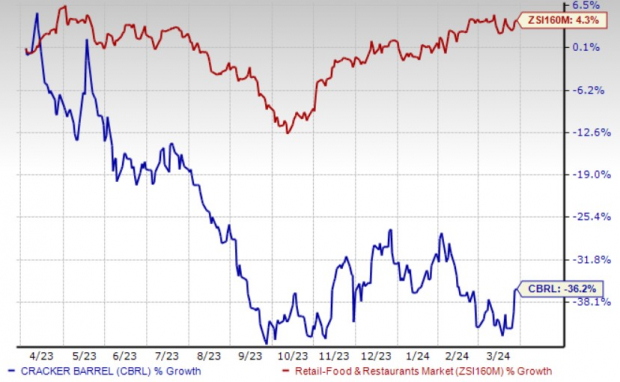

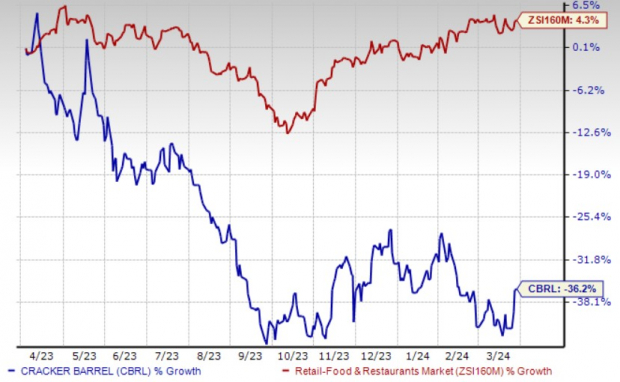

Cracker Barrel Old Country Store, Inc. CBRL is reaping the rewards of its Menu Renovation & Expansion strategy amidst a challenging sector landscape, resulting in a considerable increase in shares by 7.7% over the past month, despite a 36.2% dip earlier.

Driving Growth

With an innovative approach to its culinary offerings, Cracker Barrel has made significant strides in enhancing its menu. New delectable items such as the Fried Chicken Benedict bowl and the Ham n’ Maple Bacon bowl, along with specialty beverages, are enticing customers nationwide. The company’s relentless focus on introduction and rotation of menu items reflects its commitment to catering to evolving consumer tastes.

Looking ahead, CBRL is testing a revamped core menu in select outlets, aimed at striking a balance between innovation and simplicity. By continually reinventing its offerings, Cracker Barrel stays afloat in the fiercely competitive food industry.

Moreover, the strategic expansion drive at Cracker Barrel has been pivotal in driving its growth trajectory. Opening new locations has been a key focus, with plans to unveil more Maple Street biscuit stores in the ongoing fiscal year. As of January 26, 2024, CBRL operated an impressive network of 63 MSBC and 662 Cracker Barrel locations.

The company’s off-premise business model is another feather in its cap, with off-premise sales accounting for around 23.7% of restaurant sales. By leveraging this channel and introducing catering menu options, Cracker Barrel is effectively tapping into the burgeoning demand for convenient dining solutions.

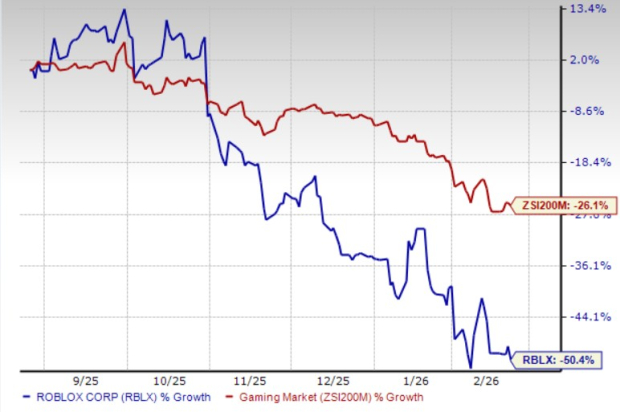

Image Source: Zacks Investment Research

Areas of Concern

CBRL faces headwinds in the form of rising operational costs, particularly in labor expenses. Despite ongoing cost-cutting measures, persistent inflationary pressures are likely to impact profits. Additionally, noteworthy investments in various strategic initiatives might dent margins initially.

While second-quarter fiscal 2024 showcased promising sales performance, with a notable increase in traffic trends, the company acknowledges the uncertain operating environment. The industry as a whole continues to grapple with challenges, and Cracker Barrel anticipates sustained pressure on industry traffic for the remainder of the fiscal year.

Promising Alternatives

For investors seeking alternatives in the Retail-Wholesale space, some notable options include:

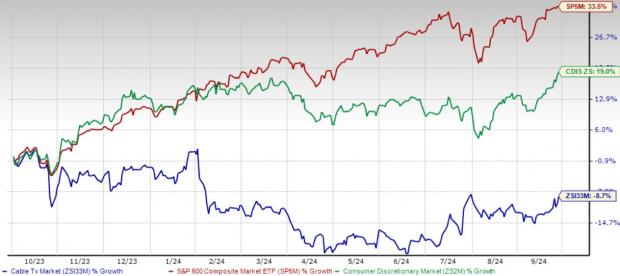

Brinker International, Inc. EAT, with a Zacks Rank #1 (Strong Buy), has recorded an impressive earnings surprise of 212.7% on average over the past four quarters. Shares of EAT have seen a healthy uptick of 32.2% in the previous year.

The Zacks Consensus Estimate for EAT foresees a growth of 4.9% in sales and a whopping 30.4% in EPS for 2024, reflecting promising prospects for the stock.

Texas Roadhouse, Inc. TXRH, a Zacks Rank 2 (Buy) company, despite a moderate earnings surprise trend, has delivered solid returns of 41.6% over the last year.

Furthermore, CAVA Group, Inc. CAVA, also holding a Zacks Rank of 2, has showcased strong earnings growth over the past few quarters.

Unlimited Access to Zacks Recommendations for Only $1

Unlock the potential of Zacks’ powerful portfolio services for just a dollar.

Join thousands who have capitalized on this one-time offer and witnessed substantial gains through services like Surprise Trader, Stocks Under $10, and Technology Innovators. The proof is in the profits: 162 positions have yielded double- and triple-digit returns in 2023 alone.

Get Exclusive Zacks Recommendations Now

Source: Zacks Investment Research

The opinions expressed are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.