Selective Insurance Group, Inc. SIGI has garnered investor favor due to robust renewal, soaring fuel prices, advantageous excess and surplus (E&S) lines marketplace conditions, and enhanced income from the fixed-income securities portfolio.

Upward Growth Trends

The Zacks Consensus Estimate for Selective Insurance’s 2024 earnings per share forecasts a 30.3% year-over-year surge while revenue estimates for 2024 stand at $4.86 billion, reflecting a 14.7% increase year-over-year.

Looking ahead, the 2025 earnings per share estimate hints at a 10.1% rise year-over-year, with revenue estimates for 2025 projecting $5.31 billion, marking a 9.3% increase over the previous year.

An impressive long-term earnings growth rate of 18.1% exceeds the industry average of 12.2%.

Positive Revisions and Ranking

Over the past 60 days, analyst sentiment has driven a 0.1% upward revision for 2024 earnings estimates and a 0.9% increase for 2025 earnings estimates, underpinning growing optimism in the prospects of Selective Insurance.

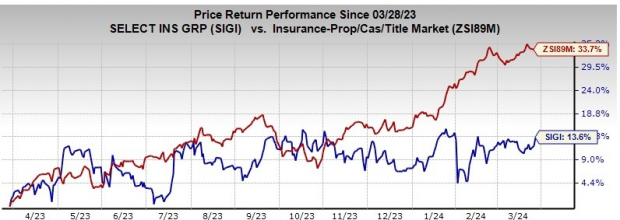

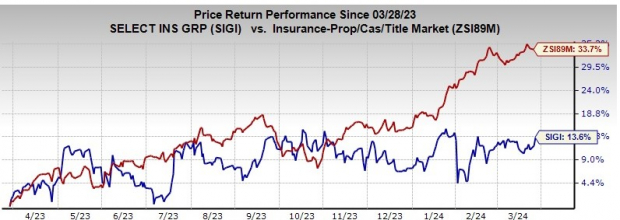

Market Standing and Performance

Carrying a Zacks Rank #3 (Hold), SIGI has exhibited a 13.6% stock price appreciation over the past year, outpaced by the industry growth of 33.7%.

Image Source: Zacks Investment Research

Performance Metrics

Selective Insurance holds a VGM Score of B, identifying the stock as having attractive value, strong growth prospects, and promising momentum.

Driving Forces

Factors such as robust renewals, escalating fuel prices, expanding exposure, steady retention rates, and increased new business gains in commercial and E&S lines are poised to propel premium growth for Selective Insurance.

The E&S Lines segment is expected to thrive amid enhanced marketplace conditions and pure price increases, reflecting a positive growth trajectory.

With an anticipated after-tax net investment income of $360 million for 2024, Selective Insurance’s solid financial position and efficient investment strategies are likely to further bolster its performance.

Furthermore, the company’s consistent dividend hikes and strong operating performance have instilled confidence among investors, establishing it as an appealing choice for those seeking reliable returns.

Considerable Alternatives

Other noteworthy options within the property and casualty insurance sector include HCI Group, Inc. HCI, Palomar Holdings, Inc. PLMR, and Axis Capital Holdings Limited AXS. While HCI Group and Palomar Holdings boast a Zacks Rank #1 (Strong Buy), Axis Capital holds a Zacks Rank #2 (Buy) at present.

Considered for their impressive track records, these alternative stocks present viable opportunities for investors seeking potential growth and stability.

From beating earnings estimates to solid year-over-year growth trajectories, each of these options showcases unique strengths and potential value for investors seeking to diversify their portfolios.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.