Geron (NasdaqGS:GERN) Receives Buy Recommendation: Analyst Predicts Significant Growth Ahead

On November 5, 2024, HC Wainwright & Co. began covering Geron with a Buy recommendation. This comes at a time when the company shows promising potential in the biopharmaceutical sector.

Impressive Price Target Forecast Highlights Potential for Growth

As of October 22, 2024, analysts set the average one-year price target for Geron at $7.31 per share. The estimated range spans from a low of $5.56 to a high of $10.50. Notably, this average target suggests a remarkable 72.81% upside from Geron’s latest closing price of $4.23 per share.

In light of these forecasts, Geron appears to be positioned for possible significant gains, prompting investors to monitor its performance closely.

Strong Positive Sentiment Among Funds and Institutions

A total of 431 funds and institutions currently report holdings in Geron, which reflects an increase of 30 owners, or 7.48%, over the last quarter. The average allocation of these funds to GERN stands at 0.23%, marking a 6.06% rise. Institutional shares owned saw a solid growth of 9.22% in the past three months, reaching 494,640K shares.

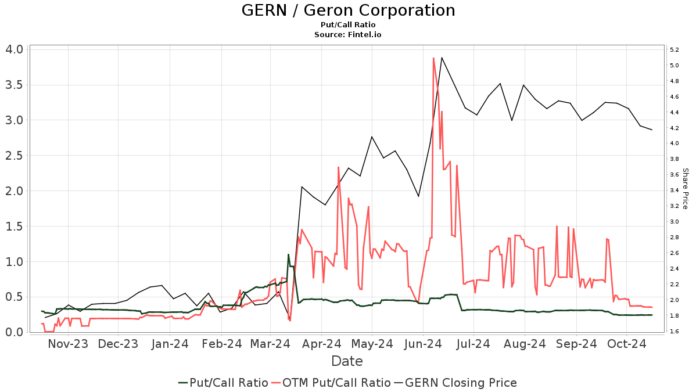

Currently, the put/call ratio for GERN is 0.27, signaling a bullish sentiment among investors.

Institutional Investment Insights

Ra Capital Management retains 46,202K shares, equating to 7.66% ownership, with no change in their position last quarter. Vivo Capital holds 27,225K shares, or 4.52% ownership, also steady from the previous quarter.

Darwin Global Management owns 23,915K shares for 3.97% ownership. Jefferies Financial Group has increased its stake significantly, now holding 20,030K shares, representing a 3.32% ownership. This marks a 99.08% increase from its previous holding of 183K shares, reflecting a dramatic rise in investment by 16,034.26% over the last quarter.

Additionally, Adage Capital Partners has increased its position, now holding 19,725K shares for 3.27% ownership, up from 7,200K shares—an increase of 63.50%, with a 245.29% rise in portfolio allocation.

About Geron: A Leader in Biopharmaceuticals

Geron is a clinical biopharmaceutical company focused on developing a first-in-class telomerase inhibitor, imetelstat. This drug aims to address hematologic myeloid malignancies. The company is currently conducting two Phase 3 clinical trials: IMerge, targeting lower-risk myelodysplastic syndromes, and IMpactMF, addressing refractory myelofibrosis.

Fintel serves as a comprehensive investment research platform for investors, traders, financial advisors, and small hedge funds, offering an extensive range of financial data and analytics.

For more details, click to learn more.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.