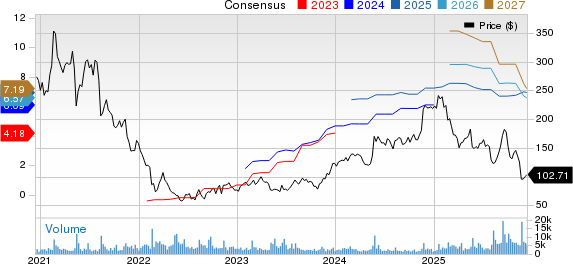

Fomento Economico Mexicano, S.A.B. de C.V. FMX, or FEMSA, is on track to unveil its fourth-quarter 2023 earnings on Feb 23. Investors anticipate an optimistic outlook backed by substantial top-line growth.

The Zacks Consensus Estimate for FMX’s fourth-quarter revenues stands at $11.2 billion, suggesting an 18.4% surge compared to the year-ago quarter.

Looking ahead to 2023, FEMSA’s estimated earnings of $5.90 per share reflect a robust 66.2% increase from the previous year. The consensus forecast for the company’s revenues is projected to reach $44.4 billion, indicating a substantial 32.4% growth from the prior year.

In the last reported quarter, FEMSA’s earnings surpassed expectations by 50.9%, maintaining a prolific four-quarter average earnings surprise of 23.2%.

Historical Performance and Future Forecast

For FEMSA, a long-standing history of market dominance positions the company for sustained excellence.

With robust market demand and effective growth strategies across all business units, FEMSA is primed for substantial growth in the digital and technology-driven initiatives. Its steadfast performance, particularly in OXXO Mexico and OXXO Gas, underscores a resilient trajectory.

Additionally, FEMSA’s venture into the specialized distribution industry is expected to yield exceptional gains, offering an unprecedented growth platform.

The company’s resilient digital foray through Digital@FEMSA, aimed at nurturing a value-added digital and financial ecosystem, has bolstered its overall performance.

Moreover, amidst prevailing challenges like margin pressures and supply-chain disruptions, FEMSA has admirably pushed forward in its strategic trajectory, demonstrating commendable resilience.

Promising Investment Opportunities

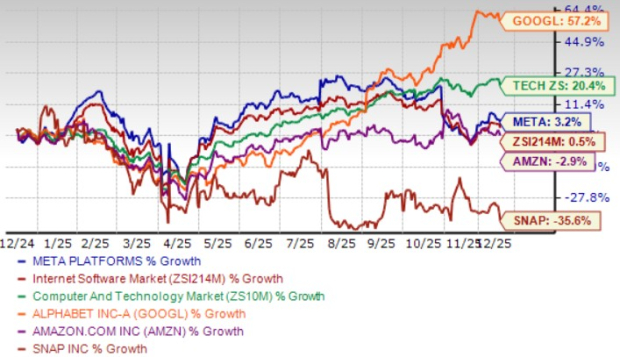

FEMSA’s growth prospects are further fortified by its relentless expansion in the United States, coupled with its compelling network in the tech and innovation arena.

With the spotlight on the omnichannel business of Coca-Cola FEMSA and the digital initiatives of FEMSA Comercio, FEMSA is consistently steering profit generation.

Despite looming concerns around margin pressures, the company’s strategic investments in digital offerings, loyalty programs, and fintech platforms have emerged as formidable growth drivers.

Notwithstanding inflationary headwinds in steel and aluminum prices, FEMSA’s resounding performance in digital wallet services, loyalty programs, and OXXO Premia is poised for an upward trajectory.

Conclusion

In an environment of evolving market dynamics, FEMSA’s strong fourth-quarter performance and resilient growth vectors underscore the company’s robust position in the market.

As FEMSA gears up to announce its Q4 earnings, investors brace themselves for a landmark event that solidifies the company’s standing as a pioneering force in the industry.

Stay updated and make informed decisions with Zacks Investment Research’s in-depth analysis on FEMSA’s performance and upcoming earnings, offering a comprehensive view of the company’s financial landscape.

For a comprehensive understanding of FEMSA’s potential, consider examining the free stock analysis report from Zacks Investment Research, offering valuable insights and perspective.

As the market eagerly awaits FEMSA’s landmark earnings announcement, there is an air of anticipation and positivity surrounding the company’s anticipated performance.