rallies.

There is no doubt that we are currently enjoying a stock market boom.

And in our view, this boom is set to become even more pronounced.

With Donald Trump’s election and Republicans gaining control of Congress, we anticipate a wave of deregulation, business-friendly policies, and tax cuts.

“““html

Understanding the Cycle: Booms and Busts in the Stock Market

As we look ahead, trends suggest that the current economic boom may continue for the next few years. However, it’s essential to recognize that every market expansion eventually leads to a contraction.

It’s not a matter of “if” but “when.”

What History Teaches Us About Market Busts

The stock market has enjoyed back-to-back annual gains of over 20%. This feat has only been achieved three times before: in 1935/36, 1954/55, and 1995/96. After the booming years of 1935 and ’36, the market suffered a significant drop of about 40% in 1937. In 1956, after two years of growth, stocks remained flat before falling 15% the following year. Similarly, during the late 1990s Dot-Com Boom, after rallying continuously through 1997 and ’98, the market faced a nearly 50% decline from 2000 to 2002.

Historically, all major booms lead to busts; it’s merely a question of timing.

Does this mean you should rush to sell your stocks and flee the market? Absolutely not.

Final Thoughts on Timing Your Investments

Many agree that the last part of a movie or game holds the most excitement. The same can be said for the final years of a market boom, as they often bring the greatest profits.

Take the Dot-Com Boom as an example. The Nasdaq Composite surged by 40% in 1995, followed by another 20% in ’96 and ’97, before skyrocketing nearly 90% in 1999 for its best year. The market’s decline began in 2000.

This illustrates the risk of leaving the stock market party too early. However, it’s equally important not to stay too long.

So, what should investors do? Seize the boom, but stay alert for the bust.

Capitalizing on rising stock prices is essential, but be prepared to exit when signs of a downturn emerge. Admittedly, timing this perfectly is a challenge.

That’s why we’ve developed the Auspex investment tool designed to help manage investments through unpredictable market cycles. This innovative stock screener allows subscribers to make consistent long-term profits within manageable 30-day periods.

The system offers the potential for significant gains with minimal monthly commitment and limits exposure to only a handful of stocks at a time.

Join me on Wednesday, Dec. 11 at 1 p.m. EST for an informative broadcast on this new investment tool that promises to enhance your market navigation.

Secure your spot today!

Sincerely,

Luke Lango

Senior Analyst, InvestorPlace

“`