PayPal(NASDAQ: PYPL) has traveled a rocky road in the market, leaving long-term investors nursing wounds as the stock tumbled from its peak of $308 per share in 2021. However, a glimmer of hope has emerged lately. With the stock rebounding over 10% from its March lows, could we be witnessing the dawn of a promising bull run?

Given this optimistic backdrop, one can’t help but wonder – is it prime time to jump on the PayPal bandwagon, or are we merely witnessing a mirage in the desert?

A Rocky Path to Rebuild Trust

Historically, PayPal has stood tall as a fintech frontrunner, offering seamless money transfers and facilitating business transactions. But over time, the rise of competitors like eBay and various mobile payment apps has challenged PayPal’s market dominance, tagging it as a relic in the eyes of many customers.

Yet, don’t write off PayPal just yet. While it may seem like a blast from the past to some, the platform’s integration of multi-payment options and swift transaction processing – courtesy of pre-existing user data – make it an attractive partner for e-commerce vendors aiming to seal deals pronto. The efficiency of quick transactions cannot be overstated, allowing consumers less leeway to question their purchases. That’s precisely why online retailers are increasingly opting to incorporate PayPal into their checkout processes.

Enhancing user experience by streamlining the checkout process and amplifying consumer information lies at the heart of PayPal’s recent platform revamps, spearheaded by the new CEO, Alex Chriss, in the early days of 2024. However, the million-dollar question remains – will these innovations drive the growth engine for PayPal?

The prevailing market sentiment paints PayPal as a sinking ship, hence the substantial discount it trades at compared to its true worth.

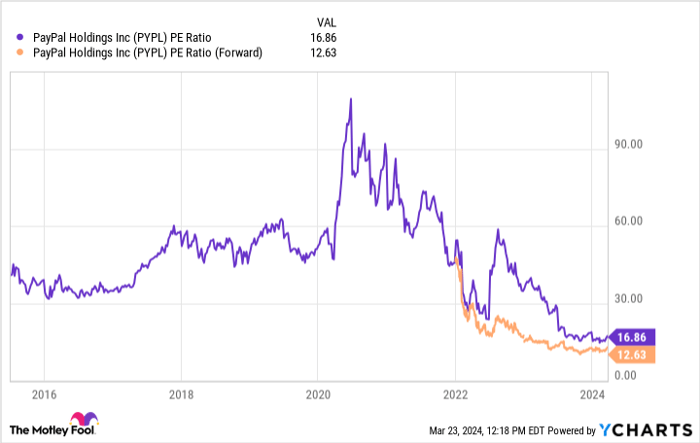

PYPL PE Ratio data by YCharts

Trading at 17 times trailing and 13 times forward earnings, PayPal appears to be a bargain buy, especially when juxtaposed against the S&P 500‘s lofty valuations of 23 times trailing and 22 times forward earnings.

While the broader market may be turning a cold shoulder to PayPal, the management team isn’t idling by.

Unleashing Market-Beating Potential

The allure of PayPal’s discounted valuation prompted the previous management to funnel substantial cash flows into share buybacks. In 2024, Chriss and his crew are on track to execute buybacks totaling at least $5 billion, continuing the trend.

Now, what does a $5 billion repurchase program signify? It’s a big deal, without a doubt.

Subtracting the $1.56 billion stock-based compensation tab PayPal footed in 2023, the net buyback amount stands around $3.44 billion. Given PayPal’s current $72 billion market cap, this move is poised to slash the outstanding shares by approximately 5% annually.

If PayPal manages to keep its net income steady in 2024 compared to 2023, the earnings per share will witness a 5.3% upsurge, absent any growth. But here’s the kicker – PayPal anticipates mid-single-digit revenue growth for Q1.

Predictions extend further into 2024 and 2025, with Wall Street analysts foreseeing a continuation of this trend. The consensus among 42 analysts points to a 7% and 8% revenue growth for this year and the next. If PayPal can deliver high single-digit growth while concurrently reducing shares outstanding by 5%, it opens the door to low double-digit percentage growth in earnings per share (EPS), placing it on the path to outperforming the market.

This optimistic scenario could draw newfound interest from investors, propelling up PayPal’s discounted valuation. The signs are pointing towards the commencement of a PayPal rally, with investors eagerly awaiting robust Q1 results.

While the full picture of PayPal’s performance will only unveil in late April, the array of positive signals and a substantial margin of safety make the present moment ripe for considering PayPal stock as a buy.

Where to invest $1,000 right now

Given the exemplary track record of our analysts, it’s wise to heed their stock recommendations. The long-standing Motley Fool Stock Advisor newsletter has consistently outshone the market.*

In their latest insights, the analysts have unveiled the 10 best stocks for investors, featuring PayPal prominently. Yet, remember, there are 9 more pearls waiting to be discovered.

Explore the 10 stocks

*Stock Advisor returns as of March 25, 2024

Randi Zuckerberg, the former director of market development and spokesperson for Facebook, as well as the sister to Meta Platforms CEO Mark Zuckerberg, sits on The Motley Fool’s board of directors. Keithen Drury holds positions in Meta Platforms and PayPal. The Motley Fool has vested interests in and recommends Meta Platforms and PayPal, as well as recommends eBay. Additionally, it suggests the following options: short July 2024 $52.50 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool adheres to a strict disclosure policy.

The thoughts and opinions articulated herein are personal views of the author and do not necessarily align with those of Nasdaq, Inc.