Intel Faces Challenges as Taiwan Semi Expands U.S. Operations

During President Biden’s tenure, his administration prioritized boosting investment in domestic manufacturing. A landmark achievement was the signing of the CHIPS and Science Act in 2022, which aims to allocate $280 billion for research and development as well as semiconductor manufacturing here in the U.S.

Over the past few years, Intel has emerged as a significant recipient of funding from the CHIPS Act. With increased investment in artificial intelligence (AI) infrastructure—particularly in data centers and semiconductor technology—I previously suggested Intel might thrive under the new Trump administration, which shares a focus on enhancing domestic manufacturing.

Stay Updated Daily! Subscribe to Breakfast News for essential market insights. Sign Up For Free »

However, Taiwan Semiconductor Manufacturing (NYSE: TSM) recently made an announcement that has caused me to reassess my cautiously optimistic view on Intel.

Intel Struggles to Keep Pace

Last year, Intel reported total revenue of $53.1 billion, which is a modest 2% decline compared to the previous year. However, the results from its foundry business are more concerning.

Intel’s Foundry generated $17.5 billion in revenue for 2024, a drop of 7% year over year. This division competes directly with Taiwan Semi, which controls nearly 60% of the global foundry market. Since Intel Foundry is contracting at a faster rate than Intel’s overall business, it raises doubts about the company’s ability to compete with its more established rivals.

To complicate matters, Intel has now postponed the opening of a new plant in Ohio until 2030. Originally, operations were set to start between this year and 2026, but this timeline has been significantly delayed.

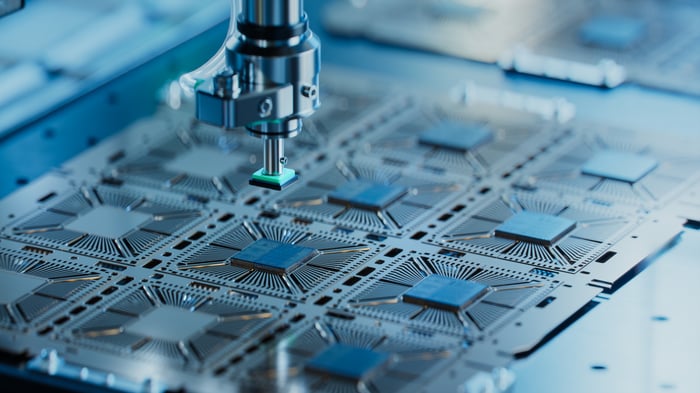

Image source: Getty Images.

Taiwan Semiconductor’s $100 Billion Expansion

On March 4, Taiwan Semi announced a $100 billion investment in the U.S. to construct three additional fabrication plants, two packaging facilities, and a research and development (R&D) center. This follows an existing $65 billion expansion project in Arizona.

TSMC’s investment is designed to enhance operational partnerships with key clients such as Nvidia, AMD, Broadcom, and Qualcomm.

Implications for Intel

In recent weeks, several members of the Magnificent Seven group have announced plans for substantial investments in AI infrastructure. While this could suggest a potential benefit for Intel due to increased capital expenditures from AI leaders, TSMC appears to be capitalizing on Intel’s challenges. I interpreted TSMC’s new $100 billion investment as a strategy to fortify its dominant position in the foundry market.

Although Intel maintains a close relationship with the U.S. government, its progress with CHIPS Act grants seems minimal. Consequently, it’s difficult to embrace an optimistic perspective around Intel at this moment. Rumors of a possible partnership with TSMC exist, yet no concrete information has emerged. In my opinion, a successful collaboration with Taiwan Semi could be the best scenario for Intel going forward.

Intel appears to be at a crossroads, struggling to keep pace with its primary rival amid a significant shift driven by AI innovation. Ultimately, TSMC’s investments in the U.S. might represent a decisive strategy against Intel.

A Renewed Opportunity Awaits

Have you ever felt you missed an opportunity to invest in successful companies? This could be your chance.

Occasionally, our team of expert analysts provides a “Double Down” Stock recommendation for companies poised to excel. If you’re concerned about missing your chance to invest, now might be the ideal moment before it’s too late. The numbers illustrate:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $292,207!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,326!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,568!*

Currently, we are issuing “Double Down” alerts for three promising companies, and opportunities like this may not come again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: short May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.