Nvidia’s Trailblazing Growth Path

As data centers pivot from CPUs to GPUs for AI workloads, Nvidia stands at the helm, reaping the rewards of this monumental shift. Historically, data centers committed around $250 billion annually to infrastructure, a trend that has recently seen a remarkable uptick, hinting at a potential spending bonanza in the making.

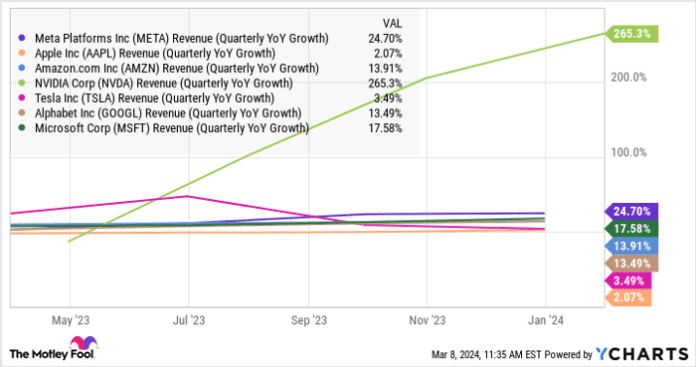

The realm for Nvidia’s offerings has expanded beyond initial projections, showcasing a 265% revenue surge year-over-year, reaching $22 billion in the fiscal fourth quarter, outpacing its fellow Magnificent Seven peers by a significant margin.

Despite these remarkable strides, Nvidia is only scratching the surface of its potential. The company’s executives hint at an estimated $1 trillion data center infrastructure currently embracing accelerated computing – a configuration utilizing multiple GPUs in unison to manage colossal datasets.

However, the unfolding landscape could dwarf these estimations. The advent of GPU-specialized cloud service providers and the amplification of AI capabilities could propel the actual data center infrastructure market valuation closer to a staggering $2 trillion, as suggested by Nvidia’s leadership team.

The Allure of Nvidia Stock

The revolutionary potential of AI is reshaping traditional computing paradigms, as evidenced by the soaring demand for Nvidia’s H100 GPU. It has become a badge of honor for companies to boast about their burgeoning H100 inventory, with Meta Platforms outlining plans to deploy 350,000 H100 units by year-end.

Anticipating relentless demand, Nvidia’s H200 GPU is set to hit the market in the fiscal second quarter. The company’s forecast projects a staggering 234% year-over-year revenue surge in the fiscal first quarter alone.

Analysts foresee Nvidia’s earnings skyrocketing at a 35% annual clip, outstripping its Magnificent Seven peers in the long run.

Nvidia’s supremacy in the GPU sector spells a potential windfall as data centers ramp up component upgrades for AI integration. Positioned for substantial growth, this GPU juggernaut offers enduring upside that could outshine its Magnificent Seven counterparts over the next decade. Considering its forward P/E of 37 in relation to expected earnings this year, Nvidia emerges as a compelling investment prospect.

Nvidia’s prolonged dominance in the GPU domain places it at the vanguard of the AI boom wave. Yet, the clincher is the company’s burgeoning cash flow, which reached a staggering $27 billion in the trailing period, marking a tenfold surge over the past five years. This financial prowess equips Nvidia with ample resources to spearhead GPU innovations and deliver sustained returns to its stakeholders.

Contemplating a $1,000 investment in Nvidia?

Before delving into Nvidia stock, ponder this:

The Motley Fool Stock Advisor team recently pinpointed what they consider the 10 premier stocks for investors to capitalize on now – with Nvidia conspicuously absent. These top picks harbor the potential for stratospheric returns in the forthcoming years.

Stock Advisor furnishes investors with a user-friendly roadmap to success, furnishing portfolio-building insights, frequent analyst updates, and bimonthly stock recommendations. Since 2002, the Stock Advisor service has tripled the S&P 500 return*

Explore the 10 stocks

*Stock Advisor returns as of March 11, 2024

John Mackey, the former CEO of Whole Foods Market and an Amazon affiliate, serves on The Motley Fool’s board of directors. Randi Zuckerberg, previously a director of market development and spokesperson for Facebook and sibling to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a part of The Motley Fool’s board of directors. John Ballard is invested in Nvidia and Tesla. The Motley Fool holds positions in and advocates for Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends various options, including long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool upholds a disclosure policy.

The author’s views and opinions expressed herein are personal and do not necessarily mirror those of Nasdaq, Inc.