Investors have been flocking to American Financial Group, Inc. (AFG) as it rides a wave of rate increases, enhanced retentions in renewal business, bolstered underwriting profit, and upgraded guidance.

Projections for Growth

The Zacks Consensus Estimate foreshadows a 4.3% year-over-year surge in American Financial’s earnings per share for 2024, climbing to a projected $7.84 billion in revenues, marking a 4.2% improvement from the previous year. Looking ahead to 2025, estimates predict a 4.5% increase in earnings per share, hitting $8.41 billion in revenues—a commendable 7.2% surge from the year before.

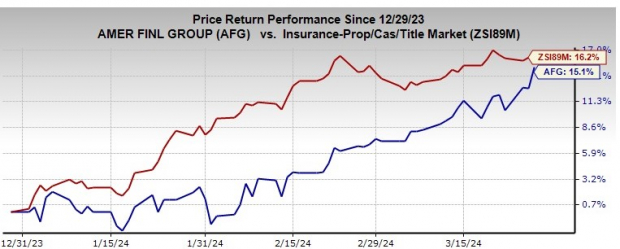

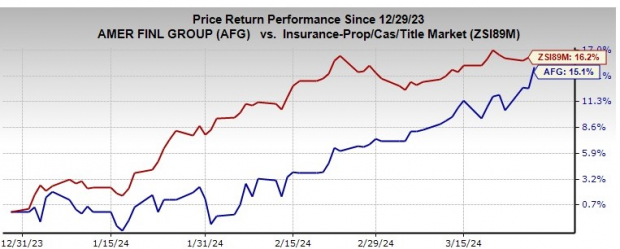

Zacks Rank & Price Performance

At the moment, AFG flaunts a Zacks Rank #3 (Hold). Since the start of the year, the stock has exhibited a 15.1% climb, slightly trailing the industry’s 16.2% uptick.

Image Source: Zacks Investment Research

Style Score

Noteworthy is American Financial’s VGM Score of B, signifying a blend of value, growth, and momentum—a positive sign for potential investors.

Favorable Business Environment

American Financial’s Property and Casualty (P&C) Insurance segment stands to benefit from various factors, such as expanding business opportunities, growth in surplus lines, and excess liability businesses. The positive trajectory is further propelled by rate hikes and increased renewals in the business, amplifying premium growth.

The company aims at an 8% year-over-year surge in net written premiums for 2024 compared to 2023. Projections for 2024 hint at core operating earnings per share of approximately $11 if performance aligns with the business plan assumptions.

AFG has consistently reported increased renewal pricing in the P&C Group, maintaining positive rates and aiming for continued uptrends. The company anticipates overall renewal rate increases exceeding loss ratio trends to meet or surpass targeted returns.

The company’s underwriting profit is poised for a boost, notably in workers’ compensation, excess and surplus, executive liability, mergers and acquisitions liability, trade credit, and financial institutions businesses—enhancing the insurer’s already admirable performance against industry standards.

Having raised dividends for 18 consecutive years, American Financial demonstrates robust operational profitability, stellar investment performance, and sound capital management—a trifecta supporting effective shareholder returns. AFG foresees generating substantial excess capital throughout 2024, opening doors for potential share repurchases or special dividends in the coming year.

Looking Ahead

Among the standout performers in the insurance landscape are HCI Group, Inc. (HCI), Palomar Holdings, Inc. (PLMR), and Axis Capital Holdings Limited (AXS). While HCI Group and Palomar Holdings sport a Zacks Rank #1 (Strong Buy) each, Axis Capital holds a Zacks Rank #2 (Buy) currently.

Does the insurance sector intrigue you? HCI Group, with a remarkable track record of beating earnings estimates consistently and a 32.2% surge year-to-date, might pique your interest.

On the other hand, Palomar Holdings, boasting impressive earnings beat streaks and a 51.8% surge year-to-date, could be an attractive venture. Lastly, Axis Capital, with a strong history of beating earnings estimates and a 17.4% gain year-to-date, presents another compelling opportunity worth exploring.

As the financial landscape teems with possibilities, American Financial Group, Inc. (AFG) maintains a solid stance, poised for continued growth and profitability—an emblem of resilience in an ever-evolving market scenario.

Zacks Unveils ChatGPT “Sleeper” Stock

Curious about the AI industry’s capital impact? Get insights into a potential gem among AI stocks set to revolutionize the market by 2030, alongside 4 other must-buy recommendations. Dive in now.

Download Free ChatGPT Stock Report Right Now >>

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report

For further insights, read the full article on Zacks.com here

Disclaimer: The author’s views and opinions expressed do not necessarily align with those of Nasdaq, Inc.