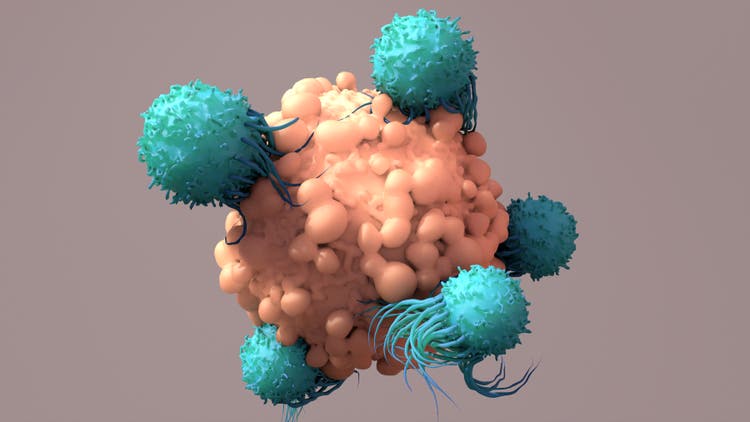

Design Cells/iStock via Getty Images

Harpoon Therapeutics (NASDAQ:HARP) ignited a spark of M&A interest after agreeing to a $23 share sale to Merck (NYSE:MRK), according to an Oppenheimer analyst. Harpoon surged 0.7% in response to this development.

“With the company’s TCE platform and multiple data/regulatory updates in 1H24, we believe the Merck deal to be a starting point and that other parties could also be interested,” stated Oppenheimer analyst Hartaj Singh, who maintains an outperform rating on HARP. “We think that Merck is among the most superior of oncology companies, however, additional interest could come from large companies that could help leverage HARP’s platform technology.”

Oppenheimer’s Singh raised Harpoon’s price target to $27 from $23.

Merck (MRK) on Monday agreed to acquire immunotherapy developer Harpoon (HARP) for $23.00 per share in cash for ~$680M of total equity value.

The transaction is set to close in H1 2024. In connection with the deal, Merck (MRK) expects to record a one-time non-tax-deductible charge of ~$650M, or ~$0.26 per share in non-GAAP results, during the quarter the deal closes.