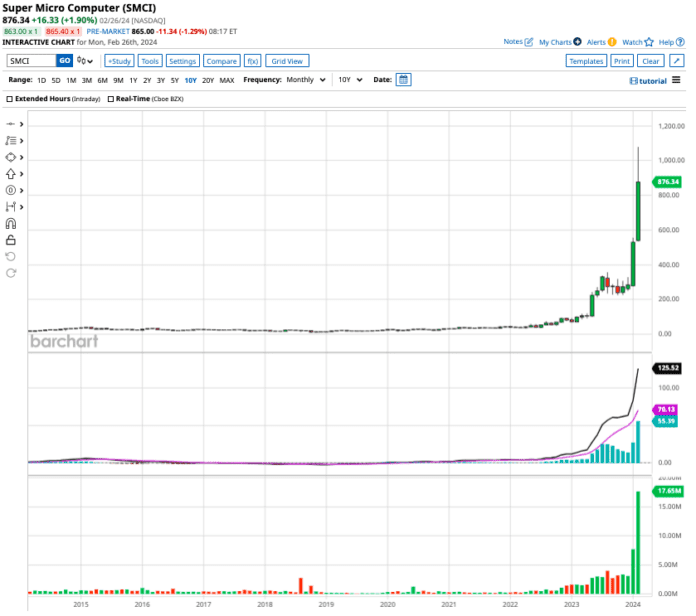

Super Micro Computer (SMCI) has been a paragon of growth, with its stock skyrocketing over 4,100% in the past decade, leaving Nasdaq Composite’s 271% return in the dust. At a market cap of $47 billion, SMCI has surged by a staggering 768% in the last year. With Wall Street pundits singing its praises, let’s delve into the future possibilities of this tech titan.

A Glimpse into Super Micro Computer

Super Micro Computer specializes in creating top-notch server and storage solutions for enterprise clients worldwide. Its offerings include cutting-edge storage systems, modular blade servers, networking devices, and more. Much like Nvidia, SMCI is poised to benefit from the AI revolution, transforming AI-powered chips into high-performance servers for advanced AI applications.

Assessing SMCI’s Stock Value

Formerly a bargain, Super Micro Computer stock has seen a meteoric rise, fueled by a revenue surge from $3.33 billion in fiscal 2020 to a whopping $9.25 billion in the last year. Analysts project further growth, with sales expected to reach $14.47 billion in fiscal 2024 and $19.56 billion in fiscal 2025. Priced attractively at 2.5 times forward sales and 29.8 times forward earnings, SMCI is viewed as a solid investment opportunity.

With earnings per share forecasted to hit $84 by fiscal 2028, SMCI could potentially reach $2,100 within the next four years, assuming a 25x forward earnings multiple.

Projections for SMCI Stock Price

Despite its remarkable ascent, analysts like those at Rosenblatt remain bullish on SMCI. Analyst Hans Mosesmann recently upped the price target to a Street-high of $1,300, emphasizing the company’s strong position in the AI computing realm. With five “strong buy” ratings out of eight analysts, SMCI’s future looks promising.

While the average target price stands at $717.38, offering a 15.7% discount to Tuesday’s close, the new target of $1,300 hints at a 52.7% upside potential from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.